Are Antivirus Software Still a Thing?

\ Welcome to 3 Tech Polls, HackerNoon's brand-new Weekly Newsletter that curates Results from our Poll of the Week, and related polls around the web. Thanks for voting and helping us shape these important conversations!

This one’s for the old heads!

Remember the time in the 90s, when home computing was finding its footing, and you, or someone you knew, had a PC installed at their homes? Seeing a home computer for the first time was a novel experience for many of us, but that novelty was soon superseded by something infinitely cooler: the internet.

Referred to as a digital information highway, the dial-up and, by extension, the internet opened up the world for many of us, but brought with it something sinister: computer viruses. Computer viruses were.. UGH, but was a daily occurrence for many of us internet heads.

That’s where software companies saw an opening, and kaboom! You now had anti-virus software. Ah, these were the days of Norton AntiVirus, Kaspersky, Panda Antivirus, Mcafee. Over the years, the names changed, but their function remained the same: to help “protect” your computer from viruses, malwares, and such.

Now that the 90s and the 2000s are over, the antivirus landscape looks a lot different. Consumers are, naturally, more savvy than they were in the wild west days of the internet, so are unlikely to click on random links on the internet they way we did back in the day, but that doesn’t mean viruses haven’t evolved either.

Cybercriminals too have become savvy since then, meaning, viruses are more subtle and aren’t as obvious as they were before. But the biggest change since the 90s is that antivirus software has become accessible, largely because they’re a default on the world’s most popular OS, Windows, and because they no longer require a credit card to use.

So, to get a feel of what the antivirus software market looks like today, we thought it’d be fun to ask readers: Do they still use antivirus software on their PCs?

This Week’s Poll Results (HackerNoon)

