Five marriages, a prodigal son: The wild life of 81-year-old billionaire Larry Ellison

On September 10th local time, 81-year-old Larry Ellison may be the most proud person in the world.

According to the Bloomberg Billionaires Index, the billionaire officially became the world's new richest man that day, with his wealth surging by over $100 billion in a single day, replacing long-time holder Elon Musk.

As Oracle's co-founder and largest individual shareholder, Ellison's net worth peaked at $393 billion that day, while Musk, who was dethroned by him, was left with only $385 billion.

From dropping out of college and being penniless to having five marriages and becoming rich enough to rival a country, why does this 81-year-old man become more and more crazy as he gets older?

From abandoned orphan to Silicon Valley billionaire

Larry Ellison was born in 1944 in the Bronx, New York, to a 19-year-old unmarried mother. Unable to support her, he was sent to Chicago to be adopted by his aunt's family at nine months old. His adoptive father was an ordinary government employee, and the family was financially struggling.

Although he later attended the University of Illinois at Urbana-Champaign, he dropped out during his sophomore year due to the death of his adoptive mother. Ellison then attended the University of Chicago, but left after only one semester.

After leaving school, Ellison moved around the United States for years. He worked sporadic programming jobs in Chicago before driving to Berkeley, California, a hub of counterculture and a vibrant tech scene. To him, "people there seemed freer and smarter."

What truly changed his life was his job as a programmer at Ampex Corporation in the early 1970s, a technology company specializing in audio and video storage and data processing. It was at Ampex that he participated in a pivotal project: designing a database system for the Central Intelligence Agency (CIA) to efficiently manage and query data. The project was code-named "Oracle."

In 1977, 32-year-old Ellison and two former colleagues, Bob Miner and Ed Oates, invested $2,000 (of which Ellison contributed $1,200) to establish Software Development Laboratories (SDL).

The first major decision they made was to develop a general-purpose commercial database system based on the experience and relational data model they had previously developed for the CIA - and simply named it "Oracle".

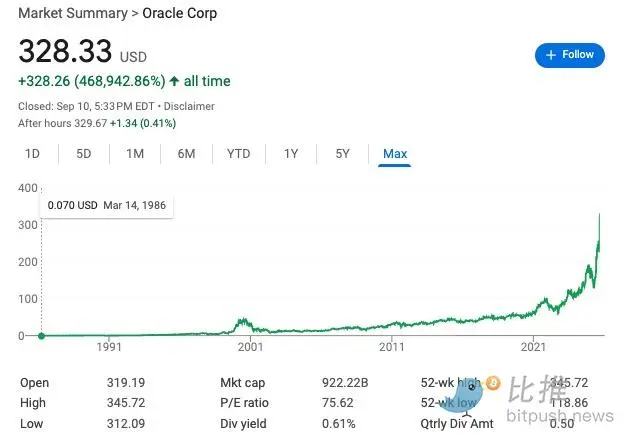

In 1986, Oracle went public on NASDAQ and became a rising star in the enterprise software market.

Strictly speaking, Ellison is not the "inventor" of database technology, but he was the first person to see its commercial value and dared to all in to use it to open up the market.

Ellison, known for his rebellious and competitive nature, has held nearly every executive position in the company.

He was president from 1978 to 1996 and first served as chairman from 1990 to 1992. In 1992, he nearly died in a surfing accident, a near-death experience that didn't deter him.

He returned to the company in 1995 and remained at the helm for a full decade. In 2014, he stepped down as CEO, handing the reins to a longtime subordinate, but he remains Executive Chairman and Chief Technology Officer, positions he holds to this day.

Over the past four decades, Oracle has experienced both highs and lows. It once dominated the database market and also lagged behind in the early days of cloud computing. But through it all, Oracle has remained a key player at the heart of enterprise software, and Ellison has always been the company's soul.

Wealth surge: AI's "delayed victory"

On September 10, 2025, Oracle announced that it had signed four contracts worth hundreds of billions of dollars in the latest quarter, including a five-year, $300 billion partnership with OpenAI.

Following the news, the stock price surged more than 40% in a single day, its biggest one-day gain since 1992.

Although Oracle lagged behind Amazon AWS and Microsoft Azure in the early stages of the cloud computing competition, it still occupies a unique position due to its database advantages and deep cultivation of enterprise customers.

In the summer of 2025, the company announced a new round of layoffs, totaling thousands of employees, primarily in its hardware sales and traditional software departments. At the same time, Oracle increased its investment in data centers and AI infrastructure, becoming one of the core suppliers of the generative AI boom.

The market is enthusiastic about the demand for AI infrastructure, and Oracle happens to have this late ticket, which has also triggered industry evaluations: Oracle has transformed from a "traditional software vendor" to a "dark horse in AI infrastructure."

Family and politics

Ellison's wealth has long been more than just a personal legend; it has also expanded into a vast empire at the family level.

His son, David Ellison, recently acquired Paramount Global, the parent company of CBS and MTV, for $8 billion, $6 billion of which came from Ellison family funds. This deal marks the Ellison family's expansion into Hollywood. With their father in Silicon Valley and their son in the film and television industry, two generations have built a wealth empire spanning technology and media.

