A must-read for those who are looking to buy fake airdrops: Top 10 warning signs of fake airdrops and how to avoid them

By Dilip Kumar Patairya

Compiled by: Tim, PANews

Key Takeaways

- In 2024 and 2025, fake airdrop scams targeting projects such as Hamster Kombat and Wall Street Pepe caused users to lose millions of dollars, resulting in global cryptocurrency fraud losses of more than $9.9 billion.

- Fake airdrops impersonate legitimate projects to trick users into revealing private keys, signing malicious contracts, or paying upfront fees, resulting in the theft of funds that cannot be recovered.

- Red flags include no official announcements, suspicious URLs, requests for private keys, grammatical errors, and unrealistic promises of returns.

- Future airdrops are gradually shifting to a model based on activity, traceability, and AI monitoring, aiming to reward real user participation while reducing cheating.

Although crypto airdrops are a legitimate means for projects to gain exposure and users, scammers are taking advantage of this craze to steal user assets through fake airdrop activities. Between 2024 and 2025, fake airdrop scams around projects such as Hamster Kombat and Wall Street Pepe have caused victims to lose millions of dollars. According to data from blockchain analysis agency Chainalysis, the estimated losses caused by global cryptocurrency scams and frauds (including fake airdrops) in 2024 will reach at least $9.9 billion.

Identifying red flags is crucial to ensuring the safety of airdrops. This article will explore key red flags and practical prevention techniques to help you effectively protect your assets.

What is a fake airdrop?

Airdrops are a common way to distribute free tokens in the crypto market, often as part of marketing campaigns, user growth strategies or community building plans. Formal airdrops achieve value by giving back to early participants, increasing token awareness or incentivizing network participation. Users usually only need to complete simple operations such as following or registering on social media, joining a community or holding coins to qualify for airdrops.

However, the popularity of airdrops has also attracted scammers. They take advantage of users' greed and curiosity by promising to give away tokens (fake airdrops) to trick users into performing sensitive actions, such as sharing private keys, signing malicious contracts, or paying gas fees. Fraudsters may impersonate real projects and use fake domain names or fake social media accounts to deceive users.

These scams often look convincing enough that even experienced users can fall for them, which is why you should always be vigilant when claiming airdrops.

Did you know? In 2023, the phishing tool Inferno Drainer helped scammers steal more than $80 million through fake airdrop activities. The tool operates in a "phishing as a service" model, providing partners with pre-built phishing kits that enable them to build fake airdrop websites and steal digital wallets on multiple blockchains.

Key red flags for identifying “fake airdrops”

Before you participate in an airdrop, be sure to learn to recognize red flags. These red flags are your first line of defense against having your cryptocurrency stolen or your sensitive information fall into the hands of scammers:

1. The official certification channel has not yet released a formal announcement

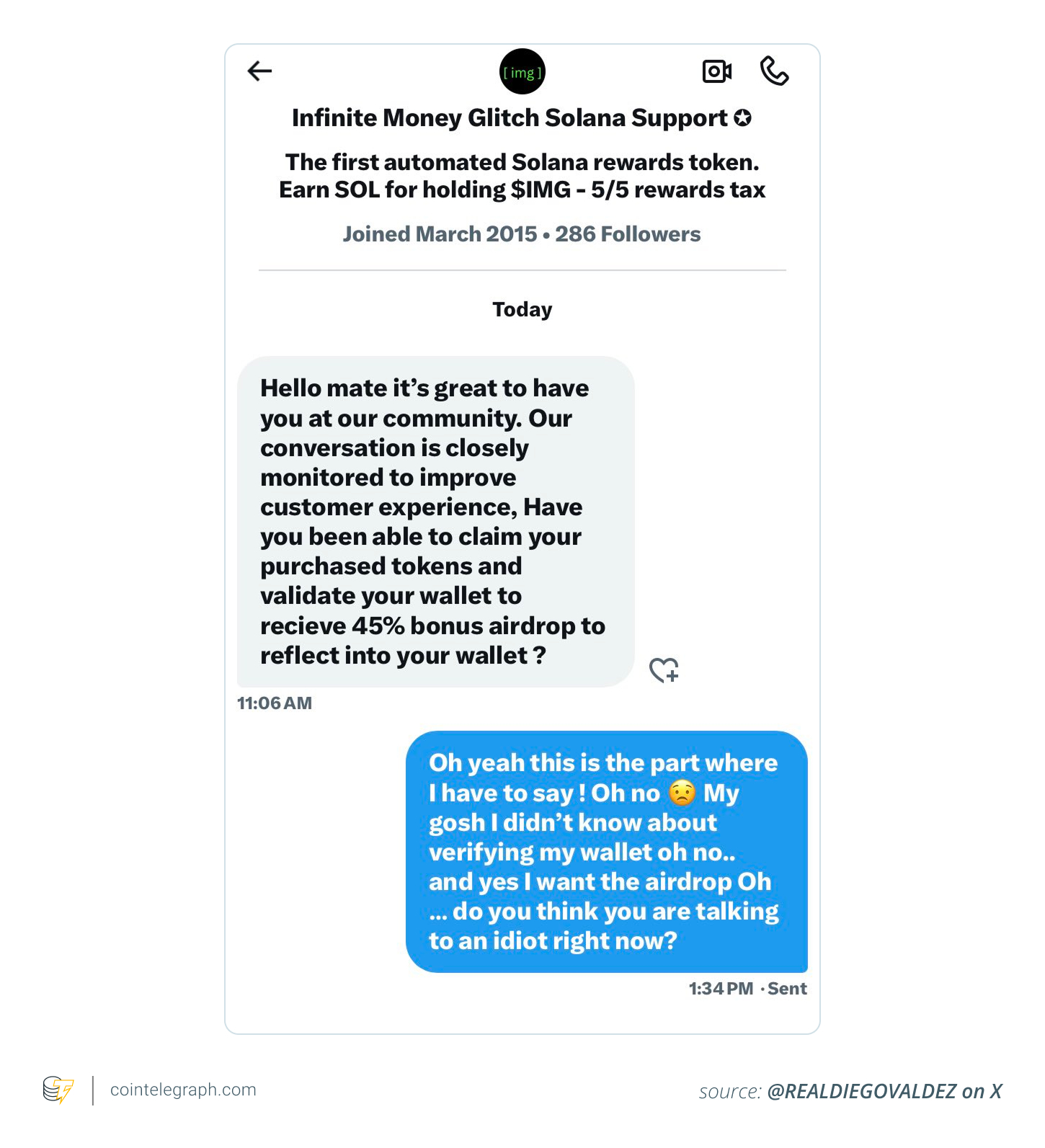

Warning: A major red flag for identifying a fake airdrop is that there has never been an announcement about it through the project’s official communication channels. Scammers often promote fake airdrops through unsolicited private messages, the creation of unofficial Telegram groups, or by building shoddy websites that mimic legitimate projects.

Countermeasure: Before clicking on any link, always confirm the authenticity of the airdrop by checking the project's official website, a verified X account, or an official Discord or Telegram channel. If the official channel does not mention the airdrop, stay away.

2. Private key or mnemonic "verification" request

Warning: A key red flag of fake airdrops is the requirement to provide your private key or mnemonic phrase to "verify" your wallet. This type of scam tricks users into handing over full control of their crypto wallets by disguising it as a qualification review process. Once the private key or mnemonic phrase is leaked, the scammers can immediately steal all the assets in the wallet.

Countermeasure: A real airdrop will never ask you for your private key or recovery phrase, and this information should always be kept confidential. If anyone or any website asks for this information, it is clearly a scam. Please exit the relevant page immediately.

3. Prepaid gas fee or cryptocurrency payment

Warning: A clear red flag for a fake airdrop is the requirement for users to pay gas fees or cryptocurrency payments upfront to "unlock" the tokens. Scammers will often insist that you send ETH or other cryptocurrency to claim your reward, but after paying, the promised tokens never arrive and your funds are lost.

Countermeasures: Legitimate airdrops are free and usually only require basic tasks such as connecting a wallet or performing simple operations. If an airdrop requires payment, it is likely a scam. Never transfer money to unfamiliar addresses.

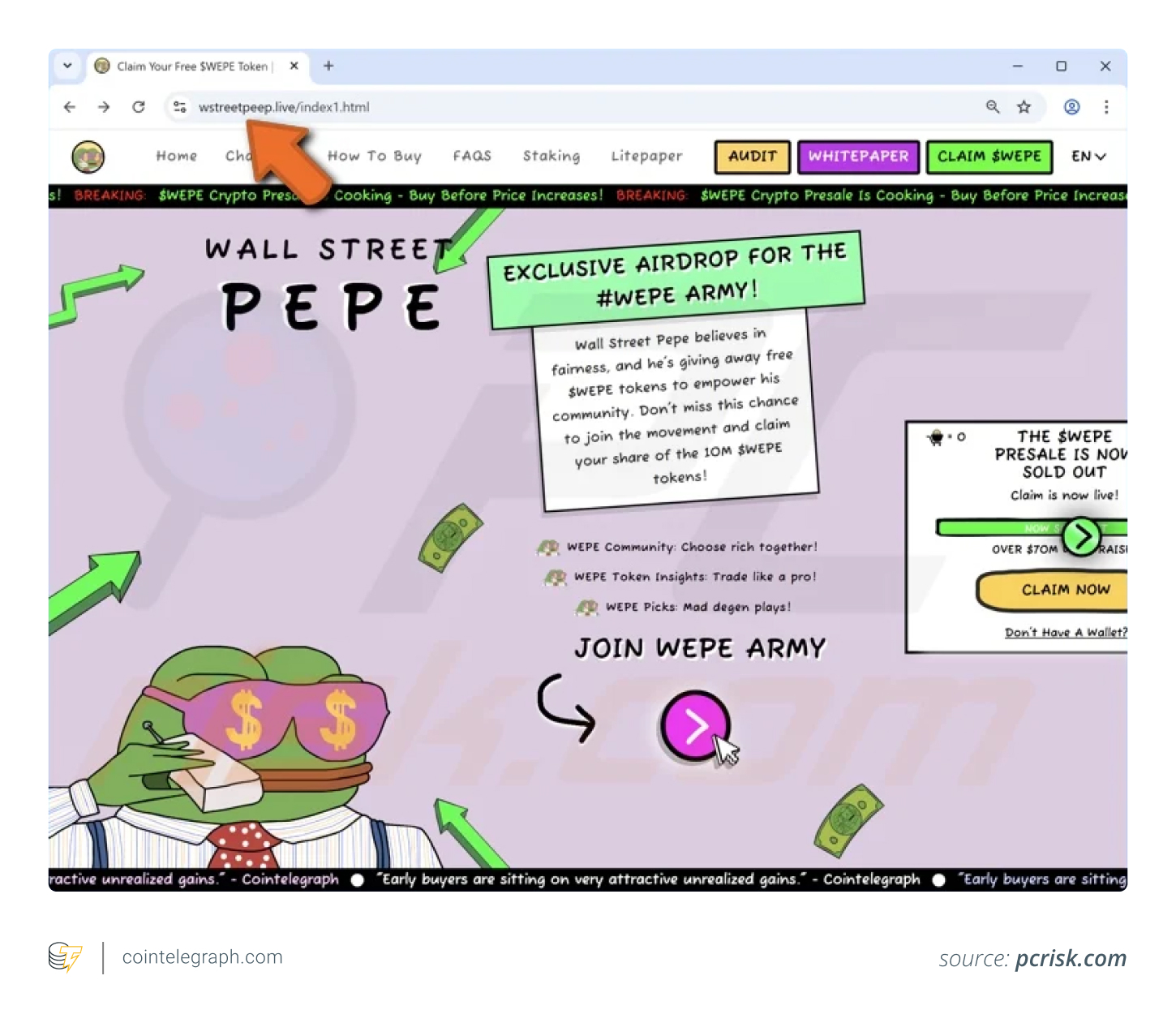

4. Suspicious URLs or cloned websites

Warning: Fake airdrops often use phishing websites that impersonate legitimate projects. These websites are designed to trick users into connecting their wallets and signing fraudulent transactions.

Countermeasure: Before participating in a transaction on a project, you must carefully check the URL link of the project. Fake links often have subtle differences, which may include spelling errors, extra characters, or the use of different domain name suffixes (such as .com replaced by .net, etc.).

Little-known fact: Some airdrop projects will use retroactive standards to issue rewards based on the user’s past activity. This mechanism can encourage users to spontaneously participate in ecosystem construction before the airdrop announcement is released, so as long as they use DApp naturally, they may be eligible to receive free tokens in the future.

5. Grammatical errors and emergency language

Warning: Many fake airdrop campaigns contain grammatical errors, spelling problems, or use urgent slogans such as "Get it now or miss it!" and "Last chance for free tokens!" These tactics are designed to create FOMO and trick users into clicking on malicious links without thinking. Crude text expressions and a deliberately created sense of urgency are the key signals to identify scams.

What to do: Legitimate crypto projects communicate in a professional and clear manner. If an airdrop announcement contains errors or uses time-sensitive language, stay away.

6. Fake social behavior or robot comments

Warning: Scammers often use fake social behaviors to forge airdrop posts, such as comments like "I just received 500 $XYZ!" or "Absolutely reliable!" These contents are usually posted by robots or fake accounts, aiming to create a credible illusion to induce user participation. They may also steal celebrity accounts or create high-end accounts to spread false airdrop information by forging authoritative endorsements. These fraudulent methods take advantage of herd mentality and celebrity effects, and the ultimate goal is to steal user assets or private data.

Countermeasures: Don’t just rely on social media comments to determine whether an airdrop is legitimate. You should thoroughly research the background of the token, verify whether it is listed on a well-known platform, and obtain real user comments through forums such as Reddit or credible crypto project Discord groups. Real high-quality projects will establish a transparent community ecosystem, rather than relying on false hype to create popularity.

7. Unknown or non-existent token projects

Warning: Some fake airdrops are advertised to be tied to unknown or non-existent projects that often lack white papers, roadmaps, official websites, or verifiable team information. Scammers use these fake tokens to trick users into connecting to digital wallets or authorizing transactions, ultimately stealing user funds.

Countermeasures: Before participating in an airdrop, be sure to conduct in-depth research on the token. Check the project white paper, official website, team qualifications, and community activity. If the project lacks basic information, or has been established for too short a time and lacks a credible background, it is likely to be a fraudulent project.

8. Token authorization trap

Warning: Some fake airdrops will trick users into connecting their wallets and granting token transfer permissions. These seemingly harmless "authorization" actions may allow scammers to freely transfer or steal tokens through the permissions they have obtained without any further action from the user.

Countermeasures: Be vigilant when approving token transactions (especially those involving unknown sources), avoid authorizing smart contract operations on untrusted websites, and regularly use tools such as Revoke Cash to verify and revoke unnecessary token authorization permissions.

9. Redirection trap of wallet stealer

Warning: Some fake airdrop links will lead users to a malicious Dapp called "Wallet Stealer". These websites are carefully designed to mimic the regular claiming page, but when the user connects to the wallet, the malicious smart contract will be executed. Once the user clicks "Catch the Airdrop", the user will unknowingly sign the transaction authorization, resulting in the attacker gaining the right to transfer all the user's funds.

Countermeasures: Be sure to check the transaction pop-up carefully before signing. It is recommended to use a browser wallet with built-in anti-phishing protection (such as MetaMask) and keep abreast of known fraud domain names. If the website displays unfamiliar information or triggers unexpected authorization requests, please disconnect the wallet immediately.

10. Unrealistic Reward Promises

Warning: Fake airdrops often attract users with unrealistic promises, such as "Get $2,000 worth of free tokens immediately without paying anything." Such scams take advantage of people's greed and curiosity, tricking users into connecting digital wallets or signing transactions without careful verification.

Countermeasure: Be wary of overly exaggerated reward promises. Real airdrops usually offer modest rewards and set certain eligibility requirements. If an airdrop opportunity looks too good to be true, it is likely a scam.

Cool fact: In 2021, Ethereum Domain Name Service ENS airdropped governance tokens to everyone who registered a .eth domain name. Many ENS holders received thousands of dollars worth of tokens simply for owning a crypto domain name.

The case of fake airdrops

Here are some well-known examples of fake airdrops to help you understand how these scams work to defraud unsuspecting victims:

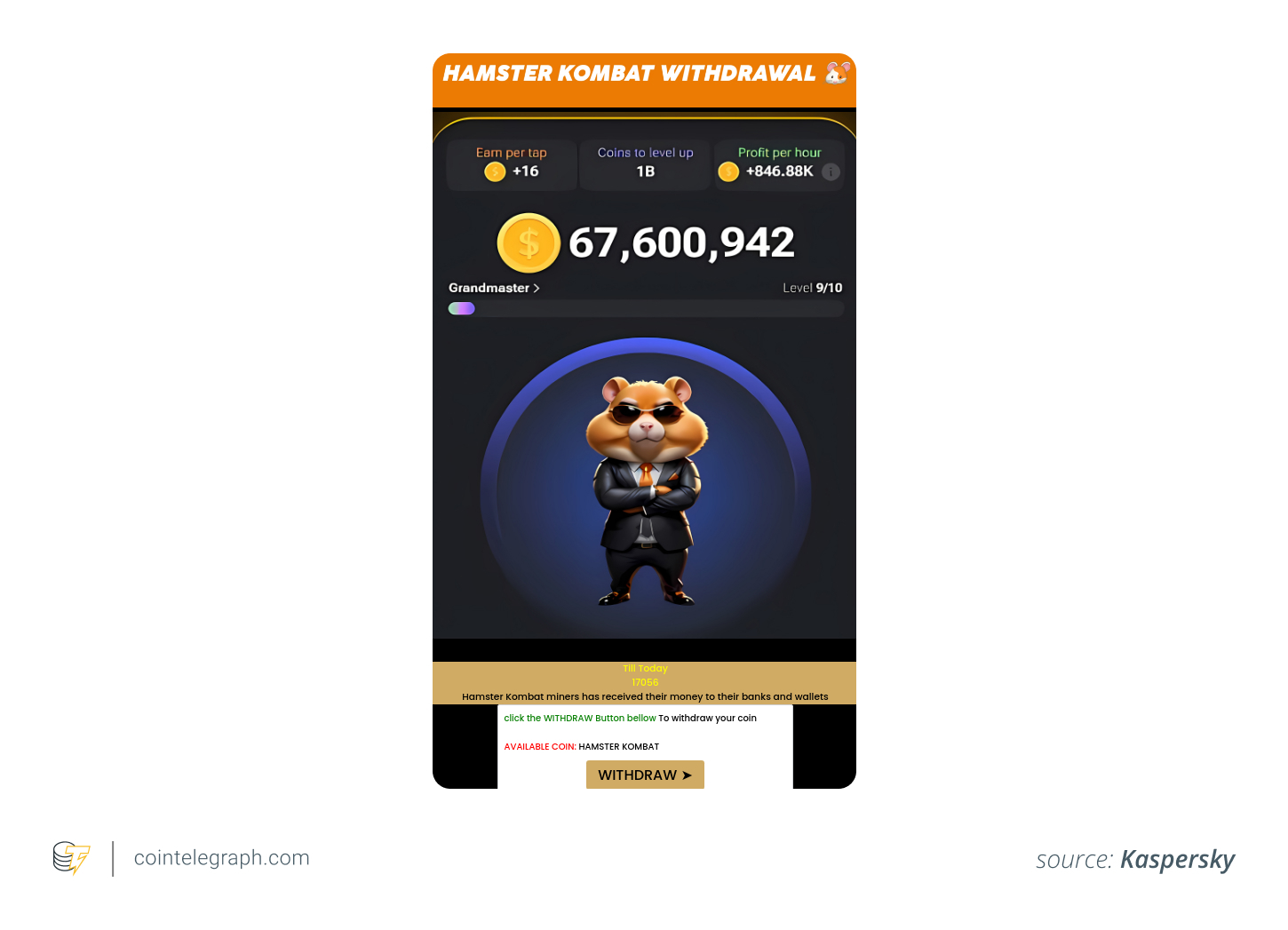

Hamster Kombat

Hamster Kombat is a point-to-point earning game based on the Telegram platform. Players play the role of hamster CEOs to manage virtual crypto exchanges. By clicking, completing daily tasks and upgrading, players can earn HMSTR tokens, which can be exchanged for tradable trading tokens. The game quickly attracted more than 250 million users after it was launched in March 2024, but the subsequent scams targeting players have raised security concerns.

Scammers are targeting Hamster Kombat, attempting to cash in on the viral popularity of the point-and-earn game. Kaspersky recently warned users to beware of fake Hamster Kombat airdrops, which are phishing scams designed to steal victims’ crypto wallet login credentials.

Wall Street Pepe

Wall Street Pepe ($WEPE) is a Meme coin based on Ethereum, which cleverly combines online Meme culture with practical trading functions. The idea of this token comes from the combination of classic Pepe and Wall Street financial transactions, and is committed to providing three core values for small traders: unique market insights, professional strategy analysis tools, and a community ecology of mutual growth.

The $WEPE airdrop scam imitated the official website of a legitimate token and used the promise of airdrop as bait to lure users to connect their wallets. Users unknowingly signed malicious contracts, which ultimately led to the theft of assets.

HEX

HEX is a token built on Ethereum that aims to help users profit from the growth of the crypto market through a system that supports token locking and periodic staking.

This fraudulent webpage imitates the official HEX website. The airdrop event on it is fake and has no connection with the real HEX project or any other formal plan. When users connect their cryptocurrency wallets to this fake website, it triggers the activation of malicious contracts, allowing cryptocurrency stealers to steal funds from the wallet.

Sui