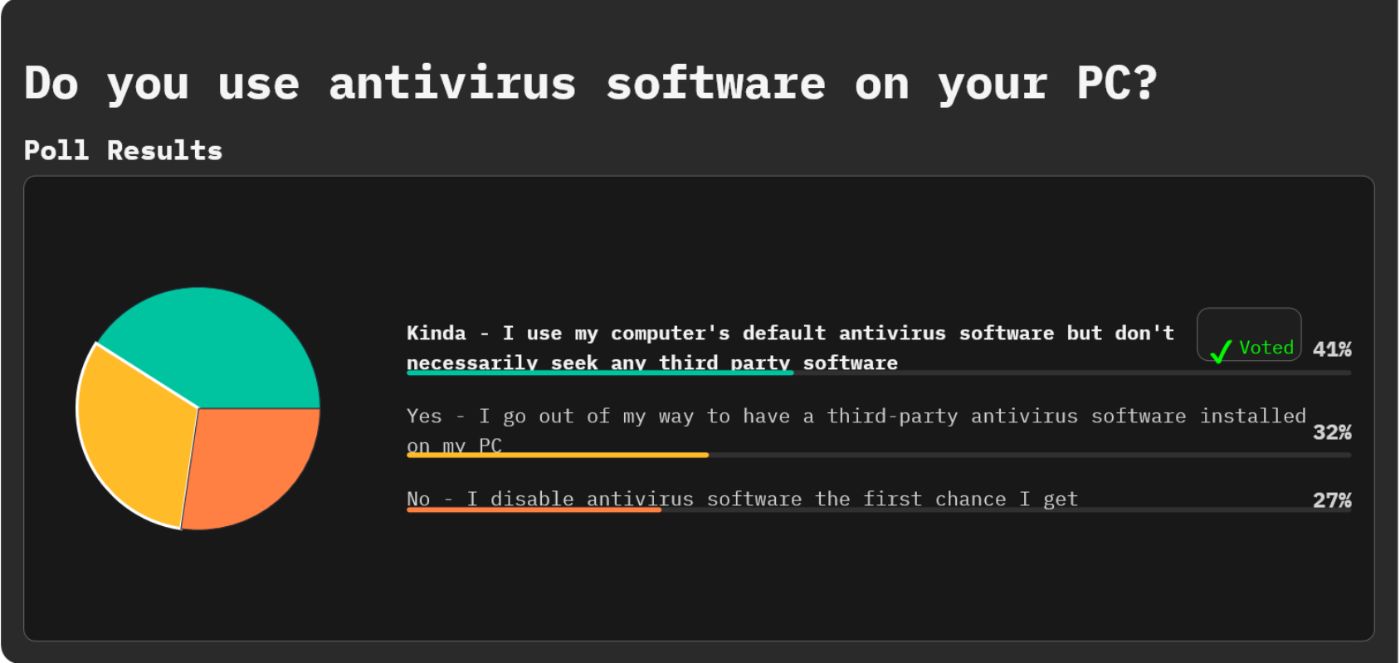

Do you use antivirus software on your PC?

Over 161 readers weighed in on the poll, and the results were.. not that surprising:

- 41% said they let Windows handle it

- 32% said they go out of their way to install third-party antivirus software

- 27% said they want nothing to do with antivirus software at all

\

So there you have it folks! The default behavior seems to be: most users like to let Windows do its thing, and don’t feel the need to go out of their way to install anything more. And why would they?

For most people on Windows 10/11, the built-in Microsoft Defender Antivirus is “good” in the way people expect it.

Independent test labs regularly include Microsoft Defender alongside paid products, and it often lands in the same top tier on protection scoring frameworks. And because it’s built into Windows, Defender tends to be stable, low-friction, and less likely to create weird system conflicts than some third-party suites.

However, for more than a quarter of readers, Defender may either not be an option (different OS, for example) or maybe they’re looking for something a bit more comprehensive. Most paid antivirus suites are no longer “just” antivirus software. They usually include:

\

- stronger/phish-focused web protection bundled with browsers/extensions,

- password manager + VPN + identity monitoring,

- more configurable firewall controls / parental controls,

- bundled scam protection tooling, etc. (Typical of suites like Norton/McAfee/Bitdefender.)

Paid suites ALSO make sense when you want stuff beyond “stop malware”—or you’re protecting multiple people/devices and want it all managed in one place. NOT if you’re a single Windows 10/11 user, who keeps updates on, use a modern browser, don’t install sketchy stuff, and you already use a password manager + good browser security habits.

\

Which leaves us with over a quarter of readers who want nothing to do with antivirus software at all!

Look, we get it.

There are legitimate reasons someone might want to disable antivirus entirely—but they’re almost always narrow, temporary, and better handled with safer alternatives (like exclusions, a VM, or an offline lab machine). “Disable it the first chance I get” is usually a values/operational choice (control, privacy, performance) rather than a security best practice.

Or maybe, some people prefer living life that, who knows :grin:

Well, that’s that! Speak to y’all next time.

:::tip Weigh in on the Poll Results here!

:::

\

🌐 From Around the Web: Polymarket Pick

What price will Bitcoin hit in January?

Users on Polymarket are betting on the possible price trajectory of Bitcoin by the end of January.

In the past week, several developments have influenced predictions about Bitcoin's price trajectory for January 2026. Industry forecasts reported on January 8 highlight a broad range of potential prices, from a low of $75,000 to a high of $225,000, reflecting significant uncertainty. On January 10, prominent analyst Tom Lee from Fundstrat predicted a new all-time high above $126,000 by month-end, citing a reset in market leverage as a bullish signal. Additionally, Bitcoin is currently consolidating around $90,000, with fading momentum and policy risks noted as key factors affecting near-term probabilities as of January 7-13.

So far, the range currently being favored by polymarket is in the $80,000 to $100,000 range, with the ~$95,000 range being the clear favorite.

🌐 From Around the Web: Kalshi Pick

When will Bitcoin hit $150k?

Over at Kalshi, users are trying to guess when Bitcoin could finally hit the $150k mark. The current favorite seems to be by June 2026, apparently.

\ Here’s to hoping! :crossed_fingers:

We want to hear from you!

:::tip Vote on this week’s poll: Which humanoid robot from CES 2026 is the most promising?

:::

\ That’s it, folks! We’ll be back next week with more data, more debates, and more donut charts!

\

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim