Why Oculus Dedicated Proxies Dominate the World of Sneaker Drops

When Nike drops a limited-edition Air Jordan or Adidas unleashes a rare Yeezy collaboration, it’s not just about fast fingers anymore—it’s about fast bots. Every major sneaker release sparks a digital battlefield where milliseconds determine who hits and who misses. In this high-stakes, bot-dominated race, one thing holds the key to victory: proxies. And not just any proxies, but high-performance, reliable solutions like Oculus Dedicated Proxies that have earned elite status among sneaker enthusiasts.

The Backbone of Successful Copping

Sneaker botting isn’t as simple as pressing “buy now.” Behind each successful checkout, there’s usually sophisticated bot software like Kodai, CyberAIO, or NSB working in tandem with powerful proxy networks. These proxies mask IP addresses, simulate human activity from different regions, and bypass geo-restrictions and anti-bot technologies designed to keep bots out.

This is where sneaker dedicated proxies from Oculus stand apart. Specifically designed to evade today’s most advanced security frameworks like Akamai and DataDome, Oculus proxies are known for their lightning-fast speeds and stealth features. Using a blend of geolocated IPs, premium ISP proxies, and adaptive rotation, Oculus allows sneaker bots to fly under the radar and strike at just the right moment.

“Speed is everything on a drop,” says Allen Freeman, a sneaker reseller who’s been using Oculus since 2021. “With Oculus, I get sub-20ms latency consistently on SNKRS. That’s the difference between carting a size 10 Jordan and walking away empty.”

The Market Behind the Hype

Much of the proxy innovation is fueled by the thriving sneaker resale market itself. According to Allied Market Research, the global proxy market is expected to grow from $1.33 billion in 2021 to over $5 billion by 2031. Within that, sneaker bot proxies occupy a fast-growing niche, projected at around $150 million annually.

Why such explosive growth? The margins speak for themselves. A $200 pair of Jordans can flip for triple or quadruple that amount on marketplaces like StockX and GOAT. So, investing $20–$40 on a batch of high-performing proxies isn’t seen as a cost—it’s strategic capital.

Among top-tier providers, Oculus shines. It’s recognized for offering low ban rates—typically under 1.5% during hyped releases—and for maintaining consistent uptime under extreme conditions. Whether it’s SNKRS, Foot Locker, or a Shopify-hosted drop, Oculus often gives bot users the edge over competitors.

Peak Events Turn Into Proving Grounds

The 2023 Travis Scott x Air Jordan 1 drop showed just how critical the right proxies can be. Several Discord cook groups cited Oculus users as having significantly higher checkout success rates than competitors—up to 15–20% better, to be precise. On platforms like Shopify and SNKRS, these few percentage points mean everything.

Another major test came during mid-2023 when Foot Locker rolled out aggressive anti-bot updates. Many proxy providers saw a decline in effectiveness. Oculus, however, swiftly deployed “stealth pools” using freshly sourced residential IPs. Users reported maintaining over 40% success rates, while competitors struggled to push past 30%.

Such responsiveness only fuels more trust, with Oculus often reporting as much as a 300% surge in traffic during key sneaker events.

Navigating a Complex and Risky Landscape

Despite its technical prowess, sneaker botting exists in a legal and ethical gray zone. While proxies and bots aren’t illegal, they do breach the terms of service of most retailers. Brands are responding with advanced bot detection tools, incorporating AI-driven fingerprinting, velocity monitoring, and increasingly complex CAPTCHA systems.

No proxy—however powerful—is foolproof. Changes on the retailer’s backend or timing misalignments can render even premium IPs ineffective. And with daily costs ranging from $1.50 to $2.50 per IP, a failed drop can quickly chip away at profits.

Still, for power users who know how to scale effectively and pivot when needed, the returns are often worth the risk.

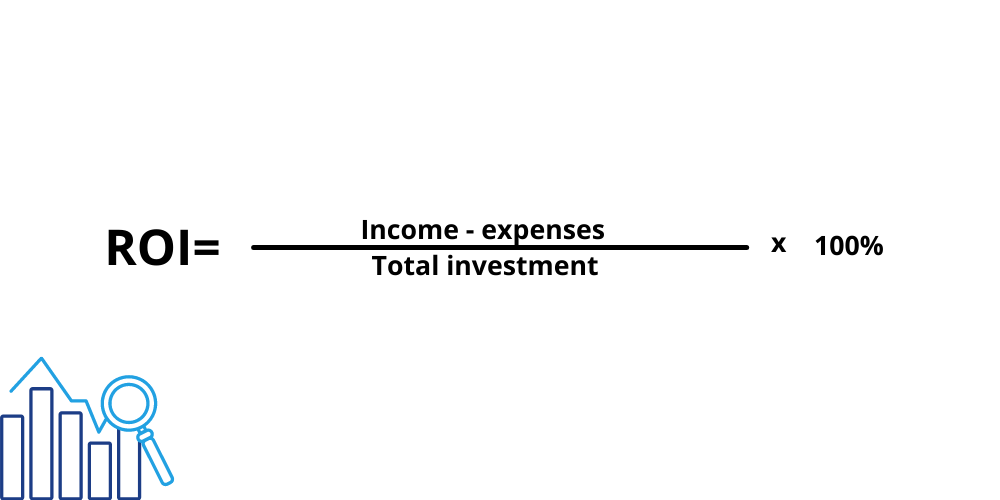

Oculus and the ROI Equation

A successful checkout on a limited-edition pair often yields 200–400% ROI when the resale market behaves favorably. For most professional botters, the scalability of Oculus makes it a go-to even when diversifying across providers. It’s not uncommon for users to rotate between proxy types—in-house, residential, ISP—but Oculus remains a staple thanks to its reliability during high-pressure moments.

A successful checkout on a limited-edition pair often yields 200–400% ROI when the resale market behaves favorably. For most professional botters, the scalability of Oculus makes it a go-to even when diversifying across providers. It’s not uncommon for users to rotate between proxy types—in-house, residential, ISP—but Oculus remains a staple thanks to its reliability during high-pressure moments.

“Oculus is one of the only brands I trust when it’s a million people fighting over 100,000 shoes,” says Maya Taylor, moderator of a prominent 10,000-member sneaker cook group on Telegram. “They’ve earned that reputation drop after drop.”

Future-Proofing the Proxy Game

Looking ahead, proxy tech will only become more central to the botting strategy. Retailers are investing more in AI-powered defenses, from behavioral detection to pattern mapping. In response, Oculus is reportedly developing advanced machine learning algorithms to mimic human-like actions during checkout flows, taking stealth to the next level.

Additionally, rumors from late 2023 hinted at possible acquisitions involving Oculus—potentially integrating its proxy infrastructure into broader fields like NFT drops, ticketing platforms, and secure web scraping.

In essence, the sneaker drop game is no longer just a shopping event—it’s a technological warzone. And at the frontlines, Oculus Dedicated Proxies continue to arm the best in the business with speed, stealth, and scale.

You May Also Like

Ethereum’un Kurucusu Vitalik Buterin, DAO’larla İlgili Dikkat Çekici Eleştirilerde Bulundu! İşte Detaylar

CME Group to Launch Solana and XRP Futures Options