Bitcoin Surges to $88K Amid Aave Governance Proposal Turmoil

Crypto Markets Experience Slight Recovery Amidst Ongoing Developments

After a week of volatility, cryptocurrency markets showed signs of recovery, driven by a slowdown in investor activity during the holiday season. Bitcoin experienced a dip to $86,561 but rebounded to above $88,600 by week’s end. Despite this bounce, institutional demand remains subdued, with spot Bitcoin ETFs seeing continued outflows.

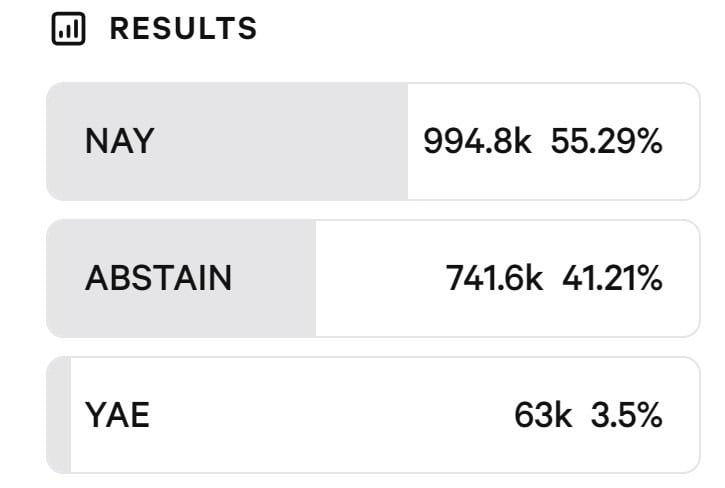

The broader crypto landscape was marked by notable governance debates within the DeFi sector, exemplified by the recent rejection of a proposal to transfer control of Aave’s brand assets to a decentralized autonomous organization (DAO). The community votes resulted in over 55% opposition, emphasizing the ongoing tension around decentralization strategies in major protocols.

BTC/USD, year-to-date chart. Source: Cointelegraph/TradingViewAave Governance Vote Rejects Brand Asset Proposal

The recent governance vote on Aave token, a leading decentralized finance platform, culminated in a rejection of a proposal that aimed to place control of its brand assets under DAO ownership. The snapshot poll closed with 55.29% voting against the move, signaling community reservations about initiating a significant shift in control. Supporters argued that such a move would reinforce decentralization, but the majority preferred maintaining the current structure.

This episode underscores the complexities of governance in DeFi protocols, highlighting how timing, community participation, and internal dynamics influence critical decisions. The rejection reflects the cautious stance of token holders amid ongoing debates about protocol evolution and decentralization.

Results of the Aave governance vote. Source: Snapshot

Results of the Aave governance vote. Source: Snapshot

Hyperliquid’s HYPE Token Faces Growth Hype and Competition

Decentralized perpetual exchange Hyperliquid is making waves in 2025, with Cantor Fitzgerald projecting its HYPE token to reach $200 by 2035. The anticipated growth is driven by the implementation of Hyperliquid Improvement Proposal 3 (HIP-3), which is expected to bolster liquidity and market participation.

Perpetual swaps, which track underlying assets without expiry, have seen increasing adoption, with their market share rising from 2.1% at the start of 2023 to an all-time high of 11.7% in November 2025, according to CoinGecko data. This shift indicates growing interest in decentralized derivatives as rivals deploy lucrative rewards to attract investors.

