Messari predicts: The reasonable valuation of PUMP may be 7 billion US dollars. Will it be a profit if it is bought in the public sale?

Written by Sunny Shi, Messari Crypto

Compiled by Alex Liu, Foresight News

According to major media reports citing people familiar with the matter, pump.fun is preparing to sell 25% of its PUMP tokens at a valuation of $4 billion to raise $1 billion.

Is this price attractive?

Sunny Shi of Messari built a valuation model for PUMP, and the results show that its FDV (full flow market value) may reach 7 billion US dollars. If the prediction is correct, PUMP tokens will be earned. But there is an important premise. The following is their valuation process (from Sunny Shi's perspective, "we" refers to Messari):

No matter what you think of Memecoin, this track is still continuing to "print money".

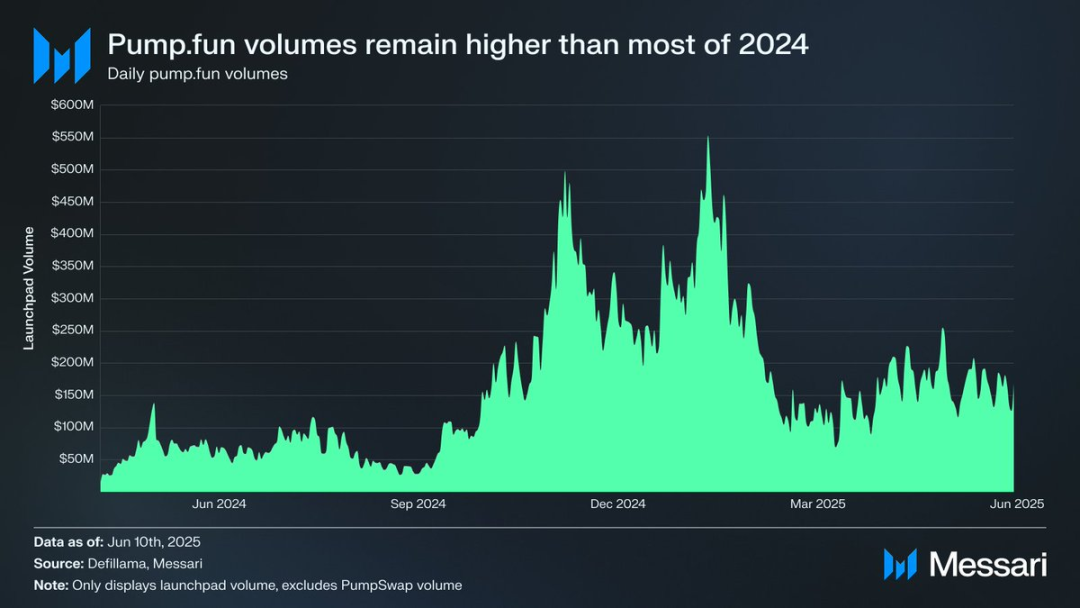

Although the trading volume of the pump.fun coin issuance platform has declined compared to the beginning of the year, it is still much higher than the level for most of 2024.

Pump.fun's trading volume is higher than most of the time in 24 years, data: Messari

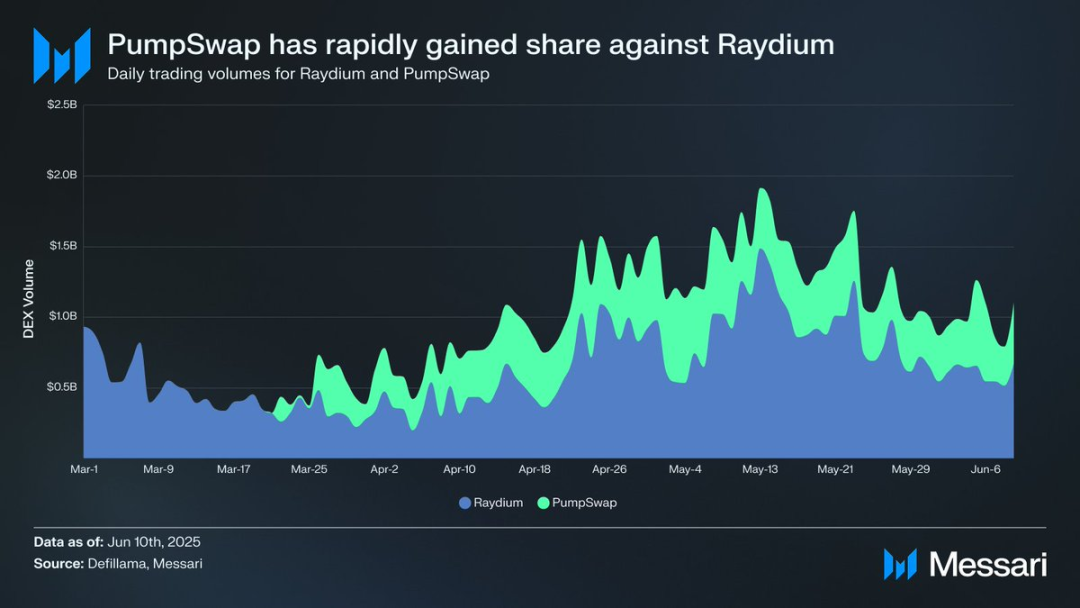

People may also be underestimating the success of PumpSwap, a DEX that launched about three months ago but has already significantly eaten into Raydium’s market share on Solana.

