Are Paid Trading Courses Worth It? I Bought 3 to Find Out

Image

I’ve seen them everywhere — ads claiming you can become a “crypto millionaire” or “beat the market in 30 days” if you just enroll in the right trading course. From YouTube pre-rolls to Instagram stories, the promise is always the same: “Learn our proven system, follow our steps, and watch your account grow.”

I’ll admit, I’ve been skeptical. Most of these courses promise more than they deliver. But part of me wondered: maybe some of them actually provide real value.

So, I decided to put my money where my mouth is. I bought three paid trading courses, ranging from beginner to advanced, and spent weeks going through them. The goal? To figure out if paid courses are worth it — or just another way to empty your wallet.

Here’s what I learned, lesson by lesson, and course by course.

Why I Decided to Buy Trading Courses

I’ve been trading crypto for years. I’ve made money, I’ve lost money, and I’ve watched friends fall into every common trap. But despite all my experience, there’s always that nagging feeling: What if I’m missing something crucial? What if there’s a shortcut I haven’t discovered yet?

Buying courses was a way to test three things:

- Content Quality — Are the lessons actually informative, or just hype and fluff?

- Practical Application — Can I use the strategies in real trading, or do they stay theoretical?

- Value for Money — Do the lessons justify the price, or am I paying for the marketing alone?

I also wanted to see whether beginner courses and advanced ones offered distinct advantages — or if the material overlapped so much that it didn’t matter which one you picked.

The Courses I Bought

I chose three different courses to get a wide perspective:

Course 1 — Beginner Crypto Trading Fundamentals ($99)

- Promises: Teach you the basics of crypto trading, chart reading, and common mistakes to avoid.

- Format: 10 hours of video lessons, plus a PDF workbook.

Course 2 — Intermediate Strategy & Risk Management ($199)

- Promises: Show how to manage risk, set stop-losses, and trade swings and breakouts.

- Format: 15 hours of video tutorials, downloadable indicators, and a private Telegram group.

Course 3 — Advanced Professional Trading System ($499)

- Promises: Teach proprietary systems, AI-assisted tools, and trading psychology for high performance.

- Format: 20+ hours of video, live webinars, private Discord channel with instructors, and access to trading signals.

Course 1 — Beginner Crypto Trading Fundamentals

I started with the basics. Honestly, the course wasn’t life-changing, but it wasn’t terrible either.

What Worked:

- Clear explanations of common terms like candlesticks, support/resistance, and trend lines.

- A structured approach for setting up exchanges, wallets, and accounts safely.

- Emphasis on risk management for newbies (e.g., “Never risk more than 1–2% of your account on a single trade”).

What Fell Short:

- Very little real trading strategy. Most lessons were about theory, with charts showing what could happen, not what actually happened.

- The examples were mostly Bitcoin charts, leaving altcoins and DeFi assets barely covered.

Verdict: Good for absolute beginners, especially those who need a structured foundation. If you already understand charts and risk basics, it’s largely redundant.

Course 2 — Intermediate Strategy & Risk Management

Next, I jumped into the mid-tier course. This one promised to move beyond theory and into actionable strategies.

What Worked:

- Practical setups for swing trades and breakout entries.

- Several risk management frameworks I hadn’t considered, including tiered stop-losses and scaling in/out of positions.

- Some bonus modules on trader psychology and avoiding FOMO.

What Fell Short:

- Some lessons felt repetitive; parts of the beginner course were recycled.

- Signals and indicators included were useful, but a few were outdated or poorly explained.

Verdict: Worth it if you want structured risk management strategies and concrete trade setups. The Telegram group helped, but the quality of discussions varied, and sometimes I questioned the advice from other members.

Course 3 — Advanced Professional Trading System

The big investment. I had high hopes for this one, and I was ready to see if it could genuinely give me an edge.

What Worked:

- Proprietary systems were genuinely interesting, particularly the AI-assisted tools for trade signals.

- Live webinars with instructors allowed me to ask questions in real time — something I found very valuable.

