China Considers Yuan-Backed Stablecoins in Major Policy Reversal

China is preparing to allow yuan-backed stablecoins for the first time, signaling a major shift in its crypto policy and a new push to expand the global role of its currency. China is reportedly considering authorizing the use of stablecoins backed by local currencies, according to the latest Reuters report. The move would mark a sharp policy turnaround after Beijing banned cryptocurrency trading and mining in 2021. The proposal is part of a strategy to strengthen the yuan’s role in international finance. The State Council is set to review and could approve the roadmap later this month, according to the report. The plan is to expand global use of the yuan and counter Washington’s accelerating push for stablecoin dominance. Beyond the council review, China’s top leadership will hold a study session by the end of August. That meeting will specifically focus on the yuan’s internationalization and the potential role of stablecoins. Senior leaders are expected to provide policy guidance, specify how the tokens should be integrated into business, and determine clear rules for their position in trade and finance, the report added. Challenging U.S. Dollar Dominance The shift comes at a time when the United States is entrenching its dominance in digital currencies. Dollar-pegged stablecoins already account for the bulk of the $275 billion global stablecoin market. Washington has also moved to formalize its lead. President Donald Trump recently signed the GENIUS Act, which aims to promote USD-backed tokens worldwide. By comparison, China’s currency has been losing ground. The yuan accounted for just 2.88% of global payments in June, its weakest share in two years. The U.S. dollar, meanwhile, controlled nearly half of international transactions, according to SWIFT data. For Beijing, the stablecoin strategy is to close that gap, positioning the yuan as a digital rival to the U.S. dollar. Laying the Regulatory Groundwork To avoid destabilizing its financial system, China is crafting a detailed framework for the rollout. The People’s Bank of China (PBOC), with other regulators, will be tasked with defining rules, assigning responsibilities, and setting targets for yuan use abroad. According to sources, the plan will also include mechanisms to manage risks such as capital flight, speculative flows, and cyber vulnerabilities. Officials see this as essential to ensuring that stablecoins complement, rather than undermine, existing monetary policy. Hong Kong and Shanghai as Launch Pads Two financial hubs will serve as launch pads for the project. Hong Kong, which introduced a stablecoin ordinance on August 1, will play a key role in offshore issuance. A PBOC advisor has already floated the idea of a Hong Kong-based yuan stablecoin to bypass capital restrictions. Meanwhile, Shanghai is building an international operations hub for the digital yuan. Together, these two financial centers will accelerate both domestic trials and offshore applications of yuan-backed stablecoins. International Push and SCO Summit China’s global ambitions will also feature at the upcoming Shanghai Cooperation Organisation (SCO) Summit in Tianjin. The summit, scheduled for August 31 to September 1, could see Beijing discuss the use of yuan stablecoins for cross-border trade and settlement. Chinese exporters have already embraced dollar-backed stablecoins for faster international transactions. By introducing a yuan alternative, Beijing hopes to wean them off the dollar and accelerate the adoption of its own currency in global commerce Challenges That Remain Despite the enthusiasm, China faces steep hurdles. Its strict capital controls limit the free movement of money across borders, raising questions about how a yuan stablecoin could function on a truly global scale. Analysts warn that unless Beijing loosens some restrictions, yuan-backed tokens may struggle to compete with the liquidity and flexibility of dollar-based stablecoins. Still, the broader significance is clear. By embracing stablecoins, China is signaling that it no longer views crypto technology purely as a threat but as a strategic asset in the global currency race.

You May Also Like

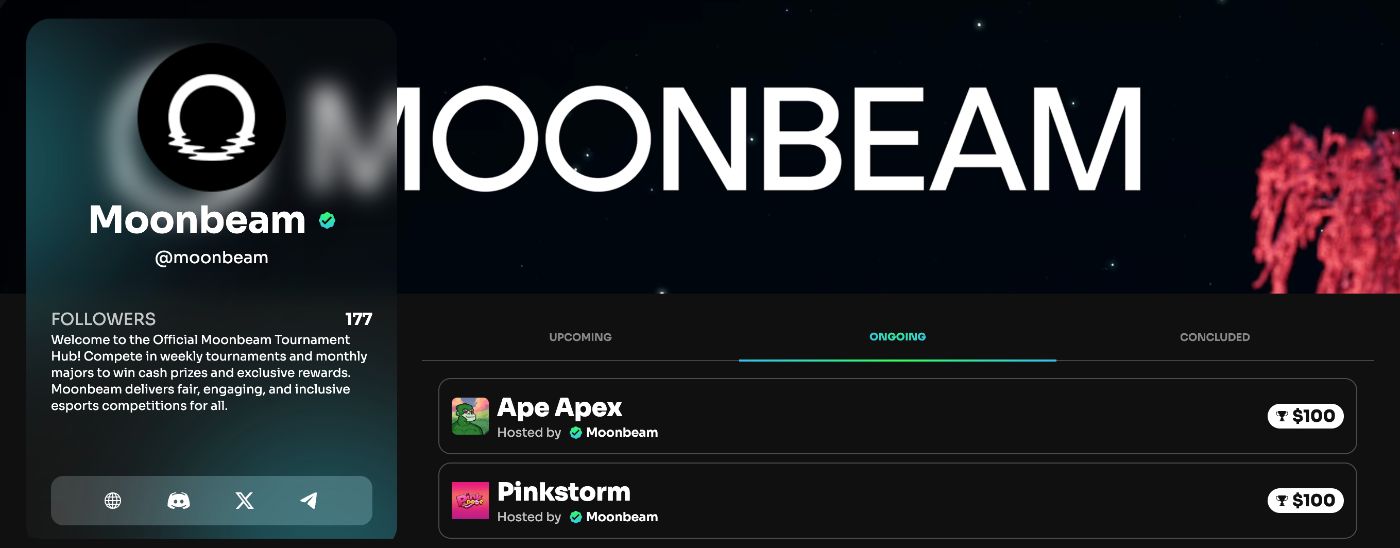

Why Web3 Gamers Are Rushing To Moondrop, Moonbeam’s GLMillionaire With 1,000,000 GLMR On The Line

Solana ETF Decision Delayed, Giving Mutuum Finance (MUTM) More Room to Eat into SOL’s Market Share