Ethereum Price Forecast: ETH attracts $8 billion from Bitcoin whale rotation and institutional investors

Ethereum price today: $4,360

- Ethereum took in $8 billion of demand pressure in August from Bitcoin whale distribution and inflows into ETH investment products.

- Both entities contributed approximately $4 billion each in capital inflows last month.

- ETH nears the apex of a tight consolidation range after a weekend-long sideways movement.

Ethereum (ETH) trades around $4,300 on Monday after attracting nearly $8 billion in capital inflows across a $4 billion Bitcoin whale rotation and $3.95 billion into ETH investment products throughout August.

Bitcoin whale rotation and Ethereum investment products pull in $8 billion

A key Bitcoin whale initiated a strategic capital rotation from BTC to ETH on Monday.

The Bitcoin OG sold 2,000 BTC worth $215 million and shifted the entire proceeds to purchase 48,942 ETH, according to smart money wallet tracker Lookonchain. The whale had earlier sold 5,000 BTC to purchase over $540 million worth of ETH in two separate transactions on Sunday.

The whale's large rotation marks the continuation of a trend that began in August after it returned to action following nearly seven years of dormancy. Since August 20, the Bitcoin OG has offloaded 35,991 BTC via the decentralized exchange Hyperliquid and purchased 886,371 ETH worth $4.04 billion, Lookonchain added.

A similar rotation is evident on the institutional front as Ethereum investment products have continued to outperform those of Bitcoin.

Over the past week, ETH products attracted $1.4 billion in inflows, nearly double the $748 million attracted by Bitcoin, according to CoinShares data. Zooming out, the gap widens as institutional investors poured $3.95 billion into ETH products in August — their second-best month on record — while withdrawing $301 million from Bitcoin.

Ethereum Price Forecast: ETH nears apex of tight consolidation range

Ethereum experienced $96 million in futures liquidations over the past 24 hours, comprising $72.68 million and $23.32 million in liquidated long and short positions, per Coinglass data.

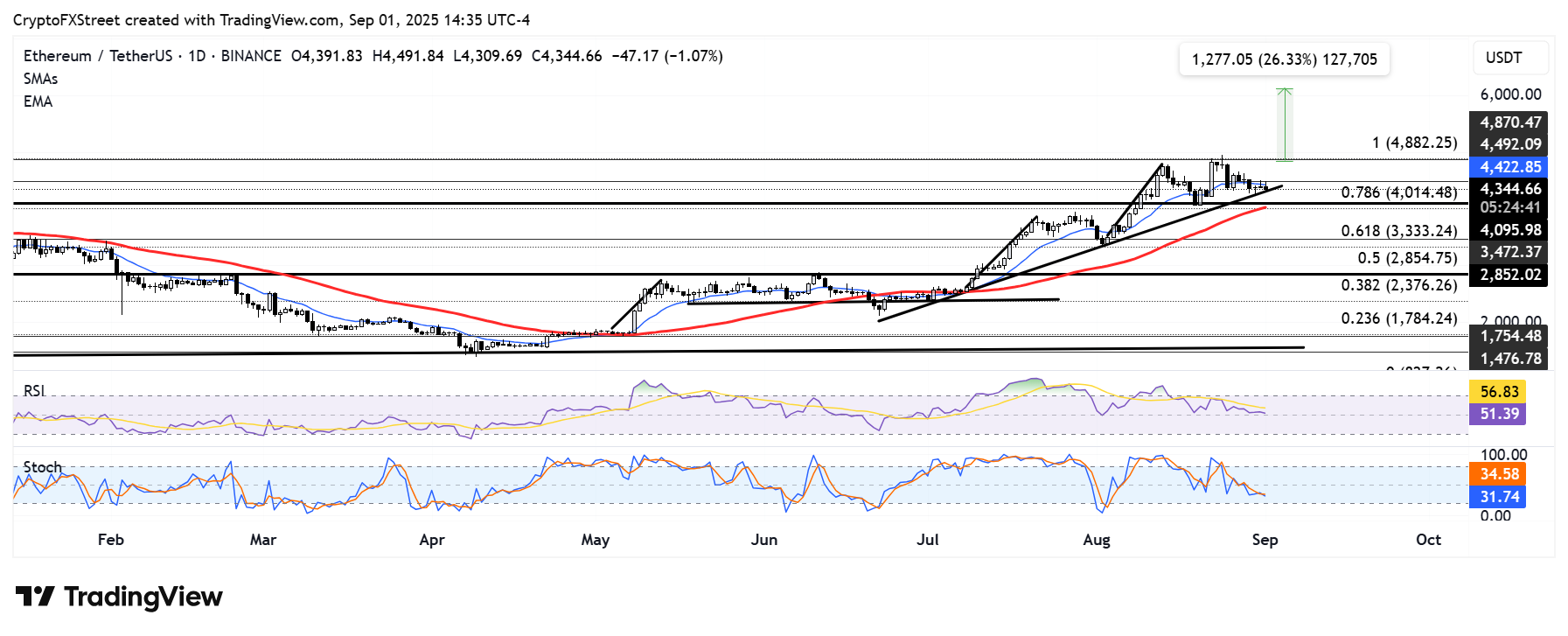

ETH continued to consolidate on Monday within a tight range marked by the $4,500 level and a key ascending trendline extending from June 22, a range that it had maintained throughout the weekend.

ETH/USDT daily chart

As ETH approaches the apex of the range, a decisive move above or below its upper or lower boundary should signal the initiation of its next trend. On the downside, ETH could hold the $4,100 support — strengthened by the 50-day Simple Moving Average (SMA). A decline below $4,100 could see the top altcoin fall toward $3,500.

On the upside, ETH must firmly clear and hold its all-time high resistance as a support level to begin an uptrend.

The Stochastic Oscillator (Stoch) hovers just below its midline, while the Relative Strength Index (RSI) is moving sideways slightly above its neutral level, indicating neutrality in momentum but with a modest bearish bias.

También te puede interesar

Financing Weekly Report | 13 public financing events; Privacy blockchain Miden completes $25 million seed round, led by a16z Crypto and others

Tesla Sees $657M Outflows As South Korean Retail Investors Favor Crypto-Related Stocks