Bitcoin Price Roars Past $94,000 as Bulls Reclaim Key Resistance

Bitcoin Magazine

Bitcoin Price Roars Past $94,000 as Bulls Reclaim Key Resistance

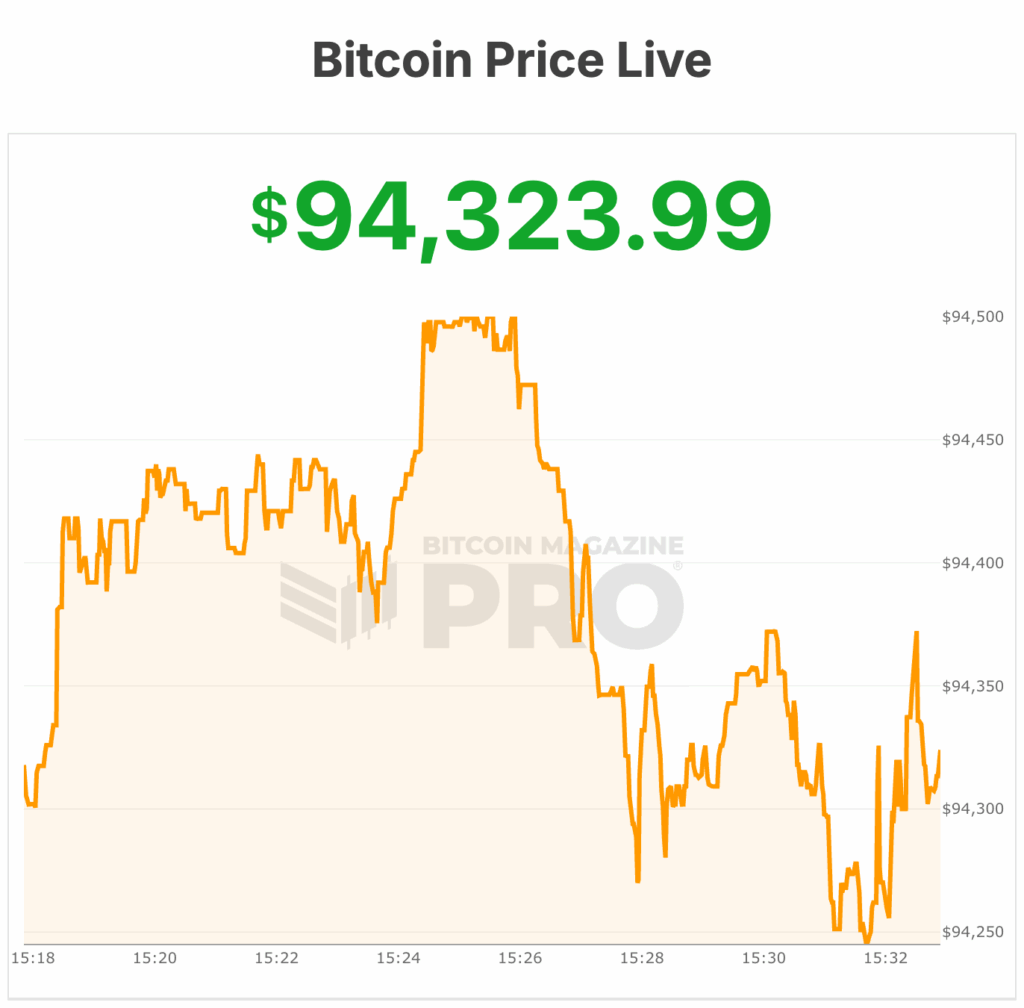

Bitcoin price surged above the $94,000 level this afternoon, breaking through a key resistance zone and signaling renewed bullish momentum after weeks of range-bound trading.

At the time of writing, the bitcoin price is trading at $94,435, up roughly 3% over the past 24 hours, according to market data.

The move marks a decisive reclaim of the upper end of January’s consolidation range, with the bitcoin price now sitting effectively flat relative to its seven-day high of $94,040 and roughly 4% above its seven-day low of $90,897.

Trading volume over the past 24 hours totaled approximately $52 billion, reflecting heightened market participation as price pushed higher.

Bitcoin’s total market capitalization rose to $1.88 trillion, also up about 3% on the day, as the asset continues to assert its position as the dominant cryptocurrency.

Bitcoin’s circulating supply currently stands at 19,975,465 BTC, just under the protocol’s hard-capped maximum of 21 million coins.

Is Powell getting pushed out of the Fed?

Over the weekend, the U.S. Department of Justice opened a criminal investigation into Federal Reserve Chair Jerome Powell, a development that rippled through financial markets and coincided with renewed volatility in the bitcoin price.

The probe marks a sharp escalation in a months-long standoff between the White House and the U.S. central bank and its Chair.

Powell disclosed via a social media post that the DOJ served the Federal Reserve with grand jury subpoenas and raised the possibility of criminal charges tied to his June 2025 congressional testimony regarding the more than $2.5 billion renovation of Fed office buildings.

The Fed chair characterized the investigation as politically motivated, arguing it reflects mounting pressure from the Trump administration to push through deeper interest rate cuts rather than maintain the central bank’s data-dependent policy framework.

President Donald Trump has repeatedly criticized Powell’s leadership and the broader Fed monetary policy. Trump has somewhat denied direct involvement in the DOJ action, but he has continued to publicly express frustration with the central bank’s reluctance to ease policy (mainly interest rates) more aggressively.

The widening dispute unsettled traditional markets over the last two days. U.S. stock futures slid, while investors rotated into perceived safe-haven assets, driving gold and silver prices to fresh record highs. Bitcoin, often framed as an alternative hedge against political and monetary uncertainty, is reacting to this tension.

Bitcoin price analysis

Tuesday’s rally follows a period of technical indecision earlier in the week, when bitcoin repeatedly tested resistance near $94,000 but failed to hold above it.

Market structure over the past several weeks had been defined by choppy price action between roughly $84,000 and $94,000, with analysts warning that bulls needed a clean breakout above resistance to regain control.

That breakout now appears to be materializing. A sustained move above a bitcoin price of $94,000 could open the door to higher resistance zones between $98,000 and $103,500, levels that previously capped upside attempts.

Failure to hold above this threshold, however, could see bitcoin slip back into its prior trading range.

The price surge comes amid continued macro uncertainty, with investors closely monitoring inflation trends, interest-rate expectations, and broader political developments tied to monetary policy.

In recent months, bitcoin has increasingly traded in tandem with macro narratives, with some market participants viewing the asset as a hedge against policy instability and long-term currency debasement.

While near-term volatility remains likely, bitcoin’s ability to reclaim and hold the $94,000 level marks a notable shift in market sentiment. Traders and analysts alike are now watching whether bulls can build follow-through and convert former resistance into support in the days ahead.

At the time of writing, the bitcoin price is $94,323.

This post Bitcoin Price Roars Past $94,000 as Bulls Reclaim Key Resistance first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim