Dogecoin Price Prediction For 2025, As Analysts Call Pepeto The Next 100x

Traders hunting the best crypto to buy now and the best crypto investment in 2025 keep watching doge, yet today’s dogecoin price prediction points to limited upside and a slower tape. Capital is shifting toward projects that mix community with live utility on chain. Searchers typing best crypto to buy now want shipped products, audits, and transparent tokenomics. That frames the real matchup today, dogecoin against Pepeto.

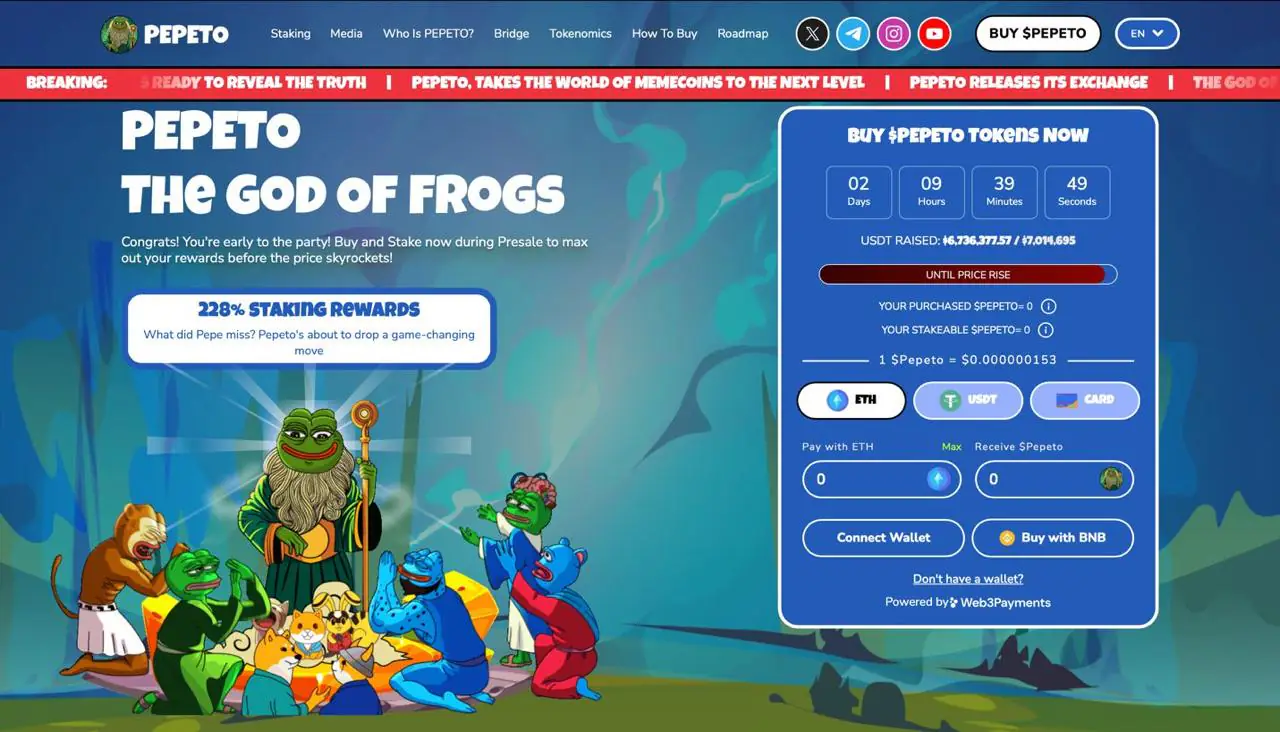

Enter Pepeto PEPETO, an Ethereum based meme coin with working rails that users can touch today. PepetoSwap is a zero fee DEX, and Pepeto Bridge moves value smoothly across chains. By pairing story with usable tools and meeting crypto presale 2025 demand, Pepeto puts utility first.

In a market where older meme coins drift on sentiment, Pepeto’s pace and delivery earn a real shot in the best crypto to buy now conversation. First, it helps to see why dogecoin may be losing steam.

Dogecoin Price Prediction Is Doge Truly Losing Momentum

Remember when dogecoin made crypto feel simple. In 2013, doge turned a meme into money and a crowd into a movement. Ten years later the nonstop impulse of those early days has cooled as market structure, competition, and liquidity cycles reshape the path forward.

With doge trading near $0.268, the short term read skews bearish to neutral. Hold above $0.26 on daily closes and expect choppy range trade toward $0.29 to $0.30, a zone where rallies have stalled. Lose $0.26 with conviction and momentum usually leaks into $0.245 with risk of a deeper test near $0.22 to $0.21. Regain $0.30 on a firm daily close and sellers lose grip as price can squeeze into the low $0.30s.

Beyond any dogecoin price prediction, the chain remains payment focused without native smart contracts, with ZK proof verification still a proposal. That creates a utility gap against programmable networks. Until larger features ship and see usage, upside for doge leans on brand cycles more than fresh on chain apps.

After years of chasing supposed life changing gains from the same names, many traders are moving earlier and hunting crypto presales. That is where Pepeto enters, a widely watched presale with bold targets and talk of significant returns. What actually powers the Pepeto buzz, and could risk takers shift from dogecoin to this play.

Source: CoinMarketcap / TradingView

Why Pepeto Looks Like 2025 Next 100x

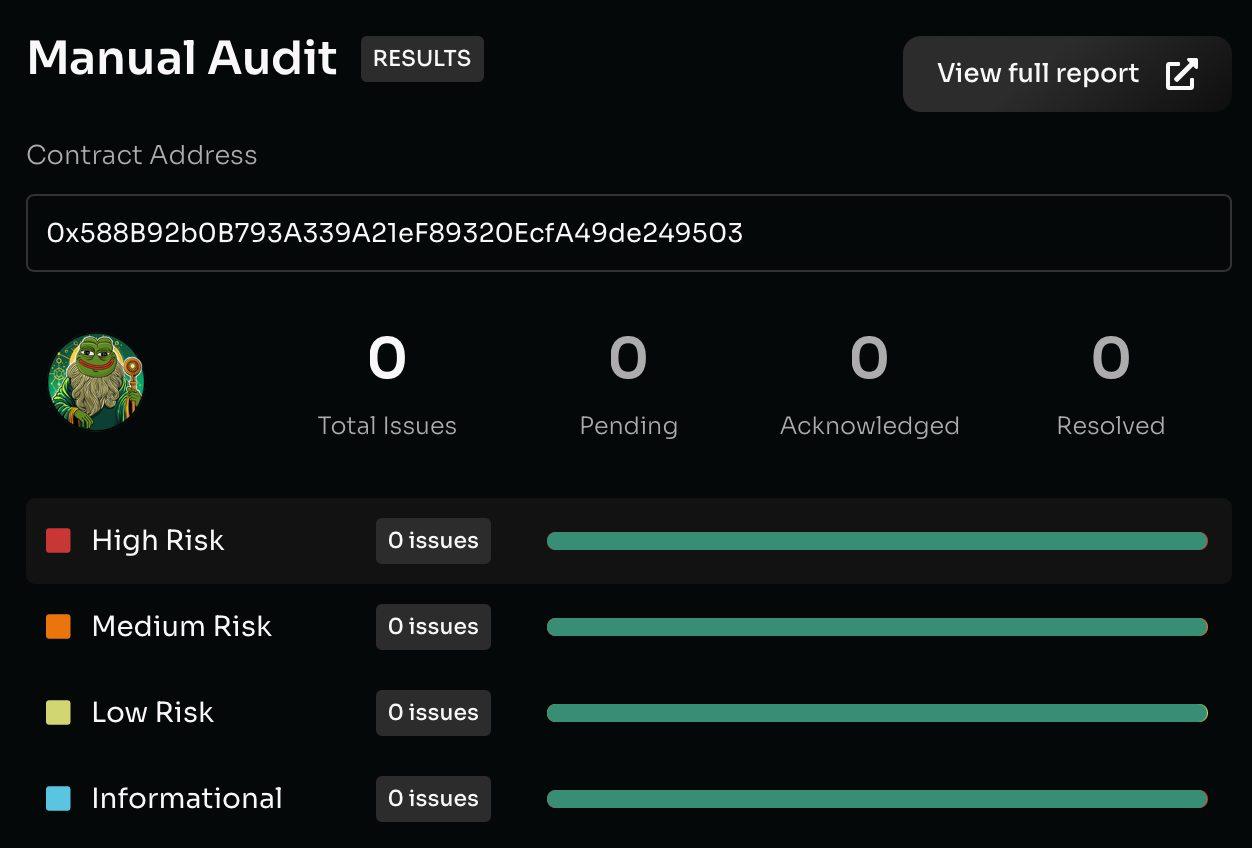

Unlike older coins that once delivered huge moves on hype alone, a trick that is far tougher in 2025, Pepeto is being built like a focused Ethereum project mission. The team treats this as lasting work, ships quickly, obsesses over details, shows up in front of the community, and pushes every week. Pepeto aims for the full package, limited supply, tools people actually use, and code reviewed by SolidProof and Coinsult, level of security many presales don’t offer.

