Bitcoin Triggers Sharp Flash Crash to $24K on Binance USD1 Pair

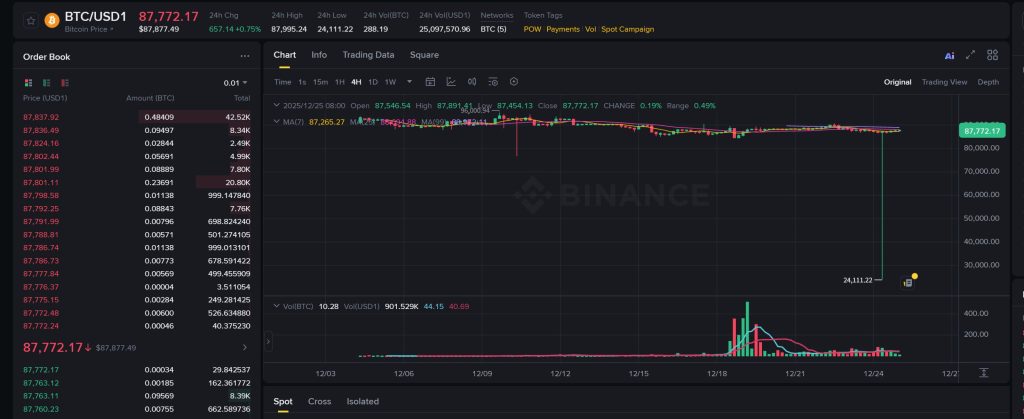

Bitcoin witnessed a sudden flash crash to about $24,111 on the BTC/USD1 trading pair on Binance, before quickly rebounding to $87,000 in seconds.

Per the exchange data, the move appeared isolated to USD1, the stablecoin launched by Trump family-backed World Liberty Financial.

Source: Binance

Source: Binance

This type of “flash wicks” occurs when liquidity thins and order books lose depth. The BTC/USDT trading pair has remained stable after resuming.

Bitcoin Flash Wicks and Quick Reversal

During non-peak trading hours, when market makers often pull back, large buy/sell orders could sweep through multiple empty levels. This scenario creates a dramatic spike that looks like a market breakout.

Further, the instant reversal of the wick shows that no broader market move supported the spike.

“Many spot investors find themselves in a similar position to where they were before the flash crash,” Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, told Cryptonews.

“This is certainly an argument against excessive leverage in a market with fluctuating liquidity in such an uncertain geopolitical climate.”

Additionally, temporary pricing issues can also trigger such dislocations. These price fluctuations are often created by faulty quotes or reactions from trading bots.

Experts often emphasize that real rallies require sustained buying pressure and rising volume. In this case, trading volume remained low, and the price quickly returned to its previous level.

BTC Price Remains Bearish – What is the Next Directional Move?

Bitcoin rose 0.89% to $87,693.65 over the past 24 hours, outpacing the broader crypto market (+0.83%). The crypto is down sharply from its October peakabove $126,000. The largest digital asset is trading at $87,773 at press time, per CoinMarketCap data.

According to analysts, Bitcoin is currently consolidating within a descending “triangle pattern,” trading below the 21MA, which serves as a resistance barrier. A definitive breakout or breakdown would confirm the next directional move.

You May Also Like

American Bitcoin’s $5B Nasdaq Debut Puts Trump-Backed Miner in Crypto Spotlight

Uniswap Governance Approves UNIfication Proposal in Near-Unanimous Vote