73% of Youngsters Favour Bitcoin for Long-Term Investment Over Gold: Study

A recent poll revealed that investors aged 24 to 45 see Bitcoin as a potential for “exponential upside” over gold. A survey of 730 Gen Z and Millennial investors by financial advisory giant deVere Group found that 73% of respondents preferred Bitcoin.

According to deVere CEO, Nigel Green, Bitcoin and gold are not rivals but “radically different assets” and solve different problems.

The survey aligns with several other studies that imply a seismic shift from traditional investments toward Bitcoin’s dominance as a safe-haven asset. For instance, on-chain analytics company CryptoQuant revealed in January that over 60% of cryptocurrency investors are aged between 25 and 44 years old.

“The momentum behind Bitcoin among younger investors is undeniable,” says Green. “They see it as digital gold – borderless, accessible, and aligned with the future.”

Bitcoin Enthusiasm is Growing

Younger investors view Bitcoin as a “cornerstone of modern portfolios,” the survey noted. The younger cohort gets attracted to transparency, portability, and potential for exponential surge. Respondents also said that Bitcoin’s operation outside the traditional banking system is a notable advantage.

“This generation is right to question the old models. But diversification is timeless,” said Green.

Last week, the CEO of Bitwise Asset Management, Hunter Horsley, posted on X, comparing Bitcoin to US Treasuries, rather than gold.

“I don’t think Bitcoin’s competition is going to end up being gold,” he wrote. “Rather, I think Bitcoin’s competition is going to end up being U.S. Treasuries and other governments’ bonds.”

Gold, Bitcoin Together Offer Balance

According to Nigel Green, having uncorrelated assets in portfolios is a pathway for building true resilience. “Gold and Bitcoin together offer that balance,” he said.

He also stressed that Bitcoin is moving toward broader acceptance, particularly after spot ETFs and broader corporate adoption, adding legitimacy and fresh demand.

“We’re living through a rare convergence,” Green added. “You have the old guard doubling down on gold, and the new guard surging into Bitcoin. Both are being driven by the same core fear: erosion of purchasing power. That should be a wake-up call.”

También te puede interesar

Fed Governor Lisa Cook Under Fire: DOJ Official Urges Powell to Act

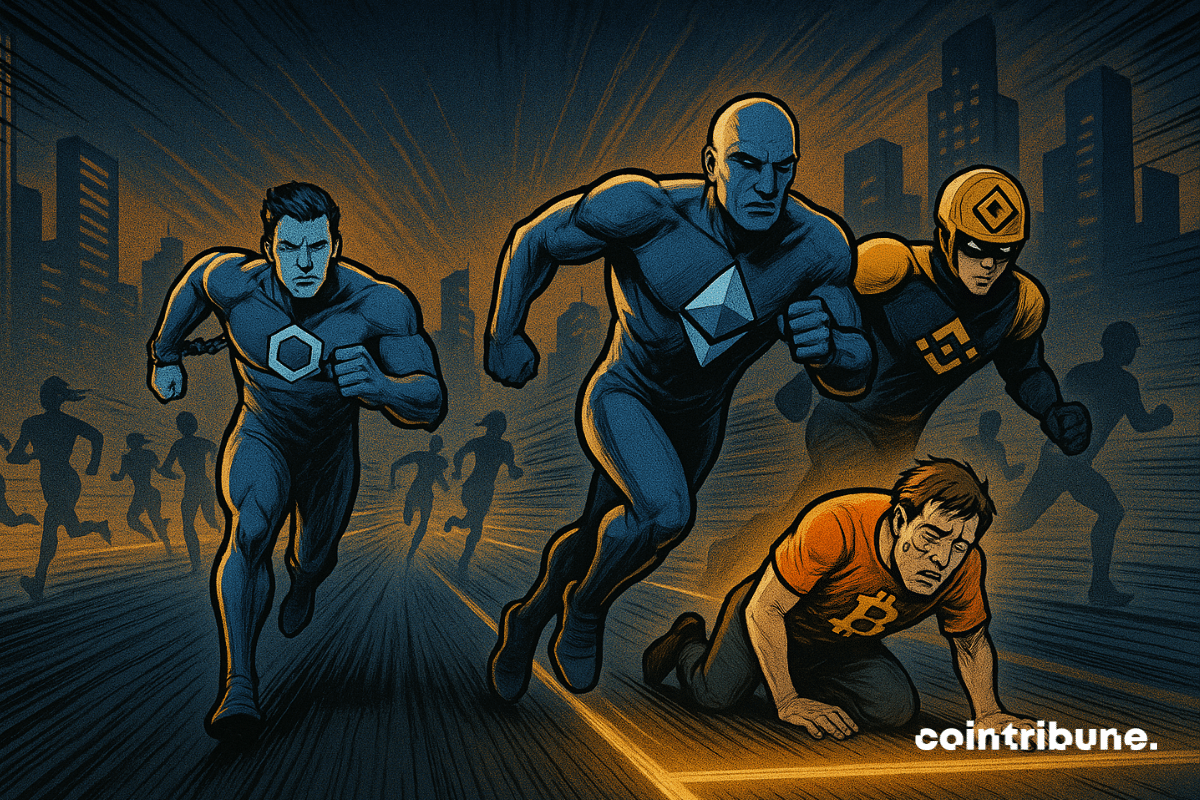

Market Shifts: Altcoins Surge as Bitcoin Slows