Ripple (XRP) Price: Analyst Forecasts Epic Rally Based on Bitcoin Dominance Breakdown

TLDR

- XRP could be preparing for its largest price rally in history, driven by falling Bitcoin dominance patterns similar to previous parabolic moves in 2018, 2021, and 2024.

- Bitcoin dominance has broken down through a multi-year trendline and is rolling over, mirroring the setup before XRP’s past explosive rallies.

- The analyst predicts XRP could reach double digits if Bitcoin dominance confirms a breakdown toward the 40-44% region.

- XRP is currently trading around $2.12-$2.14 after pulling back from December highs near $3.20.

- Whale inflows to exchanges have decreased since mid-December, suggesting reduced selling pressure and a possible re-accumulation phase.

Crypto analyst Bird has forecast that XRP may be setting up for its strongest price rally in history. The prediction centers on Bitcoin dominance patterns that have preceded XRP’s past parabolic moves.

XRP Price

XRP Price

Bird pointed out that Bitcoin dominance dropped sharply during XRP’s three major rallies in 2018, 2021, and 2024. The 2018 run saw XRP reach its previous all-time high.

Between 2018 and 2021, Bitcoin dominance trended back up before rolling over again. When the rollover happened, XRP went parabolic in 2021.

Historical Pattern Repeating

A similar setup occurred in 2024. Bitcoin dominance broke down briefly through its trendline, triggering a surge in XRP. The move didn’t fully commit as Bitcoin dominance recovered. However, the temporary breakdown was enough to send XRP to new all-time highs.

Bird says XRP is sensitive to Bitcoin dominance breakdowns, even temporary ones. Between 2023 and 2025, Bitcoin dominance trended up again, broke down through the trend, and backtested it from underneath.

The analyst says the dominance is now rolling over in the same historical area where XRP went parabolic before. He believes this setup is bigger than previous ones.

If a brief uncommitted breakdown in 2024 sent XRP surging, Bird argues a confirmed breakdown would be much stronger. He predicts the next move could send XRP into double digits and beyond.

Key Support Levels Hold

The difference this time is that Bitcoin dominance may lose the trend for good. Bird expects it to break down hard toward 44-40%. When that happens, XRP won’t just run but will enter true price discovery.

XRP is currently trading near $2.12-$2.14, down from December highs around $3.20. The price has been holding a key support zone with limited volatility.

Technical indicators show consolidation. The 14-period RSI is hovering around 44-45, showing neutral momentum. The MACD is in negative territory at approximately -0.038, but the flat histogram suggests bearish pressure is easing.

XRP is trading below its 50-period moving average while holding above the 200-period moving average near the $2 level. Traders view this as a pause within a broader support zone.

Whale Activity Decreases

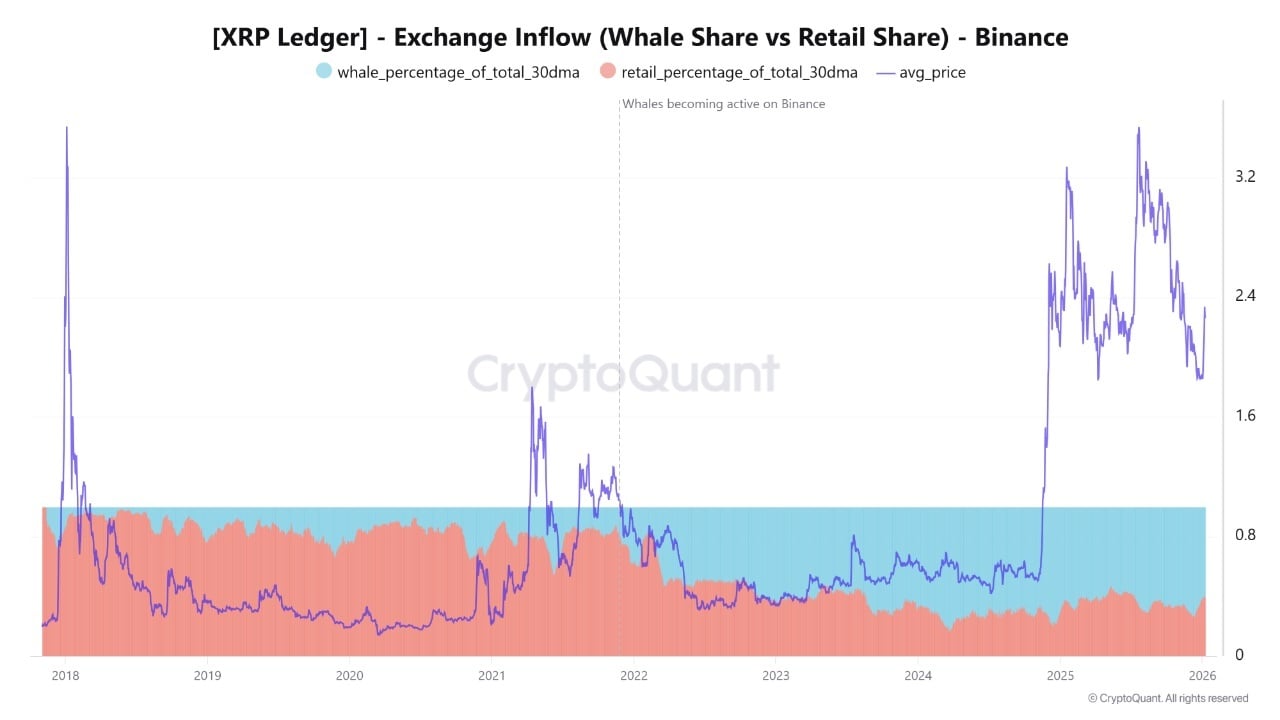

On-chain data from Cryptoquant shows whale inflows to Binance have decreased since mid-December. Whales account for about 60.3% of total XRP flows to Binance compared to 39.7% from retail investors based on 30-day averages.

Source: CryptoQuant

Source: CryptoQuant

Large holder activity has cooled after months of high participation near the peak of XRP’s rally. As whale inflows decreased, XRP transitioned from a sharp advance to a corrective phase.

The pullback in large holder transfers was not accompanied by increased retail inflows. This suggests selling pressure has not spread across the broader market.

Cryptoquant’s analysis stated this balanced behavior may indicate XRP is entering a re-accumulation phase after a strong upward move. Reduced activity from large holders diminishes short-term selling risk.

The price is fluctuating between approximately $2.06 and $2.19 in recent trading, reflecting limited directional conviction as the market awaits a clearer catalyst.

The post Ripple (XRP) Price: Analyst Forecasts Epic Rally Based on Bitcoin Dominance Breakdown appeared first on CoinCentral.

You May Also Like

Slate Milk Raises $23 Million Series B Round To Bolster Protein Drink’s Rapid Growth

The HackerNoon Newsletter: New frontiers in Human AI Interface (9/19/2025)