Sui is a layer-one blockchain and smart contract platform designed for speed, privacy, and accessibility, with a unique object-centric data model as its core feature.

When users check for airdrop qualifications on the fraudulent webpage posted by the scammers, they are prompted to link a digital wallet. This action unknowingly signs the user into a malicious contract, activating a cryptocurrency stealer. The victim’s funds are then automatically transferred to a wallet controlled by the scammers in a seamless, unauthorized transaction.

LayerZero

LayerZero's airdrop uses an innovative "proof of donation" claiming mechanism. Unlike typical airdrops that directly distribute tokens for free, LayerZero requires users to donate $0.10 per ZRO token to the Protocol Guild, which supports Ethereum core developers.

In July 2023, security company CertiK warned users to be wary of fake airdrop campaigns promoted by accounts impersonating Layer Zero on the X platform. When users click on the relevant link, they will be directed to a phishing website impersonating the official LayerZero website.

How crypto airdrops evolved from free distribution to secure community rewards

Crypto airdrops are moving beyond simple token giveaways and are beginning to adopt more advanced and secure strategies to attract user participation. Today, more and more projects are launching airdrop mechanisms based on user behavior, rewarding users for contributions such as staking assets, testing applications, or participating in governance decisions. This shift aims to foster real community participation while effectively curbing speculative behavior based on pure arbitrage.

New token distribution models are gaining attention, such as snapshot-based token allocation and retroactive reward mechanisms. These innovative approaches ensure that tokens reach contributors who actively participate in community building by enhancing transparency. At the same time, the deep integration of artificial intelligence and machine learning technologies can effectively identify fake accounts, robot programs, and fraudulent behaviors, significantly improve the security level of airdrop activities, and make the token distribution system more resistant to manipulation and more credible.

This shift reflects the evolution of responsible and efficient token distribution practices that are aligned with the goals of decentralization and community empowerment.

محتوای پیشنهادی

Listed company Everything Blockchain plans to invest $10 million in SOL, XRP, SUI, TAO and HYPE

Swiss Franc: Navigating Global Headwinds – UBS Updates GBP/CHF Outlook