Crypto Fear & Greed Index: Navigating Crucial Market Sentiment at 54

BitcoinWorld

Crypto Fear & Greed Index: Navigating Crucial Market Sentiment at 54

In the dynamic world of cryptocurrency, understanding market sentiment is crucial. The Crypto Fear & Greed Index currently stands at 54, signaling a neutral market sentiment. This five-point rise from yesterday reflects a slight shift in collective mood, but not enough for extreme optimism or pessimism. This prompts investors to assess their strategies carefully.

What Exactly is the Crypto Fear & Greed Index, and How Does It Work?

The Crypto Fear & Greed Index, an insightful tool from Alternative.me, measures market emotions on a scale from 0 (‘Extreme Fear’) to 100 (‘Extreme Greed’). It helps investors avoid impulsive, emotion-driven decisions.

- Key Components Fueling the Index:

-

- Volatility (25%): Price fluctuations.

- Market Volume (25%): Trading activity.

- Social Media (15%): Sentiment from platforms.

- Surveys (15%): Direct investor polls.

- Bitcoin Dominance (10%): Bitcoin’s market share.

- Google Trends (10%): Search interest.

These factors combine to provide a daily snapshot of the market’s emotional state, offering a unique perspective on investor psychology.

How Does a Neutral Crypto Fear & Greed Index Impact Your Strategy?

When the Crypto Fear & Greed Index sits in the neutral zone (e.g., 54), it presents a balanced environment. Unlike extreme readings, neutrality calls for careful consideration over aggressive action.

- What Neutrality Implies:

-

- Reduced Urgency: No strong buy/sell signals.

- Consolidation Potential: Prices might stabilize.

- Heightened Vigilance: Watch for catalysts shifting the index.

For traders, a neutral Crypto Fear & Greed Index means avoiding impulsive actions. Focus on technical analysis and fundamental developments. It’s an opportune moment to refine watchlists and prepare for potential shifts, encouraging a more strategic approach to investments.

Mastering the Crypto Fear & Greed Index for Informed Decisions

While the Crypto Fear & Greed Index is excellent, it’s not a standalone solution. Mastering its use involves integrating it with other analytical methods for a comprehensive view. Combining it with chart patterns or news analysis can significantly empower your decision-making.

- Key Considerations for Effective Use:

-

- Context is Key: Consider the broader market cycle.

- Lagging Indicator: Can react to moves, not always predict.

- Bitcoin-Centric: Heavily weighted towards Bitcoin.

The index offers a valuable snapshot of collective psychology, helping identify when the crowd gets too emotional. Understanding its components allows for more rational, less emotionally charged decisions. Leverage such tools to enhance your perspective, not to blindly follow them.

The Crypto Fear & Greed Index, currently at a neutral 54, serves as a vital guide in the dynamic crypto market. Its ability to distill complex data into a simple fear-to-greed spectrum is invaluable. By understanding its components and integrating it with robust analytical methods, investors can develop a more resilient, informed strategy, avoiding emotional trading pitfalls. Stay vigilant, stay informed, and let sentiment be a guide, not a master.

Frequently Asked Questions (FAQs)

- Q1: What does a “neutral” reading signify?

-

- A neutral reading (e.g., 54) indicates market balance, suggesting potential consolidation.

- Q2: How often is the index updated?

-

- Daily by Alternative.me.

- Q3: Can it predict price movements?

-

- It offers sentiment insights but isn’t a direct price predictor. Use with other analysis.

- Q4: Is it only for Bitcoin?

-

- Heavily Bitcoin-weighted, reflecting its sentiment, often a proxy for the broader market.

- Q5: Why are volatility and volume weighted highest?

-

- At 25% each, they are strong indicators of market activity and investor conviction.

Did you find this deep dive into the Crypto Fear & Greed Index insightful? Share this article with your fellow crypto enthusiasts and help them make more informed decisions in the dynamic world of digital assets!

To learn more about the latest explore our article on key developments shaping Bitcoin’s price action.

This post Crypto Fear & Greed Index: Navigating Crucial Market Sentiment at 54 first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

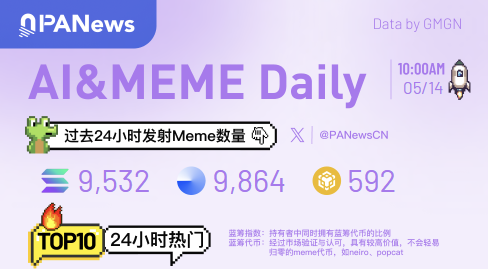

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Sending Bitcoin to Mars is now theoretically possible: Researchers