Why Growing Companies Shouldn’t Rely Too Heavily on No-Code Tools

\ No-code tools are everywhere. They’re a quick fix to develop apps, automate processes, and build websites without a team of developers.

But here’s the thing, you don't have to do it because you can.

No-code tools solve immediate problems by letting you build fast, but they usually create bigger challenges down the road. They have limitations in customization, security, scalability; you name it.

These limitations can eventually increase your reliance on manual fixes, which is what you wanted to avoid in the first place.

In this article, I'll share the disadvantages of no-code tools for growing companies and explain why and when they stop being effective for you.

5 Reasons Growing Companies Should Reconsider Relying on No-Code Tools

:::info Disclaimer: No-code tools are great. They're time-efficient, and allow you to create your website, app or internal systems without too much interference from your technical team (if you have any).

:::

\ But they have limitations, especially if you're scaling your company to accommodate more users, team members, and clients:

1. No code tools leave little room for customization

No-code tools let you create technical solutions without needing a developer, but many times, you can't exactly customize these solutions to your taste.

You can tweak some things (colors, logos, background, etc.), but when it comes to specific business needs (like when you need to integrate with custom enterprise resource planning (ERP) systems to process your orders and inventories), these tools may need a lot of manual workarounds.

For instance, let's assume a subscription-based SaaS company uses Bubble (a popular no-code platform) to handle customer billing.

Bubble allows you to integrate payment workflows via Stripe, and you can set up standard recurring plans. However, there's no built-in, flexible billing logic for tiered pricing based on usage, or conditional discounts (like the ones for early payment or loyalty-based discounts).

If you want these features, you would need custom API workflows or external plugins, which means you still need to code after all.

And let's assume that Stripe has usage tracking and tiered pricing features on its own, you would need extra technical setup and external automation to integrate it with Bubble.

It's either this, or you stick to ready-made templates that can only take you so far.

2. No-code tools are hard to scale

No-code tools are perfect for getting your business off the ground fast, but they aren't built to scale with your company.

Your company’s workflow becomes more complex as you grow; you’ll need multiple integrations to handle new services and larger databases.

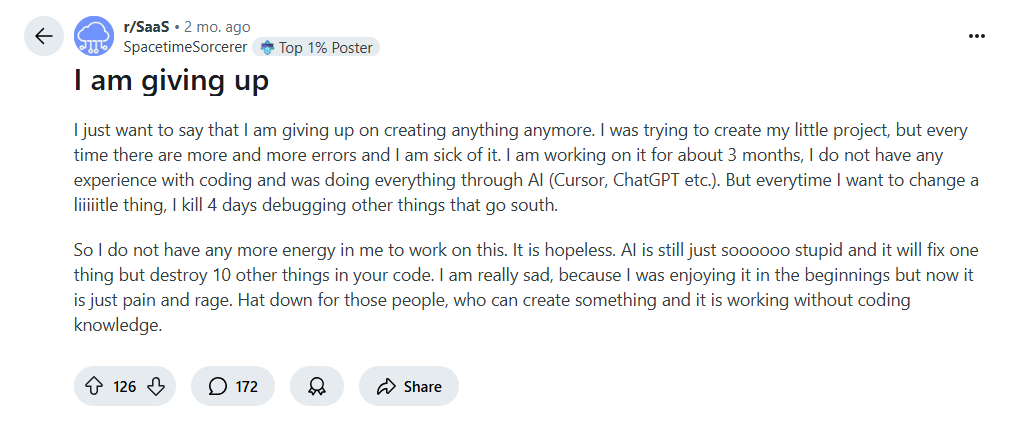

Many no-code tools can't handle operations at a larger scale, and when this happens, your automation may slow down or fail, there may be lags on functionality, and you can even hit platform limits (based on usage). Sometimes, it breaks other things in your code, like this Redditor complained.

The worst part is, unlike code you control, you can't optimize the backend to work for you.

Most times, you’ll end up depending on the platform to do what it cannot do, pay extra to get it done manually, or leave work early because you’ve been pulling at your hair so long, it hurts.

3. You're dependent on third-party providers.

We all know relying on third-party platforms to run your business can be risky. What happens when they hike their prices or change their terms?

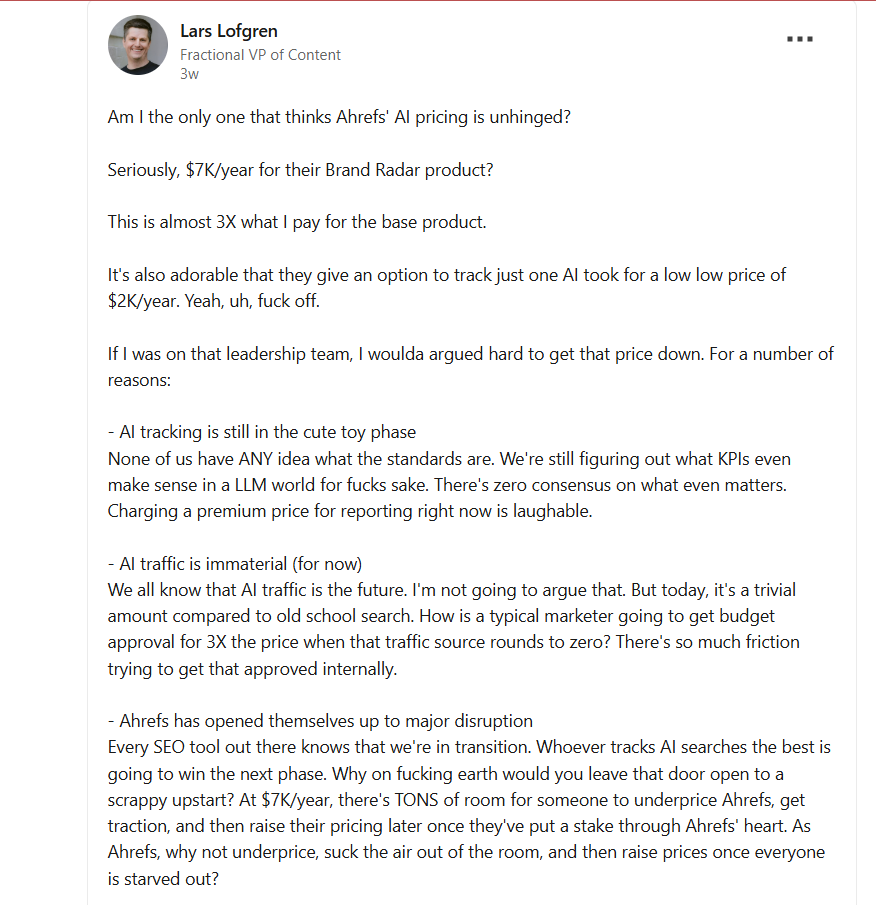

Now, this is not related, but a few days ago, Lars Lofgren posted on LinkedIn about Ahrefs' “unhinged” fee for their AI tracking tool.

https://www.linkedin.com/posts/larslofgrenam-i-the-only-one-that-thinks-ahrefs-ai-activity-7353540478417457153-TNR?embedable=true

\

:::tip PS: Ahrefs AI tracking tool is not a no-code tool.

:::

However, Lofgren says that:

“I’d only pay if I had a client writing crazy blank checks and was obsessed with AI visibility (I do not have one of those).”

He could make his choice, because even though AI tracking tools are slowly gaining visibility, he wasn't dependent on the Ahrefs AI tracking tool, because AI tracking is still in “its cute toy phase”.

With no code tools, you're basically building your business on someone else’s turf.

If a vendor goes under, makes changes you don't agree with, or hikes their prices (like Ahrefs did), you have no choice but to adapt or move everything to a new platform.

And moving isn't always easy.

You’ll need to research and find a new tool, transfer your data, get your team accustomed to the new platform (which could take weeks), and if it's a client portal tool, you’d also need to re-onboard your clients to another platform.

It's unstable, and may not help your business as you intended.

4. Can you be sure about security?

If you're in a highly regulated industry or deal with sensitive customer data, no-code tools may not meet the security standards you need.

For instance, GDPR compliance or HIPAA regulations require specific security protocols that no-code platforms may not be able to guarantee.

Since you have little to no control over the backend processes, you can't fully implement GDPR’s privacy by design principles, like the granular controls needed for user consent and data minimization.

And this is not to say that no-code platforms are not secure. They come with basic security features you need for a basic website, but they don't offer the level of protection you’ll need as you scale.

If you're handling sensitive customer data, you need full control over your systems and infrastructure.

Building your own systems means you get to set the rules, and when the rules need to change, you have full autonomy to change them.

5. There may be hidden long-term costs

No-code tools are a good bargain for the short term, but as you grow, most of these tools ask you to pay for extra features, additional team members you hire, more storage, and third-party integrations.

Even worse, you’ll still have to invest in custom development anyway to fix the problems no-code tools create, like paying for advanced features that the platform doesn't support, or ensuring regulatory compliance or security standards that need deeper technical control.

In other words, no-code tools might save you a little money upfront, but they often cost you more in the long run.

And it's not just monetary costs, you’ll spend a lot of time and energy dealing with workarounds, inefficiencies, and eventual migrations.

Conclusion

You’ll hit a wall with no-code tools if your business needs more than the basics. These tools are fine for quick launches, but you need custom solutions if your company is scaling. Start with no-code tools, but plan for custom solutions as your business grows.

\n

También te puede interesar

Liquidity Wars 3.0: Bribery Becomes a Market

Stablecoins and RWA cross-border innovation practices, Shanghai seminar discusses the new financial ecosystem