The latest news on the AI sector after Ethereum's surge: Almanak Vault is hot, and VCs are enthusiastic about DePai.

By Castle Labs

Compiled by Tim, PANews

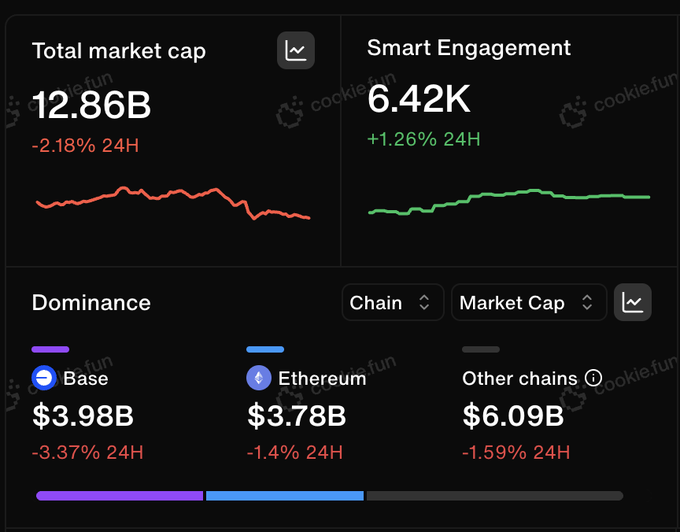

Market Overview

This has been a historic week for all of us at E-Guards, as the price of ETH finally broke through the $4,300 mark after more than four years. Hopefully, this is a good sign for the future, as we've seen another rebound across the cryptocurrency market over the past few days.

Regardless, welcome to another week where the total market capitalization of AI projects fluctuates between $10 billion and $12 billion.

The overall market trend this week was not favorable for us. However, we saw some signs of rebound in a number of AI agents, especially Vader in the Virtuals ecosystem.

We’ve been doing a lot of coverage on the Virtuals ecosystem lately, so it’s refreshing to see the auto.fun account become more active.

Other developments in the AI ecosystem include more startups joining the AWS Startup Program.

Shaw also recently released an interview with 0FJAKE:

Almanak Project Interpretation

What is Almanak?

Almanak is a platform that uses a cluster of AI agents to build, optimize, and manage complex coded financial strategies. It is designed for institutional-grade vibe coding and requires no code at all.

What can you do on the Almanak platform?

On the Almanak platform, users can build "code-based financial strategies." Almanak abstracts the underlying technical complexity, making it easy for non-developers to write code in a professional institutional environment.

Financial strategies created with Almanak offer unique advantages:

- Deterministic

- Verifiable

- Audited

- After simulation test

- Deployment speed is much faster than traditional development

Examples of these financial strategies include:

Utilize the ERC-7540 standard to deploy tokenized vaults, enabling strategy composability, substitutability, and seamless integration with the DeFi ecosystem.

Participate in a vote-buying mechanism where protocols compete through AI-managed TVL and capital routing.

How is the Almanak ecosystem developing?

Almanak launched its first "Treasury," a product curated by community curators, allowing users to monetize their strategies through management or performance fees. The treasury initially capped its fundraising at $5 million and was fully funded in less than 24 hours. The cap was subsequently raised to $10 million, which was again fully funded in less than a day.

Want to try it?

You are in luck, the Almanak platform has just opened a limited-time registration channel:

AI Hot News of the Week

How far will AI develop in 40 years? The comments under S4mmy's post are interesting:

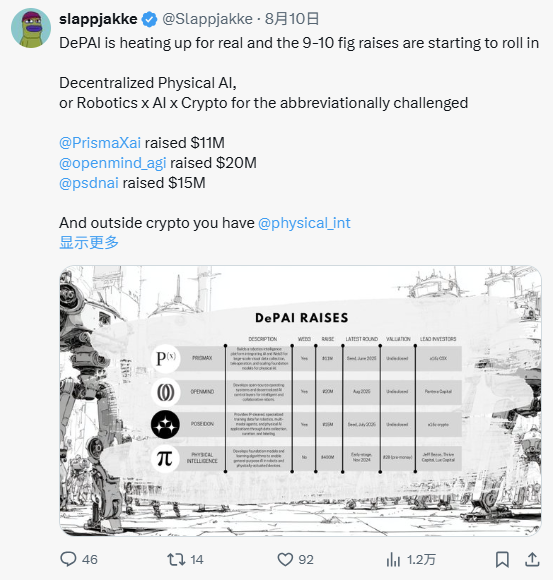

Have you heard of DePai (decentralized entity artificial intelligence)? VCs are eyeing this field, and a lot of money is pouring into it. Here's a list of the top projects compiled by expert Slappjakke:

