El Salvador’s Bitcoin Journey Hits 4-Year Mark, Results Still Divisive

El Salvador marked the fourth anniversary of its Bitcoin legal tender law with another purchase — a deliberate, headline-ready buy that keeps the country’s crypto holdings on display.

Government Figures Show 21 BTC Were Added

According to President Nayib Bukele and the country’s Bitcoin Office, the government bought 21 BTC on Sunday as a symbolic nod to Bitcoin’s 21 million supply cap.

Reports show the state has continued buying one BTC per day. The buying has been carried out since March 2024. Based on government figures and blockchain data, El Salvador now holds 6,313 BTC.

The holdings are valued at about $700 million at current prices. Small in daily budget terms, these moves carry big political weight.

Clash With IMF Loan Terms

Reports have disclosed that the purchases confound a $1.4 billion IMF loan agreement signed in December last year. The deal required public entities to halt voluntary accumulation of Bitcoin and called for a freeze on further acquisitions under the finalized Extended Fund Facility.

As part of the agreement, the government revised the Bitcoin Law so merchant acceptance is voluntary, agreed to liquidate the Fidebitcoin trust, and planned an exit from the Chivo wallet program.

Yet purchases have continued. That has left IMF officials and outside observers watching whether future disbursements will be granted, since compliance reviews are scheduled through 2027.

IMF Estimates And The Question Of DisclosureBased on an IMF report from March, the fund estimates El Salvador spent roughly $300 million on Bitcoin since 2021. At current market levels, those purchases represent more than $400 million in unrealized gains.

But the IMF also noted that limited disclosure around transactions and holdings makes a full independent assessment difficult.

Government disclosure of Bitcoin activity remains incomplete, even with public dashboards now in place. Reports have noted that unrealized gains could be affected if market prices decline.

On Bitcoin, Security Moves And Public TransparencyLate last month, the National Bitcoin Office redistributed holdings across multiple addresses, placing a cap of roughly 500 BTC per address.

Officials said the change was motivated by concerns about future quantum computing threats. The new addresses were published on a public dashboard, a move intended to boost clarity over custody.

Some market and industry observers welcome the dashboard. Others say the quantum argument sounds precautionary and that clearer audit standards are still needed.

Bold But DivisiveFour years after adopting Bitcoin as legal tender, El Salvador’s approach is still splitting opinion. Supporters say the country has built strong gains and stayed committed to its plan, while critics warn it has created problems with international lenders.

The anniversary shows that El Salvador’s Bitcoin push is still seen by many as bold, but also deeply disputed.

Featured image from Unsplash, chart from TradingView

También te puede interesar

Ethereum (ETH) Price Prediction: Seven Days of Selling Pressure Test Bulls’ Resolve

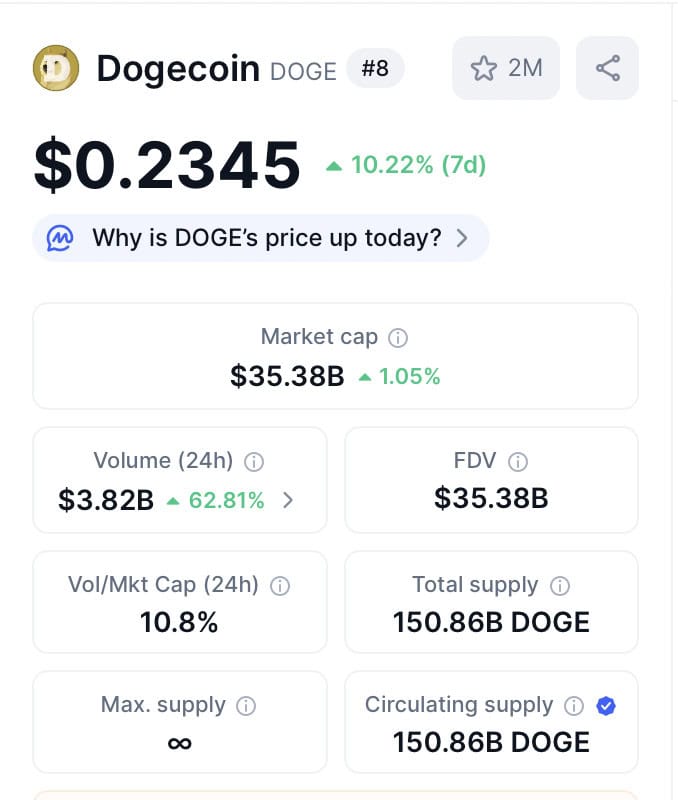

Dogecoin Price Prediction as Maxi Doge Attracts Crypto Whales