Breaking the Blackout: Iranian Protestors Use Freedom Tech to Bypass Regime Crackdown

Bitcoin Magazine

Breaking the Blackout: Iranian Protestors Use Freedom Tech to Bypass Regime Crackdown

Iran has been experiencing intense protests against the Islamic Republic regime in recent weeks. Authorities have responded with severe measures, including a nationwide telecoms blackout and jamming satellite services like Starlink, aimed at preventing coordination among demonstrators.

Iranians are embracing freedom tech tools; Bitchat, Noghteha, and Delta Chat for offline communication. Two of these apps trace their origins directly to Bitcoin, highlighting how technologies from this community provide practical solutions in high-stakes environments. Bitchat, built by Bitcoin pioneers Jack Dorsey and open-source developer Calle, operates over Bluetooth mesh networks and the Nostr protocol without needing an internet connection. Noghteha on the otherhand, is a closed-source fork of Bitchat, adapted for the Iranian context with full Persian/Farsi support, an enhanced user interface, and features tailored to local needs.

How Did Bitchat and Noghteha Gain Popularity?

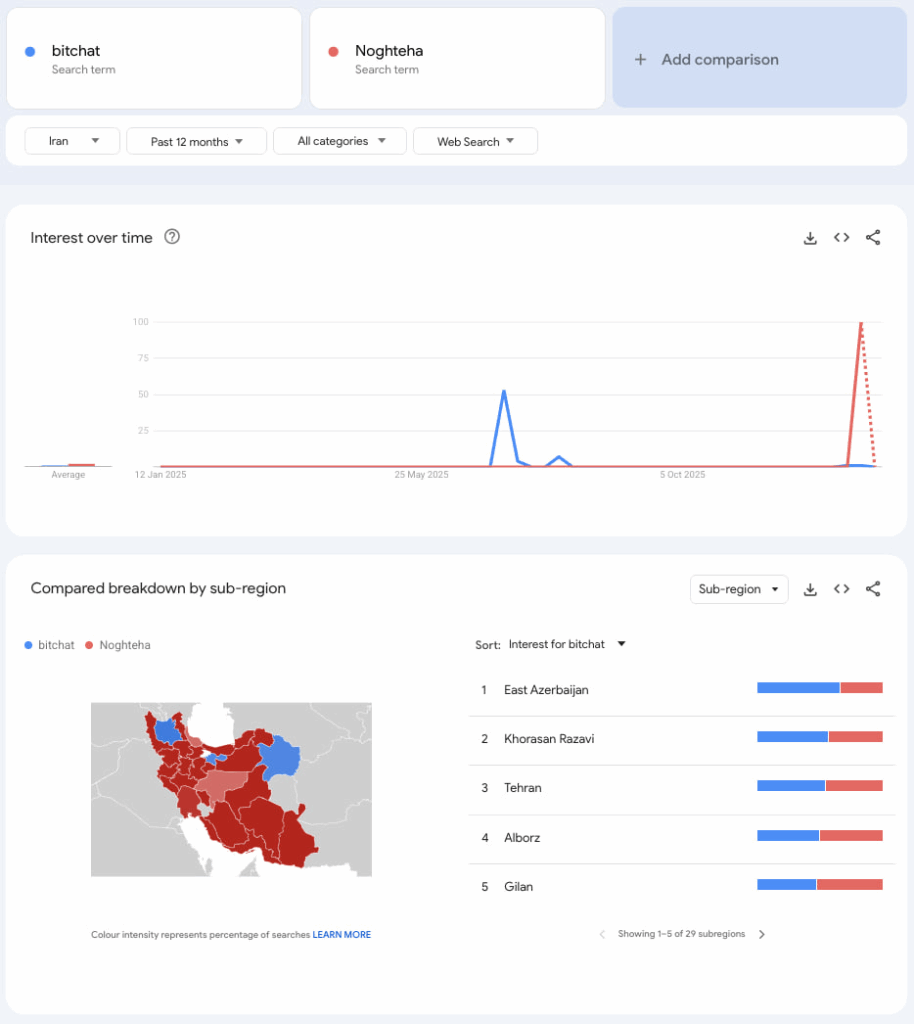

Bitchat first gained widespread attention when Jack Dorsey announced it on X on July 6, 2025, describing it as a weekend project to explore Bluetooth mesh networks. The announcement generated immediate interest, reflected in surges on Google Trends for related searches. In September, Frank Corva wrote about Bitchat’s role in supporting Nepalese protestors during social media restrictions and unrest, where nearly 50,000 downloads occurred in a single day.

Noghteha, on the other hand, saw rapid adoption in the first week of January 2026. Before the full internet shutdown, Google Play recorded more than 70,000 downloads of Noghteha in the space of three days, with numbers likely increasing through peer-to-peer sharing, sideloading, and Bluetooth transfers afterward.

Promotion of Noghteha reached a broad audience through Iran International, an opposition satellite TV channel based outside Iran. The station, a major source of information and coordination guidance from figures like opposition leader Reza Pahlavi, broadcast details about the app.

The developer Nariman Gharib, a digital-political activist, released the app independently, without government or private funding, as a response to the regime’s tactics.

But Why Fork Bitchat?

The Iranian regime employs highly sophisticated information warfare tactics. As Ziya Sadr, a prominent Bitcoin researcher and former political prisoner, explains: “The regime sets up phishing attacks, creates fake download links, and uses influencers on social media to misguide people into installing malicious versions of the same app.”

This persistent threat is likely the main reason the Noghteha developer chose not to release the app as fully open-source, and perhaps it also explains the app’s release timing, just before the internet shutdown. By releasing so close to the expected blackout, there was an opportunity to distribute a new, closed-source version into as many hands as possible before the regime could interfere with downloads or seed malicious alternatives.

Noghteha remains compliant with Bitchat’s MIT license, which allows modifications and redistribution with proper attribution. This approach is an attempt to quickly protect protesters from regime sabotage.

Calle, Bitchat’s co-creator, doesn’t quite see it that way. He’s concerned about the closed-source elements, donation requests, and security risks in adversarial settings—points that are valid and hard to dispute.

Yet the interaction raises a worthy question: Is Bitchat cypherpunk enough to counter the regime’s potential undermining of it, where openness itself could be weaponized? In that sense, does Noghteha achieve something that Bitchat can’t, and should that be the case, can Bitchat be adapted to become more resilient against such tactics?

Ultimately, it’s inspiring to see Bitcoin gaining prominence on the international stage, alongside freedom tech tools rooted in the cypherpunk principles of privacy through cryptography. Cypherpunks and, more recently, Bitcoin developers have pioneered technologies that excel in high-stakes scenarios, empowering individuals to maintain communication and autonomy amid oppression. With many of these tools released under permissive open-source licenses like MIT, they invite cloning and repurposing to fit various needs. While closed-source adaptations introduce new risks, they also can also generate valuable lessons, potentially guiding future enhancements to better withstand information warfare tactics.

The events in Iran demonstrate how innovations from the Bitcoin ecosystem adapt and thrive, offering real support to those navigating censorship, blackouts, and repression through resilient, user-focused tools.

Editor’s Note: A Warning on Security Users should proceed with caution. Noghteha is a closed-source application. Calle, the original developer of Bitchat, has explicitly warned against using the app due to the inability to verify its code or security. However, reports from the ground indicate it is being widely and successfully used by protestors.

This post Breaking the Blackout: Iranian Protestors Use Freedom Tech to Bypass Regime Crackdown first appeared on Bitcoin Magazine and is written by Conor Mulcahy.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim