Who is Abraxas Capital, the new Ethereum whale? It raised over 270,000 ETH in a single week, a "mysterious" big client of Tether

Author: Nancy, PANews

Recently, Bitcoin and Ethereum have driven a significant rebound in the crypto market, with a significant increase in market capital activity and frequent whale capital movements. Among them, London-based asset management company Abraxas Capital has become a focus of attention in this round of rebound due to its high-frequency on-chain operations and heavy Ethereum DeFi strategy.

More than 270,000 ETH were raised in a single week, and the Ethereum LST ecosystem was heavily invested

In recent times, Abraxas Capital has been active on the chain.

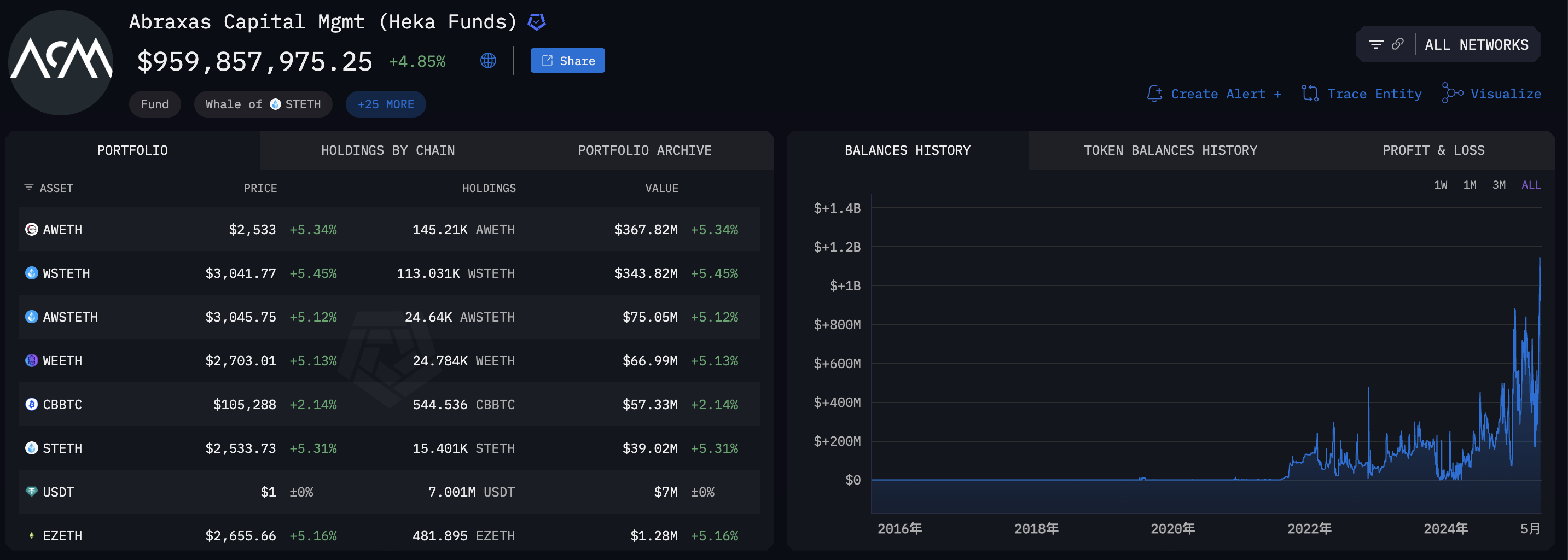

Abraxas Capital - Public Address Asset Holdings Overview

According to Arkham data, as of May 20, the total value of crypto assets held by Abraxas Capital’s two related public addresses has exceeded US$1.15 billion, with a cumulative profit of approximately US$280 million.

From the perspective of asset structure, in addition to Bitcoin worth more than $190 million, Abraxas Capital's investment portfolio is highly concentrated in the Ethereum Liquid Staking Token (LST) track, which is used for staking or as collateral in various DeFi protocols. Its main holdings include AwETH, wstETH, awstETH and weETH, among which AwETH and wstETH have a total holding amount of more than $700 million, accounting for the absolute majority of its overall assets. This type of asset has both on-chain staking income and secondary market liquidity, which also reflects that Abraxas Capital pursues a balance strategy between stable income and flexible position adjustment.

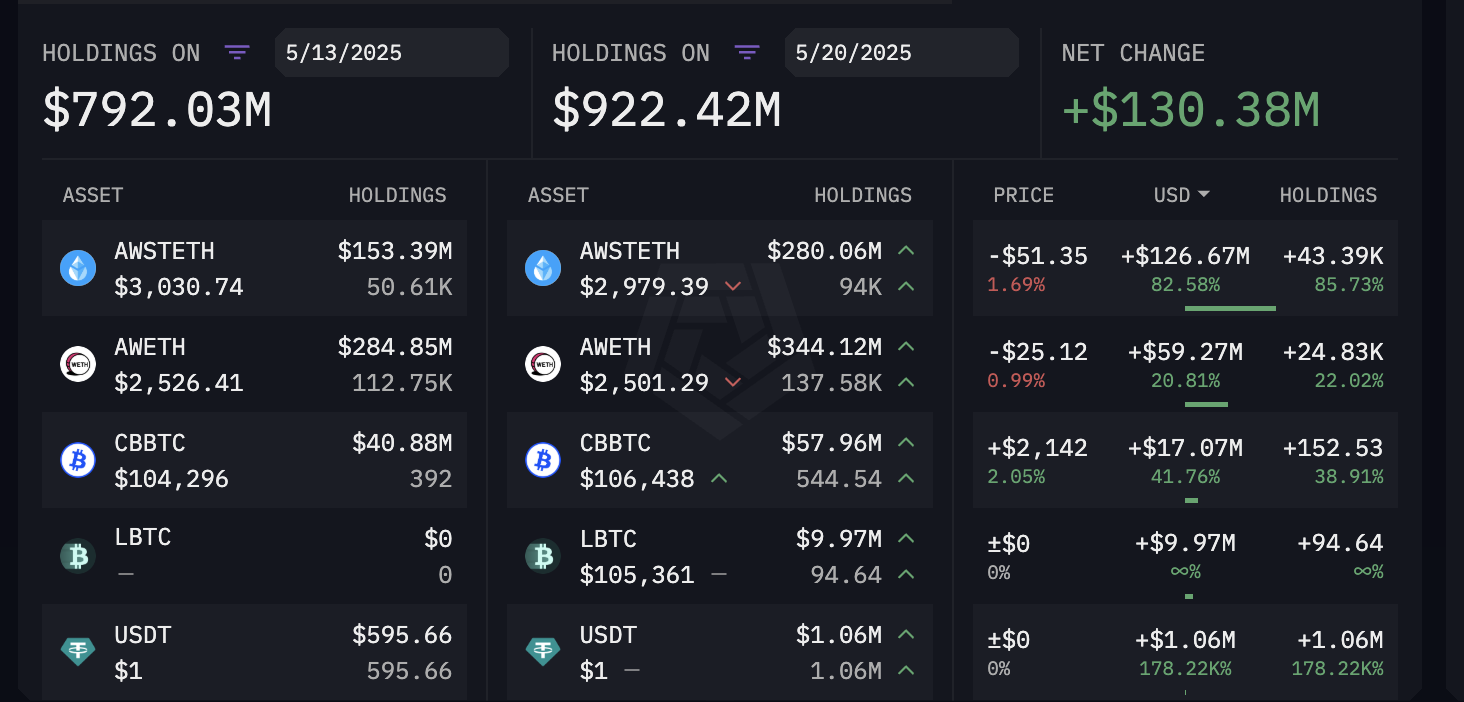

From the perspective of the pace of fund growth, the asset size of the institution has significantly accelerated since mid-February 2025, and recently exceeded the $1 billion mark. In the past week alone (May 13-20), its net assets increased by more than $130 million, mainly due to a substantial increase in AwSTETH (Aave v3 wstETH) positions, with an increase of more than $120 million.

In terms of capital flow, in the past 7 days, Abraxas Capital has withdrawn nearly 270,000 ETH from CEX (centralized exchange), completing about 6 purchase transactions per day on average, with a cumulative value of more than 690 million US dollars. Based on its average purchase price of US$2,573.8, compared with the current ETH market price of about US$2,500, this part of the position is currently in a temporary floating loss of about US$11 million.

It is worth noting that Abraxas Capital has significantly reduced its holdings of Bitcoin within a month. On-chain data shows that in the past few weeks, the institution has transferred a total of 2,000 BTC to exchanges, worth more than $190 million. However, it has recently begun to increase its holdings again, withdrawing about $85 million worth of Bitcoin from exchanges.

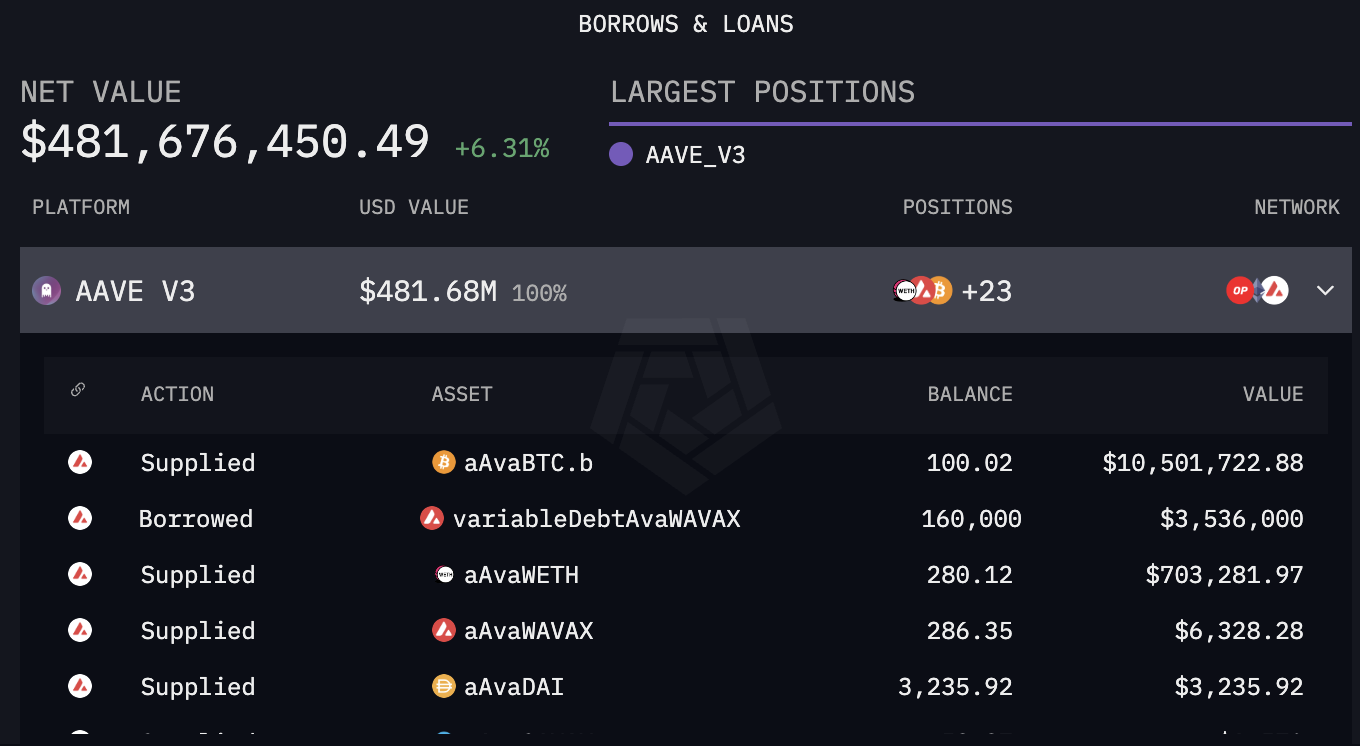

According to Arkham data, Abraxas Capital's ETH funds mainly flow to Ethereum DeFi protocols. In the past 7 days, Abraxas Capital has also transferred more than 174,000 ETH to mainstream DeFi protocols such as Aave, Ether.fi, and Compound, with a total value of approximately US$440 million at current prices. In particular, Aave is the main use of Abraxas Capital's ETH holdings, and it currently holds an asset position of more than US$480 million on AAVE V3.

From this point of view, Abraxas Capital is becoming one of the more active and heavily invested institutional players in the Ethereum ecosystem, and is strengthening the liquidity and revenue reuse rate of assets by deeply participating in the DeFi market.

The asset size exceeds 3 billion US dollars and was once a major customer of Tether

Abraxas Capital Management is an asset management company headquartered in London and regulated by the UK Financial Conduct Authority (FCA). It aims to become a top asset management institution. The company was co-founded in 2002 by Fabio Frontini and Luca Celati, who were both senior executives at Dresdner Kleinwort Wasserstein (DRKW) in London.

Abraxas Capital initially focused on the traditional financial sector, and on-chain data shows that the company had begun to deploy Bitcoin assets as early as the end of 2014. In 2017, Abraxas Capital announced that it would shift its business focus to digital assets.

Heka Funds is Abraxas Capital’s core investment platform focused on digital assets. It is headquartered in Malta and regulated by the Malta Financial Services Authority (MFSA), with assets exceeding US$3 billion.

As a multi-fund investment company, Heka currently manages three major funds: Elysium Global Arbitrage Fund was launched in 2017 and is the first digital asset fund officially licensed and officially operated in the European Union. It has achieved a return rate of 214.95% since its establishment. By the end of 2024, its asset management scale has exceeded 1.2 billion euros; Alpha Bitcoin Fund was established in 2022, focusing on Bitcoin investment, and currently manages $2 billion; Alpha Ethereum Fund was established in 2023, focusing on Ethereum, and currently manages $4.8 million in assets.

Among them, the Elysium Fund is the main business of Heka Funds. It initially entered the market with a Bitcoin arbitrage strategy, inspired by a small arbitrage fund that once bought Bitcoin at a low price on Western exchanges and then resold it to Japanese exchanges. At first, Elysium mainly engaged in Bitcoin arbitrage, but as the relevant arbitrage space gradually narrowed, the fund strategy gradually shifted to stablecoin arbitrage.

In 2019, Fabio Frontini met Tether’s CFO Giancarlo Devasini for the first time and was invited to the Bahamas to meet with Tether’s banking partner Deltec Bank. According to Frontini’s recollection, Deltec showed him Tether’s asset proof at the time: more than 60% of the reserves were in cash, and the rest were short-term U.S. Treasury bonds, which gave him full confidence in Tether’s 1:1 support. Since then, Heka Funds has verified Tether’s liquidity through a series of small test transactions and gradually expanded the scale of transactions.

