How did Flipr become a dark horse in the social prediction market after a 100-fold increase in two months?

By ChandlerZ, Foresight News

From late June to late August of this year, Flipr's price performance was truly remarkable. Two months prior, its market capitalization was less than $2 million, drawing virtually no interest. By August 27th, the project's market capitalization had climbed to a peak of $21 million, a more than 100-fold increase, including a 16-fold increase in August alone.

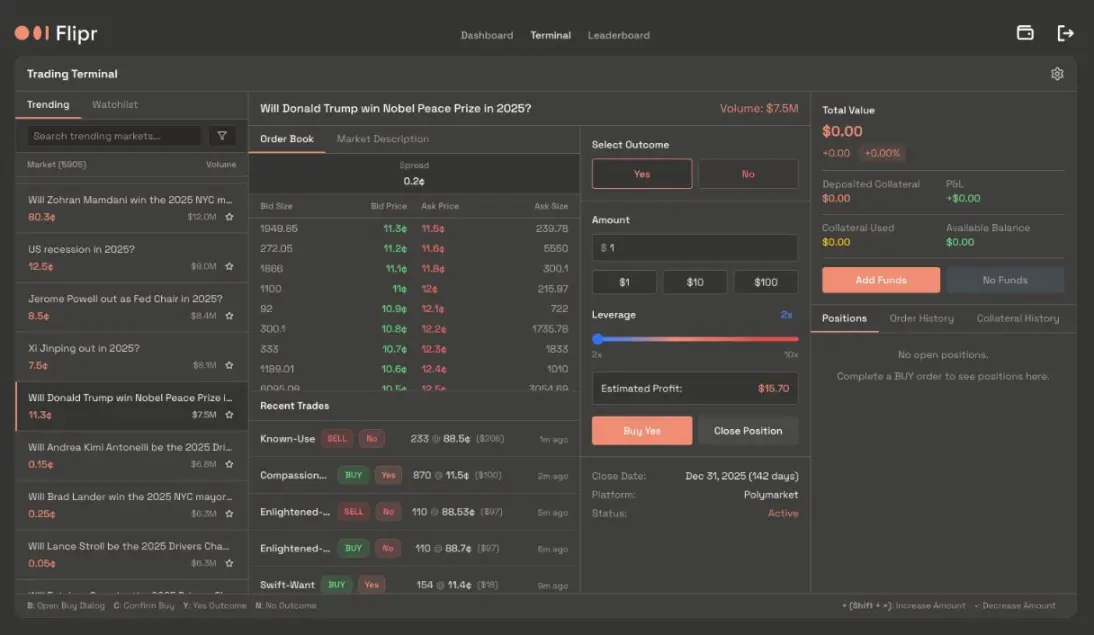

So, what exactly is Flipr? Simply put, it's not a new prediction market, but rather a social portal to the prediction market. Unlike Polymarket or Kalshi, which require independent platforms and interfaces, Flipr takes a more lightweight approach: embedding itself directly into social platform X.

What is Flipr: The “social layer” of prediction markets?

Flipr officially launched in July 2025, with its core entry point being Fliprbot, a trading bot running on the X platform. Unlike traditional prediction markets, which require navigating to a separate website, browsing a list of markets, connecting to a wallet, and then placing a bet, Flipr condenses the entire process into a social conversation.

Users simply tag @fliprbot on an X or enter a natural language command in a private message, such as "Will Donald Trump win the Nobel Peace Prize in 2025?" followed by their bet direction and amount, to complete the transaction. The bet information then appears on the timeline as content, becoming a social event that can be copied, forwarded, and questioned. Flipr essentially integrates trading and posting, making every bet publicly visible.

To lower the barrier to entry, Flipr has integrated Privy's account system at the bottom layer and introduced derivative features such as leveraged trading and stop-loss/take-profit functions. Betting is no longer an isolated activity after a redirect, but a natural extension of the conversation. Flipr even supports group chat and community integration. Group administrators can create markets instantly within conversations, allowing users to discuss and place bets simultaneously, making predictions a part of social interaction, just like chat stickers.

The logic behind this design is clear. Traditional prediction markets are more like tools for professional speculators, while Flipr aims to make trading a part of social interaction. However, rather than competing head-on with Polymarket or Kalshi, it chooses to focus on the front lines of user engagement. Polymarket and Kalshi provide trading depth and compliance, while Flipr provides visibility and reach. For prediction markets, this is a complementary relationship. Flipr acts as an amplifier, bringing previously specialized trading activities into the mainstream social landscape.