Pepeto tokenomics stay simple and growth minded. 30% goes to the presale to kickstart participation, 30% to staking rewards that back long term holders, 20% to marketing that drives adoption, 7.5% to ongoing development, and 12.5% to liquidity that keeps trading smooth. The blend supports listings and steady expansion with meaningful rewards for early holders, built for depth on day one and durable after, echoing Bitcoin limited supply while keeping the community engaged.

At the same time, the presale places early buyers at the front with staking near 228% APY and stage based price steps, letting them earn from day one. Early traction is already making that line long, a mix of purpose and working tools that lets Pepeto, an Ethereum based meme coin, run far beyond what short lived hype can support.

If there is a name set to grow portfolios in 2025, able to deliver 100x gains on early investments, is Pepeto, this could be the one people brag about spotting before the crowd. No sharp investor ignores an entry like this. Buy Pepeto now at the current price of $0.000000153, the lowest Pepeto price you are likely to see again, do not miss this opportunity, especially as early backers of legendary meme coins are reportedly buying Pepeto.

Doge Versus Pepeto What Matters To Buyers Right Now

• Programmability and reach. Doge feels like a classic car waiting on upgrades, proposals circulate, yet the road ahead still looks foggy. Pepeto launches on the Ethereum fast lane with a live exchange and a working bridge, rails users can ride today. Early buyers are not just hoping, they step onto infrastructure with stage based pricing and staking that places them near the front as usage grows.

• User flow. Friction kills momentum. Dogecoin still leans on sentiment to move the needle, while Pepeto makes motion effortless, zero fee swaps in, bridge out when you want, simple paths that invite volume. Smooth entry and exit create a feedback loop, more activity builds deeper liquidity and stronger price discovery. That is the on chain rhythm early entrants love to compound.

• Narrative and utility. Doge is an icon with a story yet thin near term utility. Pepeto blends meme energy with shipped tools, so the story does not fade when timelines go quiet. Every swap touches the Pepeto token, turning daily use into steady demand, what investors want from an Ethereum based meme coin.

• Price prediction. Dogecoin market size can cap multiples, and even a 2x looks hard with the current setup. Pepeto is earlier, lighter, and wired into Ethereum liquidity, higher beta by design, yet grounded by clear tokenomics and audited contracts. Crypto analysts predict 50x after launch and up to 100x by end of 2025, which sets Pepeto as the clear upside play versus doge and its range bound tape.

If you have been waiting for a fresh runway where early conviction truly matters, this is the setup that lets small positions dream big. Missing a presale with this much potential can mean missing the next millionaire coin.

It’s Time To Move On

Many traders keep chasing returns in doge and similar names, crowded, range bound, and stuck. If that feels limiting, it is smarter to diversify into something with visible momentum. Some analysts even see room for outsized moves at launch, with 100x mentioned.

That is where Pepeto separates itself. Some analysts still see room for outsized moves at launch, with 100x mentioned, which tracks when you study the determination of the team. It shows up in the details, an Ethereum foundation, a zero fee DEX, an active bridge, and clean tokenomics where the token powers the swap, creating ongoing demand instead of empty hype. From the practical tools to the design, this project is built to make a visible mark on the market.

Missing this crypto presale could mean skipping the next breakout people discuss for years, either as the one that made them rich or the one they regret missing. Choose your position with care.

To buy PEPETO, use the official website at https://pepeto.io/ . As listing draws near, some may try to exploit the hype with copycat pages and fake platforms. Stay cautious, verify the source, and confirm you are on the correct domain.

To learn more about PEPETO, visit Telegram, Instagram,

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Dogecoin Price Prediction For 2025, As Analysts Call Pepeto The Next 100x appeared first on Coindoo.

También te puede interesar

Unprecedented Surge: Gold Price Hits Astounding New Record High

Expect New Lows if Bitcoin Remains Under $106,000: Analyst