BitMine deepens its Ethereum bet with $46m as corporate holdings surge

BitMine has been on an Ethereum buying spree, continuing its big bet on the second-largest crypto by market cap. The company now stands as the single biggest corporate holder of ETH, building a treasury that has outpaced rivals and attracted global attention.

- BitMine has increased its Ethereum holdings with a fresh $46 million purchase.

- The company began accumulating ETH in mid-July 2025, now ranking as the larget corporate ETH holder.

- Corporate Ethereum holdings are rising overall, now worth nearly $20 billion.

BitMine has acquired an additional 9,600 ETH (ETH) for roughly $45 million, according to on-chain data shared by Lookonchain on Aug. 24. The purchase brings its total treasury holdings to about 1.58 million ETH, valued near $7.5 billion at current prices.

The multi-million dollar acquisition marks the latest in the firm’s streak of buys over the past month, since beginning ETH accumulation in mid-July 2025 with an initial purchase worth roughly half a billion dollars. Within just over a month, the company’s holdings have swelled significantly, now ranking as the largest corporate ETH holder globally.

BitMine chairman Tom Lee has described the firm’s portfolio buildup as part of a broader long-term vision, aiming to eventually hold five percent of Ethereum’s total supply. The strategy is driven by the company’s confidence in Ethereum’s potential to reshape the financial system and support large-scale adoption of blockchain technology.

The Vegas-based firm is backed by institutional heavyweights such as ARK Invest and Pantera Capital, with billions in funding support, and its continued accumulation is pushing overall corporate ETH holdings to fresh highs.

The bigger picture of corporate ETH holdings

According to the latest data from StrategicETHReserve, corporate treasuries now hold around $19 billion in ETH. This figure marks a jump from their $17 billion mark just under a week ago, and BitMine’s current $7.5 billion makes up the largest share.

Other firms are also expanding their Ethereum reserves. SharpLink Gaming, the second-largest corporate ETH holder, holds over 740,000 ETH, worth more than $3.5 billion. The third-largest is The Ether Machine, which holds over 345,000 ETH worth approximately $1.6 billion.

The Ethereum Foundation itself, which manages the protocol’s treasury, controls hundreds of thousands of ETH, worth just over $1 billion. Together, BitMine, SharpLink, and the Foundation account for the majority of the more than $19 billion in publicly disclosed corporate ETH holdings, while dozens of smaller firms make up the remaining share.

Amid the ongoing wave of aggressive accumulation, Ethereum co-founder Vitalik Buterin has warned of potential risks, cautioning that it could evolve into “leveraged poker.” Buterin described a scenario where companies borrow heavily against their ETH reserves, leaving them exposed to forced liquidations in a downturn, a chain reaction that could amplify volatility and undermine confidence in Ethereum’s stability.

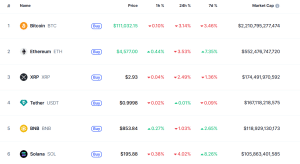

Meanwhile, on August 23, ETH climbed above $4,900 to set a new all-time high. However, the asset was unable to hold the gains, and its price has since retreated. At press time, ETH trades just over $4,535, down roughly 4.3% in the past 24 hours.

You May Also Like

Galaxy Digital, Multicoin Capital And Jump Crypto Partner To Start A $1B Solana Treasury Firm, Bloomberg Says

U.S. Banks Warn Stablecoins Could Trigger Massive Deposit Outflows