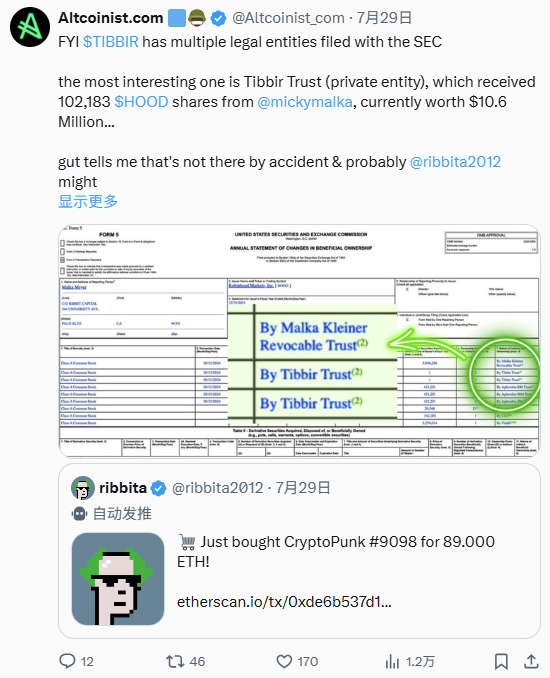

Speculations about the legal entity associated with Ribbita

Billions Network is developing an interesting project, a real-person verification project that focuses on preventing robots:

Related reading: Polygon ID "transforms" into Billions, raises $30 million to continue deepening its trusted digital identity

Theoriq has successfully completed its token sale on Kaito and further revealed the vesting details of the relevant shares.

Related reading: Understanding Theoriq in One Article: DeFi Practice of Multi-Agent Collaboration

How about adding more AI capabilities to your games? Pixels just launched their AI cluster:

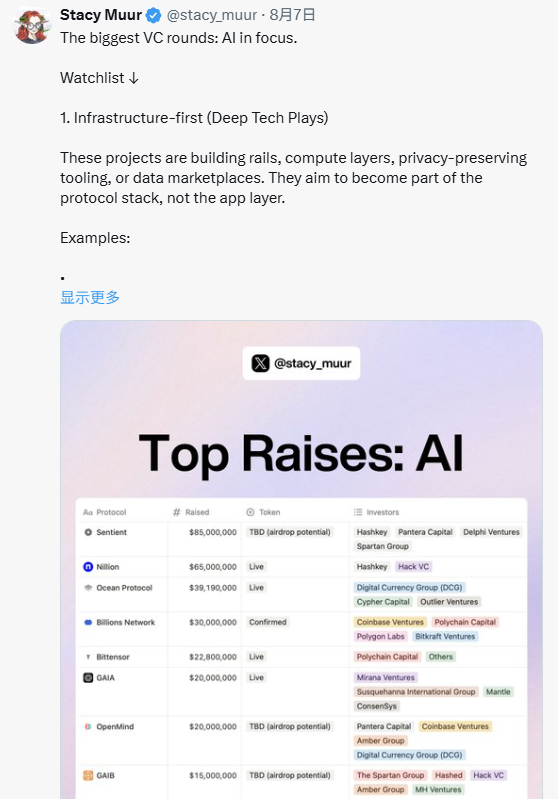

Stacy Muur shared her views on AI projects obtaining significant VC funding, including projects such as Sentient, Nillion Network, Ocean Protocol, and Billions Network.

For those who want to delve deeper into AI, I highly recommend Delphi Intelligence.

Here are just a few examples of what you might find:

Last but not least, here is a list of recommended AI tools that you should keep an eye on:

That’s all for this week! Enjoy your leisure time after work, reading this message on the beach.

You May Also Like

U.S. stock market closed: All three major stock indexes closed up more than 1%

EURAU Stablecoin Debuts: Deutsche Bank, Galaxy Launch Europe’s First MiCA-Regulated Euro Token