Japanese Bitcoin Giant Metaplanet Raises $1.4 Billion to Enter U.S. Market

The expansion marks a turning point for the company, which transformed from a struggling hotel operator into one of the world’s top Bitcoin treasury firms. With over 20,000 Bitcoin worth $2.3 billion, Metaplanet now ranks as the sixth-largest corporate Bitcoin holder globally.

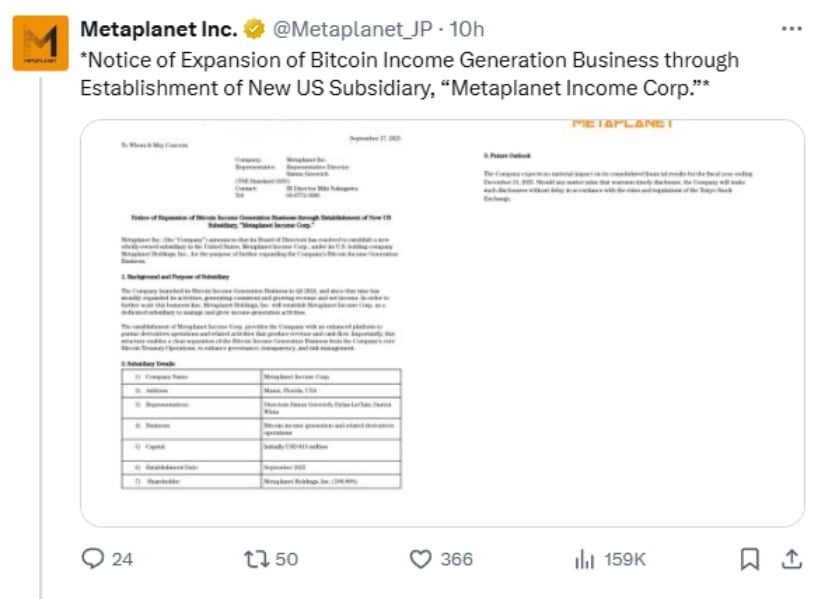

Miami Operations Target Bitcoin Income Generation

On September 17, 2025, Metaplanet established Metaplanet Income Corp. in Miami with $15 million in startup capital. The new subsidiary will focus on Bitcoin derivatives trading and income-generating activities, separate from the company’s main Bitcoin storage operations.

CEO Simon Gerovich will lead the Miami office alongside directors Dylan LeClair and Darren Winia. The derivatives business, which launched in late 2024, has already delivered steady profits and represents the company’s “engine of growth,” according to Gerovich.

Source: @Metaplanet_JP

The choice of Miami reflects the city’s emergence as a major Bitcoin hub. Florida’s business-friendly policies and growing status as a financial innovation center made it an ideal location for Metaplanet’s U.S. expansion.

Record-Breaking Fundraising Attracts Global Investors

Metaplanet originally planned to raise $880 million through an international share offering. Strong investor demand led the company to increase the offering to 385 million shares, raising ¥212.9 billion ($1.44 billion).

The fundraising attracted participation from major mutual fund groups, sovereign wealth funds, and hedge funds. Each share was priced at ¥553 (about $3.75), representing a 9.9% discount to recent trading prices.

Metaplanet plans to use most of the funds – 183.7 billion yen – for Bitcoin purchases in September and October 2025. Another 20.4 billion yen will support the company’s Bitcoin income generation business expansion.

Aggressive Bitcoin Accumulation Strategy Continues

The company has maintained an aggressive Bitcoin buying strategy throughout 2025. In early September, Metaplanet purchased an additional 136 Bitcoin for $15.2 million, bringing total holdings to 20,136 Bitcoin.

Metaplanet’s Bitcoin yield – a measure of Bitcoin growth per share – reached 487% year-to-date for 2025. The company acquired its Bitcoin at an average price of $103,196 per coin, positioning it for significant gains as Bitcoin trades above $116,000.

The company aims to reach 30,000 Bitcoin by the end of 2025. Even more ambitious targets include 100,000 Bitcoin by 2026 and ultimately 210,000 Bitcoin by 2027 – representing about 1% of Bitcoin’s total supply.

Japan Subsidiary and Premium Domain Acquisition

Alongside the U.S. expansion, Metaplanet created Bitcoin Japan Inc. in Tokyo’s prestigious Roppongi Hills district. This subsidiary will manage Bitcoin-related media, events, and services throughout Japan.

The company also acquired the premium Bitcoin.jp domain from a private owner who held it for over a decade. The domain will serve as a central hub for Bitcoin Magazine Japan, the Bitcoin Japan Conference, and future Bitcoin-related products and services.

From an accounting perspective, Bitcoin.jp will be treated as an intangible asset and amortized according to standard rules. While it won’t significantly impact 2025 finances, management expects the domain to generate revenue and increase visibility for the company’s Bitcoin operations.

Market Position and Performance Challenges

Metaplanet’s rapid Bitcoin accumulation has drawn comparisons to MicroStrategy, the U.S. software company that pioneered corporate Bitcoin treasury strategies. While MicroStrategy leads with over 638,000 Bitcoin, Metaplanet has emerged as Asia’s clear leader in corporate Bitcoin adoption.

Despite the company’s Bitcoin gains, its stock has faced recent pressure. Shares dropped 1.16% following the expansion announcements and have fallen 31% over the past month. The stock remains up 71% year-to-date, reflecting investor enthusiasm for the company’s Bitcoin strategy despite short-term volatility.

Investment giant Fidelity has become the company’s largest shareholder through its subsidiary National Financial Services, owning 12.9% of shares worth approximately $820 million.

The Road Ahead

Metaplanet’s dual expansion strategy separates Bitcoin accumulation from income generation activities. This approach aims to provide steady cash flow while maintaining aggressive Bitcoin purchasing power.

The Miami subsidiary will operate independently from core treasury functions, allowing for better risk management and governance. Company executives expect the U.S. operations to have minimal impact on 2025 financial results but anticipate stronger contributions in future years.

With Bitcoin’s recent surge above $116,000 and growing institutional adoption worldwide, Metaplanet’s expansion comes at a pivotal moment for corporate cryptocurrency strategies. The company’s success could inspire other Asian firms to adopt similar Bitcoin-focused business models.

You May Also Like

Washington Faces New Dilemma Over Venezuela’s Alleged BTC Reserves

Jose Mourinho Is Back. Can He Be The Special One Again?