FOMC and Canadian ETF Debut Fail To Pump XRP Price: What Catalyst Does XRP Need?

XRP price is down when writing and trending below $3.50. Ripple is struggling for momentum despite the launch of three spot XRP ETFs in Canada and FOMC expectations in the U.S.

The XRP Army often expects the coin to go “up only.” It has been on an uptrend, and since Donald Trump took office, has risen in the market cap rankings and is now one of the best cryptos to buy.

XRP Price Consolidates

Whether XRP will break above $3.50 in June 2025 remains to be seen. Still, bulls are optimistic, expecting prices to tick higher and break above key resistance levels at around $2.40 and $2.60 in the coming days.

Technically, the local support is at $2.00. As long as prices trend above this level, buyers may view every dip as a loading opportunity.

Multiple triggers, including favorable regulations and institutions racing to create complex XRP products, could prop up prices. Even so, the coin is still moving sideways, and buyers are staying away, a move that’s also being felt by some of the best Solana meme coins.

Spot XRP ETF Launch in Canada

Notably, the launch of Canada’s first spot XRP ETFs was expected to drive prices, as institutions in the country now have a clear route for direct exposure to XRP.

Purpose Investments, 3iQ, and Evolve ETFs rolled out spot XRP ETFs, listing them on the Toronto Stock Exchange (TSX) on June 18 under the tickers XRPP, XRPQ, and XRP, respectively.

As expected with any spot XRP ETF, shares issued are directly backed by XRP. Investors who buy them are also eligible for tax-sheltered investment accounts like TFSAs and RRSPs in Canada.

Looking at how these spot XRP ETFs are structured, Purpose Investments’ product offers USD-denominated and CAD-hedged versions of their XRPP.

Meanwhile, 3iQ sought a competitive advantage by waiving fees until the end of the year to draw more inflows.

In the United States, the SEC has yet to approve any spot XRP ETF. Some heavyweights that have applied to issue this derivative product include Franklin Templeton and 21Shares.

After the SEC delayed its decision on the Franklin Templeton spot XRP ETF application on June 17, eyes are on whether the regulator will also put off approval on the Grayscale on October 18.

Overall, Polymarket punters have placed a 90% chance that a spot XRP ETF will be approved in the United States by the end of 2025.

(Source)

FOMC Crypto Disappointment

Much was expected from the FOMC meeting in the United States.

Although the Federal Reserve was expected to keep rates steady between 4.25% and 4.50%, the Jerome Powell press conference was supposed to move markets. However, it didn’t.

Instead, the Federal Reserve was cautious, citing risks posed by Donald Trump’s tariffs. There were also mentions of sticky inflation and resilient labor markets.

This combination meant the central bank kept rates steady, disincentivizing aggressive positions in crypto assets, including XRP.

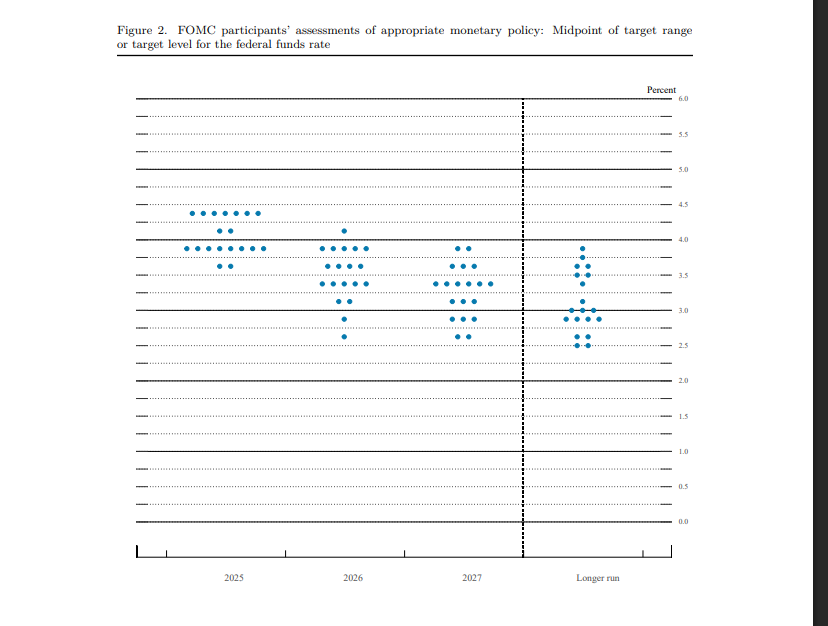

Looking at the FOMC Dot Plot, the market still expects two 25-basis-point rate cuts in 2025. Even so, from Jerome Powell’s press conference, the central bank maintains a hawkish tone.

(Source)

Notably, seven members of the FOMC now support no cuts in 2025, up from previous projections.

Moreover, the FOMC remains data-dependent. While they could cut rates in upcoming meetings, they are still assessing the impact of tariffs on inflation, which could dampen economic growth.

7 High-Risk High-Reward Cryptos for 2025

The post FOMC and Canadian ETF Debut Fail To Pump XRP Price: What Catalyst Does XRP Need? appeared first on 99Bitcoins.

También te puede interesar

Asia’s Largest Web3 Event TOKEN2049 Exclusively Unveils NFT Assets Valued Over US$100 Million

Waves Protocol’s Units.Network Raises $10M as AI-Blockchain Market Heats Up