Snorter is Called the Best Crypto to Buy for Uptober as Viral Solana Presale Raises $4M

Meme coin prices have fallen over the past week, driven by macroeconomic jitters and profit-taking. As a result, CoinMarketCap’s Fear and Greed Index has dropped 12 points in four days, from 52 to 40.

At first glance, this might seem concerning, but it’s actually the kind of situation many traders have been hoping for. After a notably strong September when Bitcoin rallied and many altcoins reached new highs, the market now appears to be stabilizing ahead of Q4. During this fiscal quarter, the crypto market has historically seen the biggest gains, so this week’s cooldown might be just the calm before the storm.

And for this Q4, traders will have a new tool to help them make even bigger profits: Snorter (SNORT), a new Solana-based meme coin trading bot set to launch on the open market in October.

Snorter has been gathering funds for development through a public presale event in recent months, allowing anyone to contribute capital in exchange for a discounted token price. To date, the presale has raised over $4 million, demonstrating strong investor interest.

Those who haven’t bought in yet still have a chance – the Snorter token presale will run for another 27 days, after which SNORT will be listed on the open market. According to some analysts, SNORT’s debut on the open market could see huge gains, with whispers of up to 100x potential circulating.

Meme coin prices set for gains in Uptober

The meme coin market – like other sectors in the crypto industry – has experienced losses this week. Dogecoin is down 10%, Pepe is down 10%, and Pump.fun has fallen by a significant 32%.

This dip is testing traders’ conviction – do they capitalize, knowing that the traditionally lucrative October, also known as “Uptober,” is approaching, or do they succumb to fear and exit their positions?

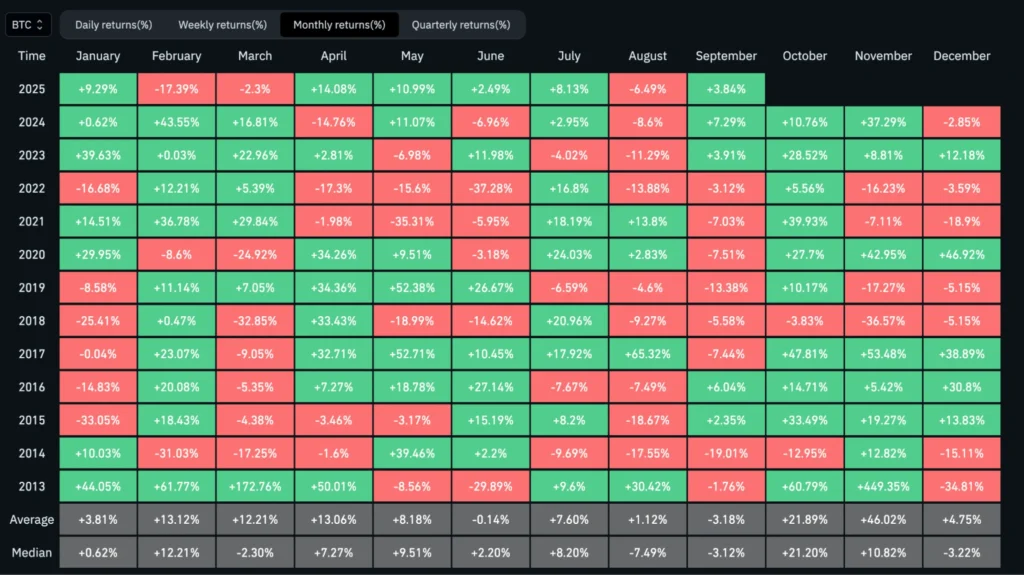

Bitcoin has averaged a 21% return in October since 2013, making it the second-best-performing month, only behind November, which is called “Moonvember.” And in terms of median returns, October is well ahead with a 21% gain, followed by February, which has yielded a 12% ROI.

However, with factors such as interest rate cuts, crypto ETFs, and a more favorable regulatory environment, it seems that this coming October might just be one of the strongest yet.

And with Snorter set to launch, this could prove one of the smartest ways to capitalize – both through the SNORT token’s potential for price appreciation, and the opportunities that the Snorter bot provides.

How Snorter spots the next 100x meme coin

The Snorter trading bot is built on two core pillars: automated token sniping and copy trading.

Automated token sniping gives users complete control, allowing them to instruct the Snorter bot on exactly which tokens to target. The bot will scan mempools, monitor liquidity, and instantly buy when its criteria are met – long before tokens appear on data tracking websites like CoinGecko and CoinMarketCap.

This enables Snorter users to acquire new meme coins within their first seconds, rather than days or weeks after launch. It operates on a private RPC network that provides faster access to the mempool, and trades are executed directly within the Telegram app with sub-second finality and MEV-resistance. This eliminates lag, reduces front-running risks, and lowers the chances of failed transactions.

The second pillar is copy trading, which is ideal for those who don’t want the burden of creating a trading strategy and scouting for tokens manually. It’s a fully hands-off approach that allows users to mirror the trades of successful wallets with control over position sizes.

Snorter also performs risk checks, using AI to flag rug pulls, verify smart contracts, and confirm liquidity. This ensures that the tokens investors purchase are safe and secure. Unsurprisingly, all of this is attracting attention from analysts, with Borch Crypto recently calling SNORT the best crypto to buy and suggesting it could deliver 50x gains.

Snoter is currently on fire, having raised over $4 million in its presale – a clear sign of investor enthusiasm and price potential. And with the presale ending in 27 days, hype and FOMO are only growing stronger right now.

Its role as an innovative meme coin trading bot, its timely launch during Uptober, and support from analysts are three compelling factors, even when considered individually. However, when combined, they create a rare setup that suggests SNORT could be the best cryptocurrency to buy now.

Visit Snorter Presale

También te puede interesar

Fed Makes First Rate Cut of the Year, Lowers Rates by 25 Bps

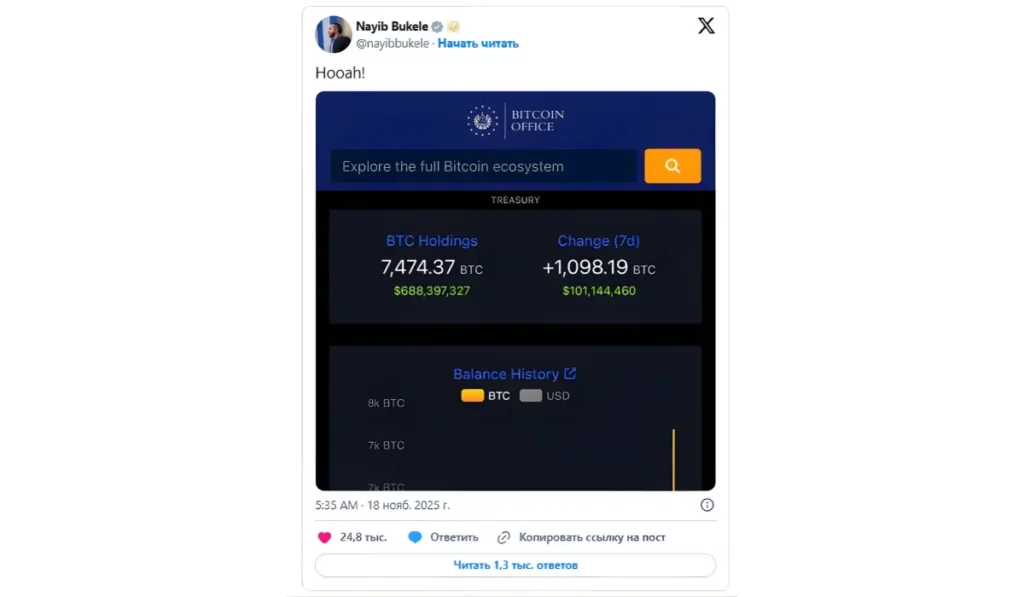

El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury