US import collapse hits gold, tech - GDP math changes again

The US trade deficit dropped to $59.6 billion in August, falling nearly 24% from the month before, according to data published by the Commerce Department on Wednesday.

The drop followed a fresh wave of global tariffs introduced by President Donald Trump, who’s now back in the White House and pushing hard on trade deals.

The trade deficit data should have landed on October 7, but it got pushed back thanks to the longest government shutdown in US history, which finally ended last week. The shutdown delayed a string of economic reports, and the agency still hasn’t said when the September trade numbers, originally set for release on November 4, will be announced.

The drop was mostly caused by a 5.1% decrease in imports, the largest monthly slide in four months. Exports went up slightly.

These numbers aren’t inflation-adjusted, but the trend was clear: companies pulled back on foreign buying after Trump’s new tariffs kicked in.

Just a month earlier, the deficit had spiked because businesses were rushing to bring in goods ahead of the tariff deadline. Those import surges are now reversing as deals take effect.

US import collapse hits gold, tech; GDP math changes again

Back in April, Trump announced a new set of reciprocal tariffs, but he paused them while the US tried to negotiate deals with key trading partners. By August, several of those deals were finalized, causing the trade data to swing wildly.

That kind of volatility also messes with GDP calculations. Before the latest update, the Atlanta Fed’s GDPNow model projected that net exports were adding 0.57 percentage point to Q3 GDP. That could change again now that August numbers are out.

Meanwhile, the Census Bureau said it will publish September retail sales on November 25, and durable goods orders on November 26.

The most aggressive pullback in imports came from nonmonetary gold, after the US slapped a 39% tariff on Switzerland, a top gold supplier. The result? Imports plunged, and the deficit with Switzerland got smaller. Imports of capital goods, including computer accessories and communications equipment, also fell.

On an inflation-adjusted basis, the merchandise trade deficit narrowed to $83.7 billion, the lowest since the end of 2023. That’s a big move, but the damage wasn’t evenly spread.

The deficit with China hit its highest since April, while the gaps with Mexico and Canada shrank slightly. It’s a snapshot of how trade tensions continue to reshape US trade flows and impact supply chains.

Switzerland cuts deal as tariff fight cools off

Jamieson Greer, the US Trade Representative, confirmed in a CNBC interview that Washington and Bern had “essentially reached a deal” to bring the Swiss tariff down from 39% to 15%.

“We’ve essentially reached a deal with Switzerland. So we’ll post details of that today on the White House website,” Greer said. The administration plans to release the full terms this Friday.

Greer said the agreement will bring more Swiss manufacturing to the US, including pharmaceuticals, gold smelting, and railway equipment. “So we’re really excited about that deal and what it means for American manufacturing,” he added.

The deal is the end of a months-long negotiation that began when Trump shocked Swiss officials by imposing the massive 39% tariff, more than double the one applied to EU nations.

Trump defended the move by pointing to what officials described as a $40 billion goods trade deficit with Switzerland. But Swiss negotiators said they thought they already had an agreement with the US before Trump’s move hit.

Bloomberg had earlier reported that both countries were circling the 15% rate. Trump later confirmed that “officials had been working on a deal.” Swiss industries like watches, machinery, and precision instruments took the brunt of the blow.

Greer said this new deal clears the way for those sectors to bounce back and ship more to the US, without the punishing duties.

Sharpen your strategy with mentorship + daily ideas - 30 days free access to our trading program

También te puede interesar

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

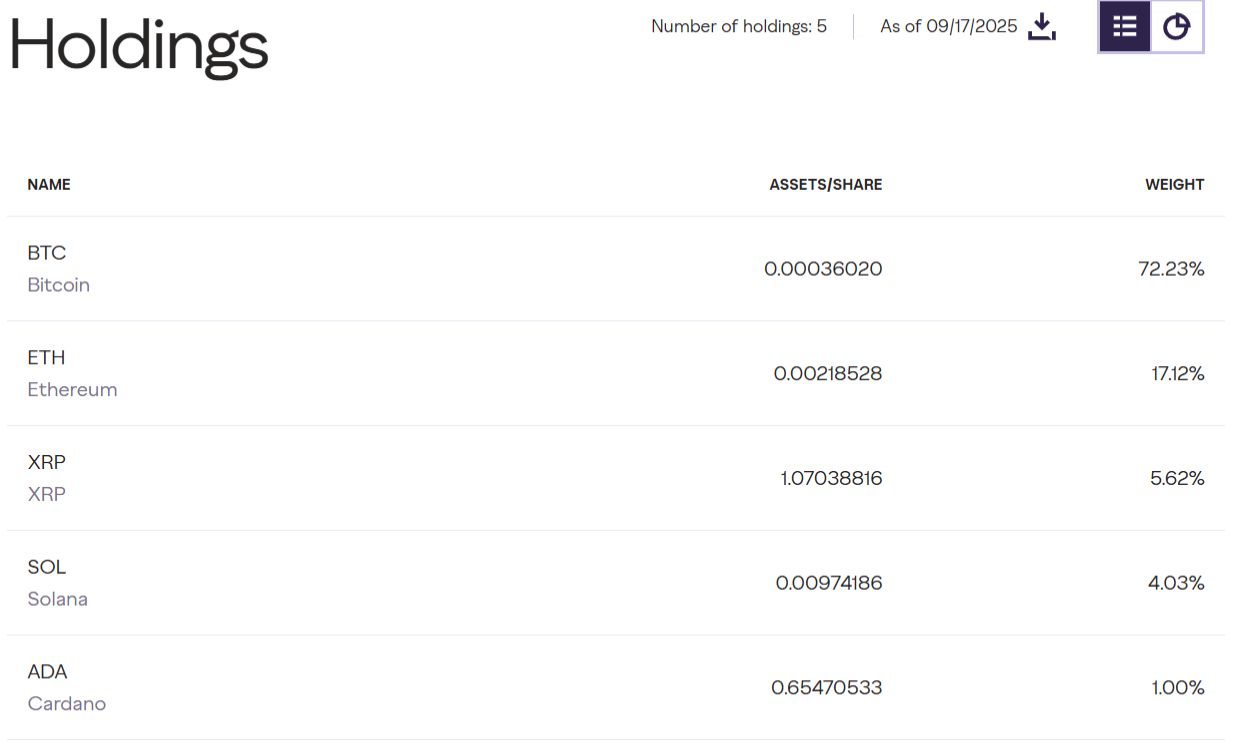

Grayscale’s Crypto Large Cap Fund, Including BTC, ETH, XRP, ADA, Gets SEC Approval