Ellison has also frequently appeared on the political stage. He has long supported the Republican Party and is a well-known political donor.

In 2015, he financed Marco Rubio's presidential campaign; in 2022, he donated $15 million to South Carolina Senator Tim Scott's Super PAC. In January of this year, he appeared at the White House alongside SoftBank CEO Masayoshi Son and OpenAI CEO Sam Altman to announce the construction of a $500 billion network of AI data centers. Oracle technology will be at the core of this effort, representing not only a commercial initiative but also an extension of power.

The life of a "prodigal": love of the outdoors, love of self-discipline, love of marriage

Luxury and self-discipline, adventure and passion, these contradictory qualities coexist in Ellison.

Ellison owns 98% of the Hawaiian island of Lanai, several California mansions, and some of the world's finest yachts.

He has an almost instinctive obsession with water and wind. In 1992, he narrowly escaped death while surfing, but he still couldn't let go of the thrill. Later, he devoted more energy to sailing.

In 2013, the Oracle Team USA he supported staged a comeback in the America's Cup and eventually won the trophy, which was one of the most classic comebacks in the history of sailing.

In 2018, he founded SailGP, the high-speed catamaran sailing league, which has now attracted investors including actress Anne Hathaway and football star Mbappé.

Tennis was another of his passions, and he revived the Indian Wells tournament in California, calling it the "fifth Grand Slam."

Sports is not only his hobby, but also considered to be his secret to staying young.

In a 2018 Quora discussion, a former executive at one of Ellison's startups mentioned that Ellison spent several hours exercising daily in the 1990s and 2000s. He rarely consumed sugary drinks, consuming only water and green tea, and maintained a strict diet. This self-discipline has kept him looking energetic at 81, leading him to be described as "20 years younger than his peers."

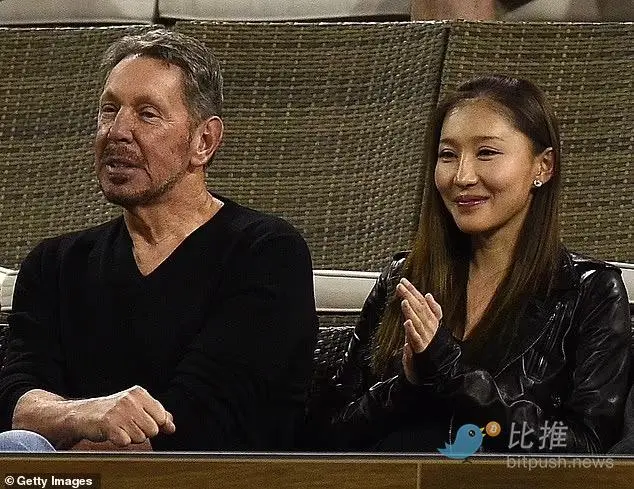

In terms of personal relationships, Ellison has been married four times and has been involved in constant scandals.

In 2024, he quietly married Jolin Zhu, a Chinese-American woman 47 years his junior. The news came from a University of Michigan document that mentioned a donation from "Larry Ellison and his wife, Jolin." This marriage brought his private life back into the public spotlight. According to the South China Morning Post, Jolin Zhu was born in Shenyang, China, and graduated from the University of Michigan.

Some netizens joked that Ellison loves surfing and dating. For him, the waves and the romantic scene seem equally attractive.

Philanthropy and the Future

In 2010, Ellison signed the Giving Pledge, pledging to donate at least 95% of his wealth. Unlike Bill Gates and Warren Buffett, however, he rarely participates in group activities. According to an interview with The New York Times, he "cherishes his solitude and refuses to be influenced by outside ideas."

In 2016, he donated $200 million to the University of Southern California to establish a cancer research center. Recently, he announced that he would direct part of his wealth to the Ellison Institute of Technology, a joint venture with Oxford University, to research healthcare, food, and climate change. He wrote on social media: "We will design a new generation of lifesaving drugs, build low-cost agricultural systems, and develop efficient and clean energy."

Ellison's philanthropic approach is highly personal. He is not keen on standing with his peers, but prefers to independently design a future that suits his own ideas.

Conclusion

At the age of 81, Larry Ellison finally became the world's richest man.

He began with a CIA contract, built a global database empire, and then astutely positioned himself in the AI wave, achieving a belated comeback. Wealth, power, marriage, sports, and philanthropy—his life was never short of topics, and he was never far from the center of the storm.

He's the prodigal son of Silicon Valley—stubborn, combative, and uncompromising. The title of world's richest man may soon change hands, but for now, Ellison has proven to the world that in an era where AI is reshaping everything, the legacy of the older generation of tech moguls is far from over.

Author: Seedco

También te puede interesar

Data: Hong Kong virtual asset ETF today's transaction volume is about HK$19.0813 million

Looking at the L2 dilemma from Linea’s coin issuance: Has Ethereum’s expansion path reached a dead end?