- Trading psychology modules were deep and actionable, focusing on real-world scenarios where emotions ruin decisions.

What Fell Short:

- Some of the proprietary strategies were complex and required significant time to implement. It wasn’t a plug-and-play system.

- The course was heavy on selling add-ons, like private mentorships or extra indicator packs.

- Not every strategy worked equally well in all market conditions; some were clearly optimized for bull markets.

Verdict: A mixed bag. Definitely the most valuable for serious traders, but the price is high and success depends heavily on your ability to implement the strategies consistently.

Key Lessons Across All Three Courses

After going through all three, several insights became clear:

- Paid courses are only worth it if you implement the strategies. Watching videos isn’t enough. You need to take notes, practice, and make real trades to see results.

- Beginner courses are cheap insurance. They’re worth the money if you’re just starting, but if you’ve been trading for a while, you’ll learn very little new.

- Intermediate courses bridge the gap. They teach risk management and practical setups, which can actually improve your win rate and reduce emotional losses.

- Advanced courses can pay off — but only for disciplined traders. If you’re not willing to put in time and effort, even the best systems won’t help.

- Marketing is everywhere. Every course, even the best one, had upselling and hype. You have to separate the actual educational value from the sales pitch.

How My Trades Changed After Taking the Courses

Before taking these courses, my strategy was… messy. I relied heavily on intuition, FOMO trades, and inconsistent risk management. After implementing lessons from the courses:

- My stop-loss discipline improved drastically. No more holding losers too long.

- I scaled in and out of positions more effectively, protecting profits.

- I became more patient; I no longer chased every pump or panic-sold during dips.

- My portfolio volatility decreased — while total gains didn’t skyrocket, my drawdowns were smaller, which matters more for long-term survival.

Are Paid Trading Courses Worth It?

Here’s the reality: it depends on your goals, experience, and commitment.

- Absolute beginners can benefit greatly from structured, foundational courses. They save you years of trial and error.

- Intermediate traders can use paid courses to improve risk management and learn actionable strategies. This is where you see the most ROI if you follow the lessons consistently.

- Advanced traders might find high-end courses helpful for refinement, psychology, or exposure to new tools — but you need discipline and focus to make it worthwhile.

One week of casual watching won’t make anyone rich. Paid courses are not shortcuts; they’re accelerators — if you’re willing to put in the work.

Final Thoughts

After buying and completing three courses, here’s my takeaway:

- Not all courses are scams. Some provide real education and actionable strategies.

- Implementation is everything. Without practicing what you learn, the content is useless.

- Expect upsells and marketing. Ignore the hype, focus on lessons that improve your trading skills.

- Time and patience are key. Courses don’t replace experience — they condense it.

In the end, I’m glad I invested. I walked away with better discipline, smarter trade management, and a deeper understanding of trading psychology. But the truth is simple: no course will make you rich overnight. The real gains come from applying the lessons consistently over time.

Are Paid Trading Courses Worth It? I Bought 3 to Find Out was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

محتوای پیشنهادی

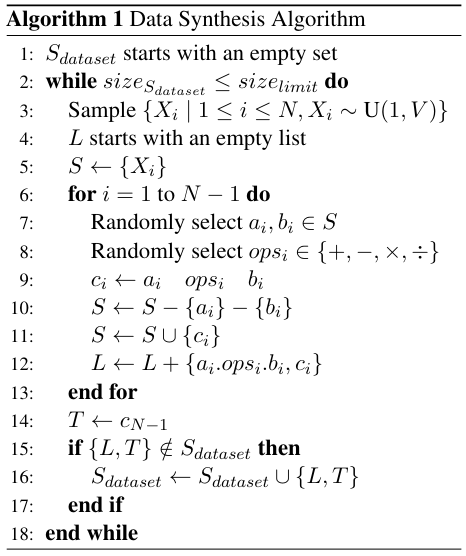

A Framework for Synthesizing Arithmetical Puzzle Datasets for Large Language Models

PA Daily | Moonshot launches New XAI gork ($gork); analysis shows that Trump’s crypto assets account for about 40% of his total assets