Why Network States Are the Future and the Death of the Nation-State Model

- Experts believe the relevance of traditional nation-states is waning amid digital innovation.

- Blockchain tools such as cryptocurrencies, smart contracts, and DAOs enable new forms of governance and community-building.

- Efforts like Bitnation and other micronations have attempted to establish digital states, but none have achieved full sovereignty.

- Established governments may respond through regulation, litigation, or military actions to curb emerging network states.

- The evolution of network states reflects the core values of decentralization, transparency, and privacy inherent in crypto culture.

The traditional nation-state, a political structure dating back nearly 380 years, faces increasing challenges from the capabilities offered by modern blockchain technology and the internet. Jarrad Hope, author of “Farewell to Westphalia” and co-founder of Logos, a project developing blockchain solutions for digital sovereignty, suggests that society’s organizational landscape is at a crossroads.

“Modern nation-states are nearly 380 years old, predating even the scientific discovery of oxygen and gravity,” Hope told it. “The internet and blockchain present new tools for organizing society that allow people to build across geographies.”

These tools include cryptocurrencies resistant to inflation, tamper-proof ledgers, smart contract platforms for automated legal and financial agreements, privacy-preserving protocols, and decentralized autonomous organizations (DAOs) that enable transparent governance. Hope emphasized:

However, Hope notes that the primary obstacle to creating fully autonomous network states lies in resistance from established nation-states and large institutions, including multinational corporations. He points to the UK Online Safety Act as an example of centralized efforts to control digital infrastructure, underscoring the ongoing tug-of-war between decentralization advocates and centralized authorities.

The idea of network states—virtual nations built on blockchain and distributed governance—remains popular within the crypto community, rooted in decentralization, transparency, equal access, and privacy. These principles echo the cypherpunk ethos that fostered the development of cryptocurrencies like Bitcoin and Ethereum.

Related: The EU’s two-tier encryption vision is digital feudalism

Network states are still in their infancy, and blockchain alone is insufficient for full sovereignty

Various attempts to establish these digital nations date back to projects like Bitnation in 2014, which aimed to create a borderless, blockchain-driven state. Yet, none of these efforts have yet succeeded in forming fully autonomous, functioning network states that operate as sovereign entities in cyberspace.

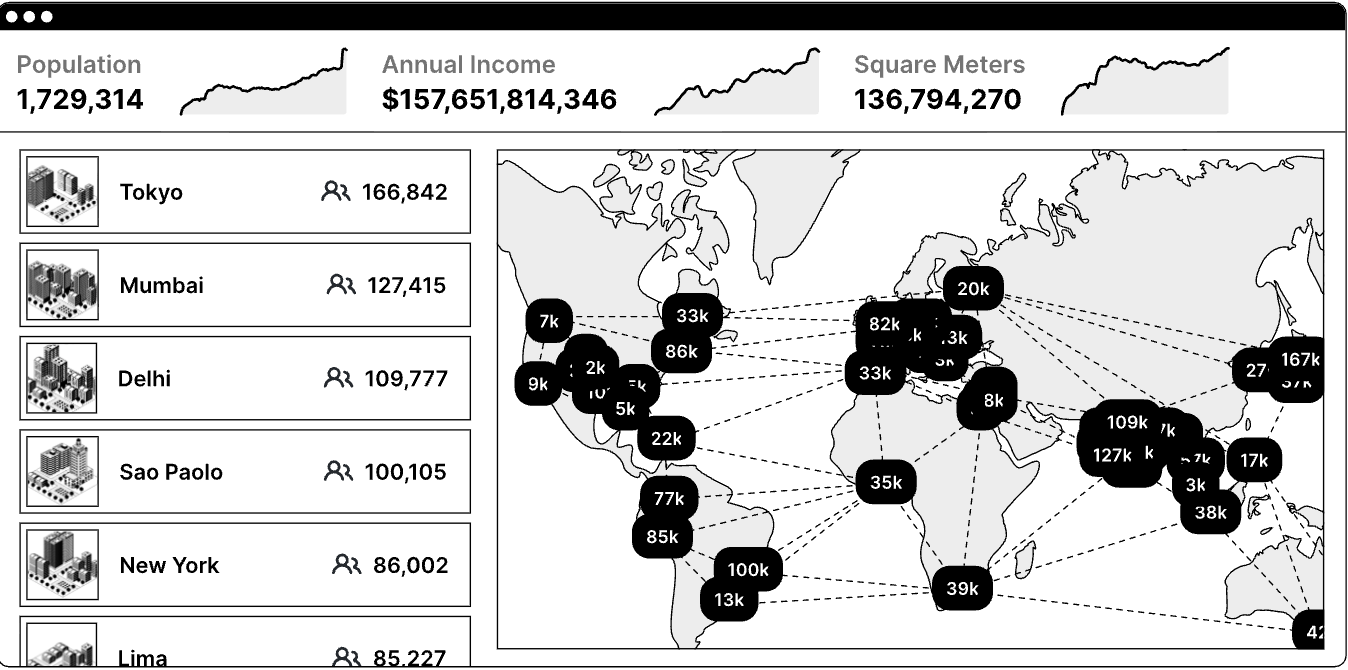

An illustrated example of a network state. Source: The Network State

An illustrated example of a network state. Source: The Network State

Experts from the crypto industry, including Hope, warn that as these digital communities evolve, existing nation-states will seek to undermine them through regulation, legal challenges, or even military means. Such measures aim to protect sovereignty and prevent the rise of competitor models that threaten the current geopolitical order.

This ongoing tension highlights the transformative potential of blockchain and crypto for governance, which continues to inspire enthusiasts and developers alike. While the journey toward fully realized network states is still underway, the core values driving this movement remain influential across digital and traditional spheres.

This article was originally published as Why Network States Are the Future and the Death of the Nation-State Model on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

También te puede interesar

Unprecedented Surge: Gold Price Hits Astounding New Record High

Investors Gear Up for 24,505% Profits With New Meme Coin on Ethereum