DEX to CEX perps volume ratio. Source: CoinGecko

DEX to CEX perps volume ratio. Source: CoinGecko

Security Measures Proposed to Combat Address Poisoning

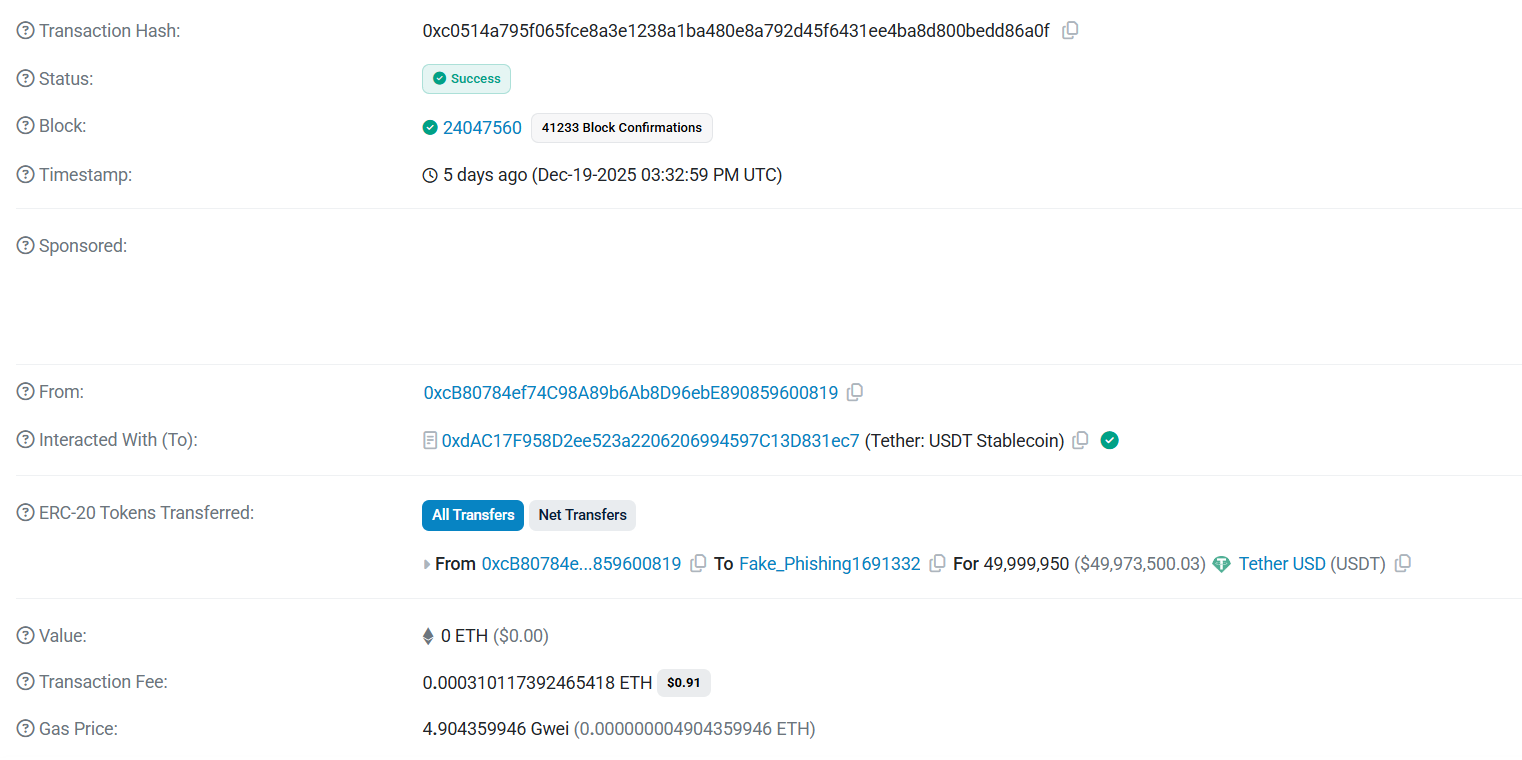

Binance co-founder Changpeng Zhao proposed enhanced security protocols to prevent address poisoning scams, notably including real-time wallet warnings and blacklisting suspicious accounts. Address poisoning involves scammers tricking victims into sending crypto to illicit wallets through small, manipulative transactions, often resulting in significant financial losses.

Recently, a scam resulted in a $50 million USDT loss, emphasizing the need for better security measures. Zhao suggested that wallets should automatically flag or block transactions to known blacklisted addresses, and spam transactions with negligible value should be filtered out to reduce scam surfaces.

$50M address poisoning transaction, wallet 0xcB8. Source: Etherscan.io

$50M address poisoning transaction, wallet 0xcB8. Source: Etherscan.io

Ethena’s USDe Loses $8.3 Billion Amid Market Deleveraging

Ethena’s synthetic dollar, USDe, has seen significant outflows since a major liquidation event in October, losing approximately $8.3 billion in market value amid declining confidence in leveraged synthetic assets. The crash, which eroded nearly 30% of the market cap, marked a turning point as investors withdrew from collateral structures reliant on synthetic and hedging mechanisms rather than traditional reserves.

From nearly $14.7 billion on October 9, USDe’s market cap plummeted to around $6.4 billion by December, reflecting broader deleveraging trends in the crypto sector and waning investor trust in synthetic assets during turbulent market conditions.

Uniswap’s Protocol Fee Switch Nears Activation

Uniswap’s much-anticipated protocol fee switch, known as “UNIfication,” is set to go live following a successful community vote exceeding 40 million tokens. Scheduled after a two-day delay, this upgrade will activate fee switches on Uniswap v2 and v3, leading to the burning of 100 million UNI tokens from the treasury. Additionally, a new liquidity provision incentive system will be introduced to improve returns for providers.

This upgrade aims to stabilize the token’s supply and demand, fostering greater investor confidence. The announcement sparked a nearly 40% rally in UNI’s price from around $7 to nearly $9.70 in early November. Uniswap, the largest decentralized exchange, has processed over $4 trillion in trading volume since its inception in 2018, ranking it as the 39th largest crypto by market cap at $3.8 billion.

Continued integration of protocol improvements highlights the evolving sophistication of decentralized finance, with broader implications for market dynamics and token economics.

This article was originally published as Bitcoin Surges to $88K Amid Aave Governance Proposal Turmoil on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Coinbase Data Breach Fallout: Former Employee Arrest in India Over Customer Data Case Raises Bitcoin Security Concerns

Burmese war amputees get free 3D-printed prostheses, thanks to Thailand-based group