Eightco Stock Jumps 3000% on Worldcoin Treasury Strategy, BitMine Investment

2025/09/09 06:10

Eightco shares surged after unveiling plan to hold Worldcoin as its main treasury asset.

Aviso legal: Los artículos republicados en este sitio provienen de plataformas públicas y se ofrecen únicamente con fines informativos. No reflejan necesariamente la opinión de MEXC. Todos los derechos pertenecen a los autores originales. Si consideras que algún contenido infringe derechos de terceros, comunícate con service@support.mexc.com para solicitar su eliminación. MEXC no garantiza la exactitud, la integridad ni la actualidad del contenido y no se responsabiliza por acciones tomadas en función de la información proporcionada. El contenido no constituye asesoría financiera, legal ni profesional, ni debe interpretarse como recomendación o respaldo por parte de MEXC.

Compartir perspectivas

También te puede interesar

Ethereum (ETH) Price Prediction: Seven Days of Selling Pressure Test Bulls’ Resolve

TLDR Ethereum price has struggled to break above $4,500 resistance for over 10 days, forming lower highs since August peak Spot Ethereum ETFs experienced massive outflows totaling $912 million over seven consecutive days Network activity and revenue declined 44% in August despite price hitting all-time highs near $4,950 Technical analysis shows descending triangle pattern pointing [...] The post Ethereum (ETH) Price Prediction: Seven Days of Selling Pressure Test Bulls’ Resolve appeared first on CoinCentral.

Compartir

Coincentral2025/09/09 15:35

Compartir

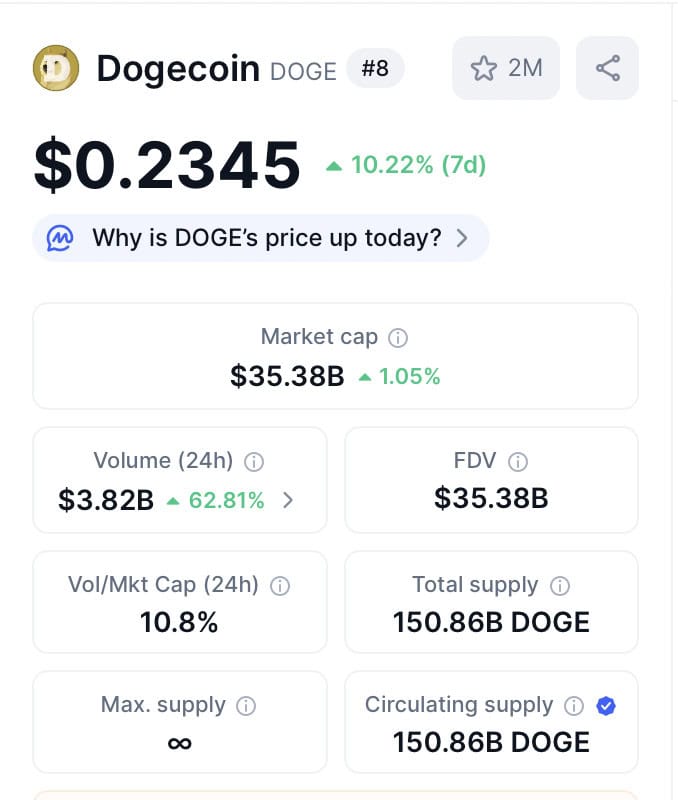

Dogecoin Price Prediction as Maxi Doge Attracts Crypto Whales

The crypto market continues to be choppy, with $BTC gaining just 1% on the weekly chart, and the fear and greed index drifting around 44-48.

Compartir

Brave Newcoin2025/09/09 15:37

Compartir

Is Ethereum overstretched? Bulls eye $6K DESPITE revenue slipping by 22%

The post Is Ethereum overstretched? Bulls eye $6K DESPITE revenue slipping by 22% appeared on BitcoinEthereumNews.com. Key Takeaways Ethereum’s revenue-price divergence highlighted an overstretched market. However, fresh liquidity and speculative demand could push ETH towards a $6k breakout. The market’s split on whether Ethereum [ETH] has really bottomed or not. On-chain, the ETH/BTC ratio has been breaking down, hitting its third weekly lower low after failing to clear the $0.04 supply wall. Looks like traders are still taking profits off ETH’s 18.8% August pump. Meanwhile, Token Terminal revealed that ETH’s revenue hit just $14.13 million in August – Marking its lowest level since May even as price blasted to a new $4,900 ATH and highlighted a clear divergence. Source: TokenTerminal Typically, that kind of revenue-price gap signals an overstretched market. That’s not all though as Ethereum closed August with $39.75 million in fees, right in line with its $42 million four-month average. Simply put, the fees stayed steady while revenue slipped, meaning that the the network itself captured less value. And yet, Ethereum’s trading volume ripped to $1.13 trillion – Its highest since post-election levels. This suggested that traders are still piled in and chasing the price, despite the monetization lag. Ethereum bulls target $6k Ethereum’s stablecoin market has been firing its ATHs too. Low revenue with steady fees tells us users are still paying chunky gas, but the network isn’t pocketing proportional value. In short, ETH’s fundamentals may be lagging, hinting that the market might be overstretched. Still, ETH ripped through $4,900, thanks to the stablecoin supply hitting $152 billion all-time high in August – Marking a 9.35% jump from last month. Technically, that’s about $13 billion of fresh liquidity chasing the price. Source: Token Terminal The result? Speculative capital piled into Ethereum’s ATH. On-chain flows gobbled up the fresh liquidity, sending the price higher, even as the network didn’t capture much real value. Classic…

Compartir

BitcoinEthereumNews2025/09/09 15:10

Compartir