How Did EminiFX’s Founder Lose $228 Million? Inside the Shocking Crypto Ponzi Scheme Uncovered

- EminiFX owner gets 228 million Ponzi fraud fine.

- The scheme used money on new clients to pay the early investors.

- The case is an indication of tighter crypto regulation and enforcement.

The 228 million dollar sum is the amount that the EminiFX founder is held accountable for. This follows a long probe into a Ponzi. The scam deprived thousands of investors of their money.

EminiFX guaranteed good profits on crypto and forex trading. However, the activities were developed as a result of lies and deceit.

EminiFX promoted itself as a profitable trading platform. An attraction of consistent monetary gains enticed the victims.

Nevertheless, the company did not make actual returns. Rather than use the cash that it was getting as payment to new customers, it used the money to pay early investors. The plot later fell under the pressure of regulation.

How Was The Scheme Of EminiFX Unravelled?

Law enforcers discovered the work mechanism of the operation. They explained a typical Ponzi scheme in its essentials. The fake profits were paid by the inflow of new investors’ funds. This gave an illusion of success, which deceived many.

The founder intentionally deceived investors regarding the dangers. These were held as deliberate actions by the court. The damages are comparable to the judgment amounting to $228 million. It ensures losses for the investors and penalties for them.

This decision was arrived at following a legal tussle. Evidence was collected on fraud and misrepresentation by prosecutors.

The case was constructed with the help of the testimonies of victims. It was stressed by regulators that the a necessity to prevent such crime.

Crypto Industry Rips Hangover to Legal Fallout

In this case, the risks of unregulated digital finance are evident. It comes after a worldwide sweep of crypto fraud enforcement. There exists a wide range of businesses that do not have well-understood regulations.

That exposes investors to fraud such as EminiFX. This decision can trigger the need to tighten crypto regulations by lawmakers. The industry analysts foresee increased use of similar platforms under more scrutiny.

The Business Wire report mentioned that digital asset companies are having to cope with increased pressure to be transparent. The number of institutional investments in the crypto field rises, and risks do as well.

The EminiFX example is a reminder to investors of what they should be wary of. It is vital to exercise caution and question, according to legislators. Such cases may drive the industry toward a safer practice.

The ruling also boosts the demands for improved education of investors. A lot of those who became entangled in the scheme did not know much about crypto risks.

Such a fraud may be reduced by increasing financial literacy. The judgment made in the court forms a precedent for holding culpable operators. It also persuades the victims to pursue justice.

The post How Did EminiFX’s Founder Lose $228 Million? Inside the Shocking Crypto Ponzi Scheme Uncovered appeared first on Live Bitcoin News.

You May Also Like

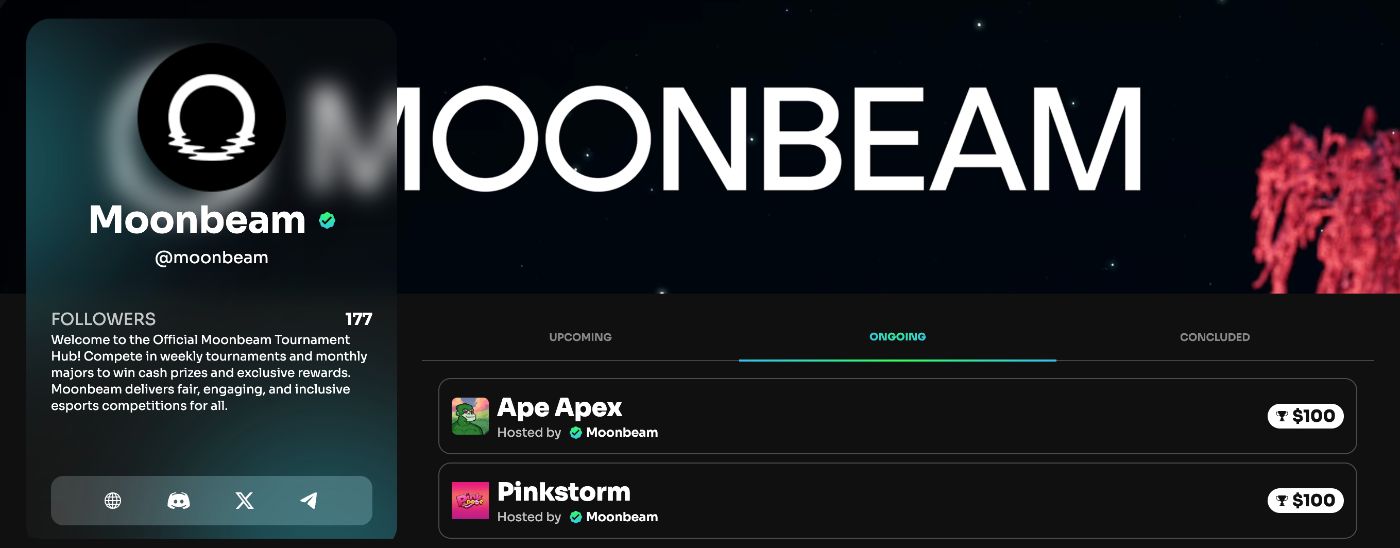

Why Web3 Gamers Are Rushing To Moondrop, Moonbeam’s GLMillionaire With 1,000,000 GLMR On The Line

Solana ETF Decision Delayed, Giving Mutuum Finance (MUTM) More Room to Eat into SOL’s Market Share