This product logic determines its virality. Betting becomes a dynamic thread that can be forwarded, commented on, and even bet against. Opinions and financial bets overlap in the same space, amplifying the visibility of transactions across social networks. Flipr transforms the prediction market from a tool into a form of content, and this spreadability is the key to its rapid popularity.

On July 7, Flipr launched the Mindshare Mining campaign, which lasted for six weeks and distributed a total of 10 million FLIPR tokens as rewards.

Unlike common transaction mining, it doesn't simply reward transaction volume, but instead incorporates a more complex scoring system that seeks to integrate betting and social interaction. Points are calculated across five dimensions: The most intuitive aspect is that the larger the transaction volume, the higher the user's score. Posting time is also factored in, with the earliest posts of the week receiving greater weight, encouraging immediate user participation. Consecutive postings receive additional rewards. Furthermore, the project has built-in anti-spam constraints into the mechanism, with excessive posting resulting in point deductions to prevent the community from being overwhelmed by meaningless information. User interaction with posts is also factored in, with the number of likes, comments, and reposts directly impacting the final score.

The landscape of the prediction market and the future of Flipr

Flipr's rapid rise makes sense within the context of the prediction market's development. Over the past year, Polymarket and Kalshi have demonstrated the scale and potential of prediction markets, but neither has yet to launch a token. This has left investors without a direct target to invest in. Consequently, hot money has naturally flowed into Flipr, despite its small market capitalization and its association with the prediction market.

Meanwhile, the popularity of prediction markets continues to grow. Polymarket's trading volume exceeded $9 billion in 2024, reaching $2.6 billion in a single month during the US election, firmly establishing itself as a leading crypto-native prediction platform. Kalshi, with CFTC approval, has rapidly expanded in the compliance sector, reaching nearly $2 billion in trading volume in 2024 and a $2 billion valuation after funding in 2025. Over the past two years, prediction markets have evolved from a fringe experiment into a rapidly growing niche market.

According to official information, Flipr has already integrated with Polymarket and will soon integrate with Kalshi. Flipr isn't attempting to compete with major players in terms of liquidity or compliance, instead focusing on the front-end user experience. Platform X has 150 million daily active users, who already operate in an event-driven, sentiment-driven environment. Flipr embeds prediction markets into this context, allowing betting and posting to overlap, thereby lowering the barrier to entry. For Polymarket and Kalshi, this "social layer" may be the missing link.

More importantly, Ethereum co-founder Vitalik Buterin has publicly expressed his support for prediction markets on numerous occasions. Over the past two years, he has become a near-universal proponent of prediction markets, repeatedly emphasizing their role in promoting "information accuracy" and "cognitive correction." He noted that while in token voting, there are virtually no penalties for choosing the wrong outcome, in prediction markets, misjudgments can result in real financial losses. This mechanism forces participants to be more rational, and market prices often provide more accurate probabilities than media sentiment. For him personally, prediction markets help him maintain composure, preventing social media sentiment from amplifying the significance of events, while also providing a heads-up when truly significant events occur. Vitalik therefore views prediction markets as a social technology that can enhance rationality at the group level, highly aligned with the open governance goals of blockchain.

At the same time, he frequently discussed the potential applications and areas for improvement of prediction markets. Vitalik pointed out that most prediction markets currently lack interest compensation, limiting their appeal as hedging tools. However, if this issue can be resolved in the future, related markets will spawn a large number of hedging applications and significantly increase trading volume. He also combined prediction markets with artificial intelligence, believing that AI-driven prediction markets could provide new avenues for community fact-checking, DAO adjudication, and even automated market making. For example, he envisioned embedding prediction markets within X's "Community Notes" feature, leveraging AI and incentives for small bets to accelerate the verification of facts. Vitalik even categorized prediction markets and community notes as the two flagship social cognitive technologies of the 2020s, believing that they are built on open participation rather than elite control and are important tools for promoting decentralized social governance.

The key question going forward is whether Flipr can convert this short-term surge into long-term, stable growth. After the Mindshare Mining incentive program ends, user activity could decline if new mechanisms are lacking to maintain momentum. If the partnership with Kalshi can be further implemented, Flipr has the opportunity to become a social front-end for compliant predictive trading in the US market, which would provide new growth opportunities.

También te puede interesar

Altcoin Season Index Surges to 46: What This Means for Your Portfolio

Mira Network establishes a foundation and may launch TGE soon