Comparison of market share between PumpSwap and Raydium, data: Messari

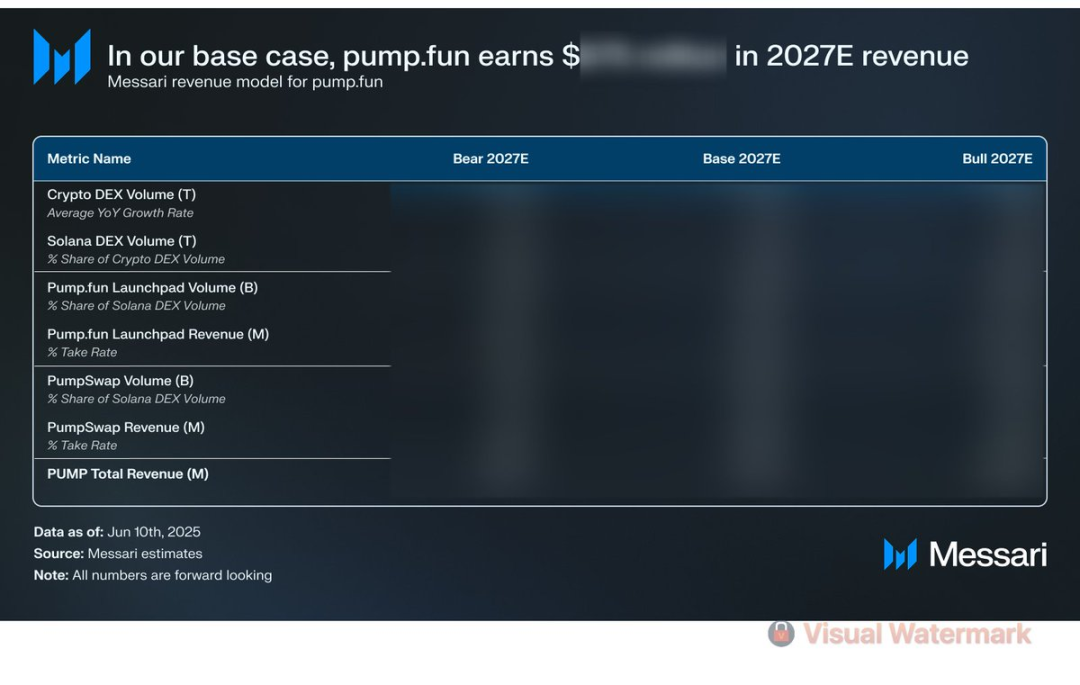

Our valuation methodology uses a top-down model that assumes overall crypto market volume, Solana’s share, launch platform share, and PumpSwap’s market share. These assumptions and models are only available to enterprise clients, but I will share the main conclusions.

In our base case, we believe Memecoins will occupy a niche within the broader cryptoeconomy as they are more suitable for speculative use than NFTs.

Of course, the Solana ecosystem will undoubtedly diversify into new asset pairs as it matures, but this may also be true.

We believe that even if pump.fun’s share of the Solana ecosystem declines slightly, the pump project is still expected to generate approximately $675 million in revenue over the next two years as PumpSwap continues to grow.

Based on a 10x valuation multiple, the corresponding FDV is approximately US$7 billion.

However, the key premise is this: if a project chooses an opaque token/equity structure that distributes most of the revenue to insiders rather than token holders, then we believe the market has become sufficiently cautious to ignore this poor way of accumulating value.

In our full report, we provide valuation tables for assessing the potential value of PUMP based on the percentage of revenue that token holders receive.

Regardless of how the market ultimately judges this, this is a great opportunity to participate in the most profitable crypto application in history. Now it depends on whether the project team can give token holders enough participation value (buy-in) to make it a project worth investing in.

Notes to Editors:

On Aevo's pre-market perpetual trading market, the price of PUMP is currently $6, corresponding to a FDV (fully floated market value) of $6 billion.

PUMP pre-market price on Aevo

You May Also Like

A Blockchain Platform Where DApps Can Achieve High-Speed And Low-Latency Interactions

Capital Group’s $1 Billion Bitcoin Bet Soars to $6 Billion