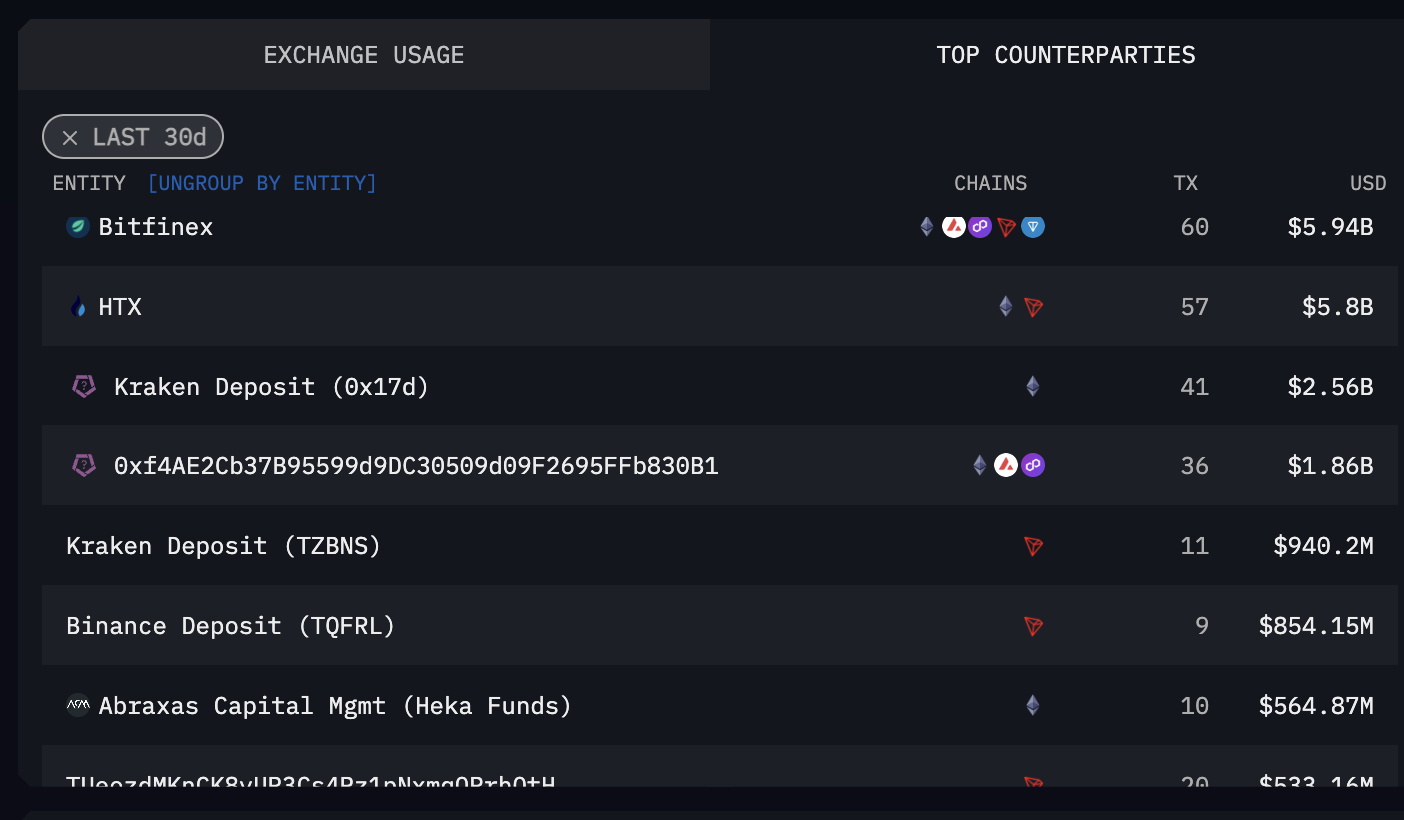

With continuous transactions and cooperation, Heka Funds has gradually grown into one of Tether's largest institutional clients. It can be said that Heka Funds is also the driving force behind Tether's rapid development. According to a research report released by Protos in 2021, Heka Funds obtained more than US$1.5 billion in USDT at that time, accounting for about 1.5% of Tether's total issuance. This year, Heka Funds has accumulated a profit of approximately US$52 million, far exceeding the US$5.8 million profit achieved by its parent company Abraxas, making it one of the most successful funds within the group. In the past 30 days, Arkham data showed that among Tether's major trading counterparts in the past 30 days, Heka Funds' trading volume reached US$564 million, ranking eighth.

In an interview with Protos in early 2025, Frontini once again publicly expressed his confidence in Tether. He pointed out that Tether is earning huge interest rate spreads in the high-interest rate environment in the United States, and its business model is very simple but extremely effective. He also quoted Howard Lutnick (CEO of Cantor Fitzgerald)'s comments at the 2024 Davos Forum, saying that Tether's assets are mainly held by Cantor, the largest U.S. Treasury broker, which further strengthened his confidence in Tether.

It is worth mentioning that earlier this month, on-chain analyst @DesoGames found that by tracking the flow of funds in a certain cycle of Tether, it mainly flowed to Abraxas and Cumberland crypto entities. However, the funds were transferred in a complex and opaque manner through multiple layers of accounts, and this operation may be intended to cover up the source of illegal transactions. The analyst further disclosed that HEKA Funds claimed that its fund net assets were 1.3 billion euros, but purchased 1.5 billion USDT through HEKA (Tether issued approximately 2.5 billion US dollars in this cycle), an amount that obviously exceeded its financial capacity and was suspicious. At the same time, shareholders and directors of HEKA Funds were found to appear in the offshore leak database, with complex backgrounds and difficult to trace their true identities. HEKA Funds may just be a shell fund used by Abraxas to cover up its real activities, lacking transparency and credibility.

Currently, judging from the on-chain trends, as the crypto market structure continues to financialize and the arbitrage space for early stablecoins gradually narrows, Abraxas Capital is also exploring expanding its strategy to a more sustainable Ethereum collateralized lending ecosystem.

You May Also Like

Trump: Reciprocal tariffs will take effect at midnight tonight

Crypto Market July Report: The Tariff War Enters a Desensitization Period, and Three Major Dynamics Emerge in the Post-Tariff Era