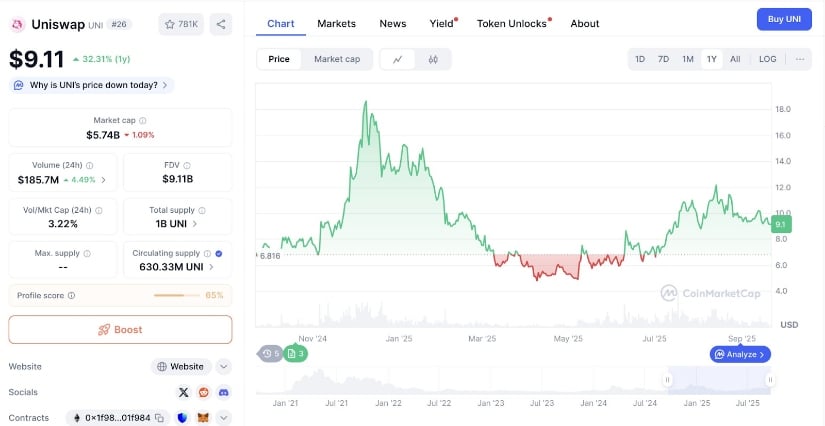

UNI Crypto: With a $5.7B Market Cap, Investors Question Token Utility Amid Soaring Protocol Revenues

Yet none of this revenue reaches token holders, leaving the token’s $5.7B market cap driven mostly by governance weight rather than real value capture.

Price Struggles to Reflect Protocol Strength

In a recent X post, market analyst Clemente highlighted the growing disconnect between Uniswap’s massive protocol revenue and the token’s stagnant value. While the asset Labs reportedly brings in $50 million per year and the protocol itself generates an eye-popping $1.65 billion in fees annually, none of this revenue directly accrues to the token holders.

With the token trading at $9.11 and carrying a $5.7 billion market cap, the lack of value capture has sparked heated discussions across the community.

Source: X

The core issue stems from the asset’s design as a governance token, rather than a direct claim on the protocol’s cash flows.

This structure allows holders to vote on proposals but does little to reward them financially, leaving many to question whether governance utility alone justifies the asset’s multi-billion-dollar valuation. Without a clear buyback, burn, or dividend mechanism, the token risks being overshadowed by other DeFi tokens that tie revenues more directly to holders.

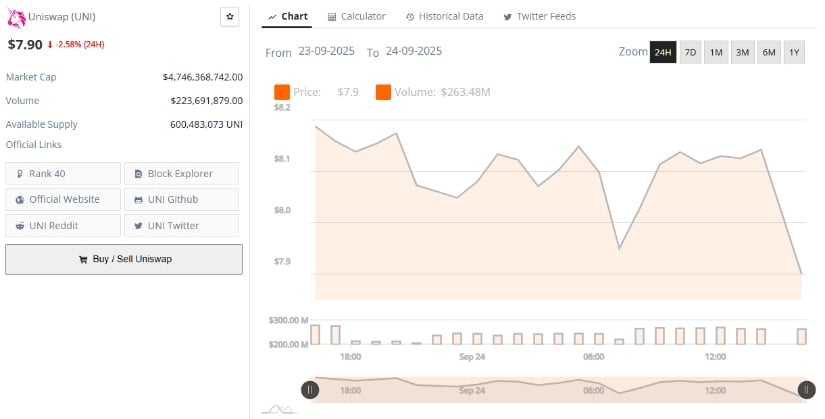

Price Action Highlights the Disconnect

Supporting analyst view, BraveNewCoin data show Uniswap trading at $7.90, down -2.58% in the last 24 hours. The token carries a $4.74 billion market cap, with daily trading volume at $223.6 million and a circulating supply of just over 600 million.

Source: BraveNewCoin

Despite the protocol’s enormous fee generation, price action suggests investors remain cautious, as the asset continues to lag behind the platform’s financial strength.

This steady underperformance underscores the ongoing debate about its role in the ecosystem. While the underlying protocol thrives, the lack of direct value capture weighs on sentiment.

Bearish Momentum Persists Despite Signs of Stabilization

At the time of writing, UNI is trading at $8.12, a modest 0.72% uptick on the day after weeks of volatility that pushed the asset from highs of $12.29 down to lows of $4.55.

Despite this slight recovery, the broader short-term outlook remains bearish, as the token is still retracing heavily from its August peak. The pullback highlights sellers’ dominance, though the latest price action suggests the market may be attempting to stabilize.

Source: TradingView

Momentum indicators reinforce this cautious picture. The MACD remains negative, with both the line and signal below zero, pointing to persistent bearish control, while the histogram indicates fading strength in selling pressure as the gap narrows.

Meanwhile, the RVI sits at 46.42, below its moving average of 49.77, signaling that sentiment leans bearish but not in oversold territory. This leaves room for either further downside if pressure continues or a potential shift toward consolidation if buyers step in to defend current levels.

You May Also Like

China Launches Cross-Border QR Code Payment Trial

LUNC Burns Spike 74%, But Technical Price Setup Dims Hope