February blockchain game report: Daily activity decreased by 16%, but user stickiness was strong, and blockchain game investment increased by 243% month-on-month

Author:Dappradar

Compiled by: Felix, PANews

The global economy is going through turbulent times, with various macroeconomic challenges causing financial markets to take a hit. Investors are dealing with uncertainty, and traditional industries are experiencing greater volatility. Despite the economic downturn, blockchain gaming continues to grow.

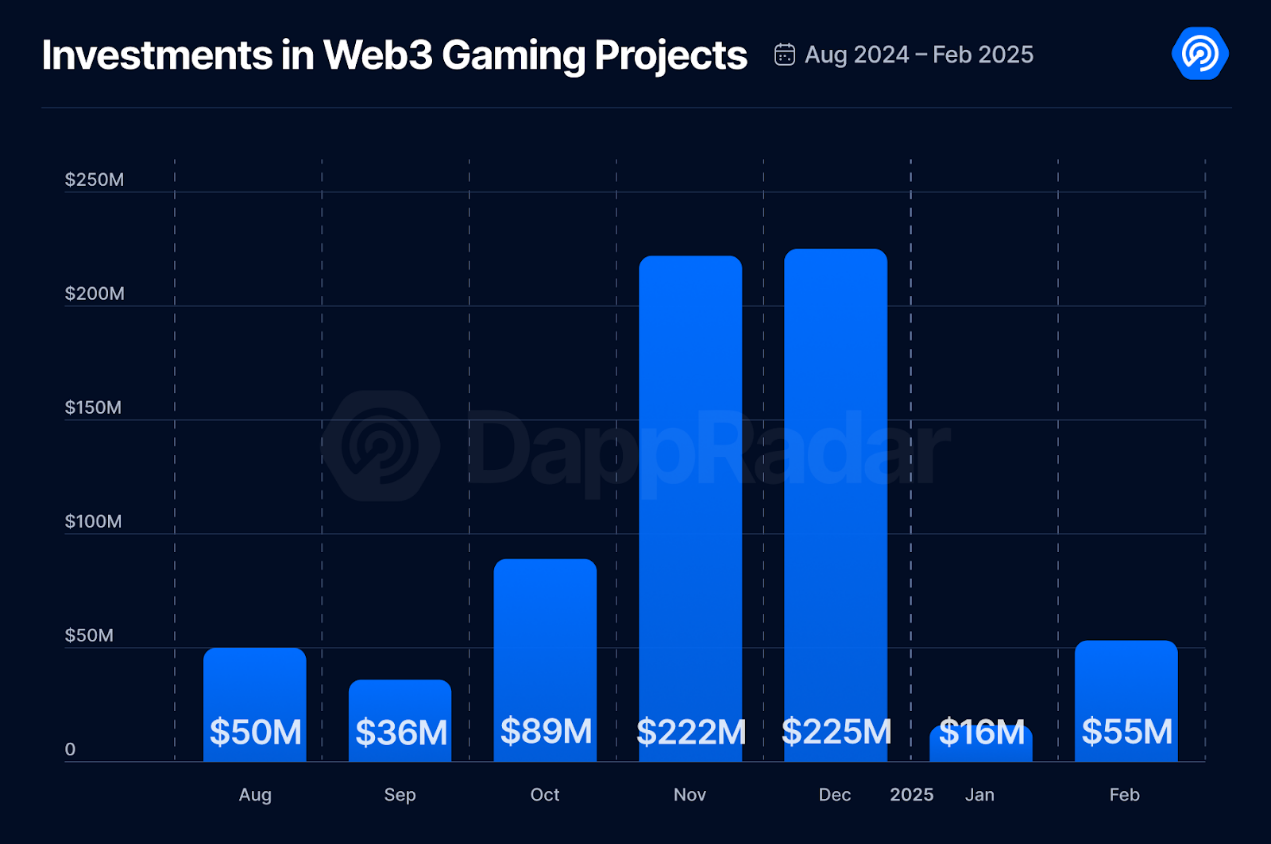

Although the number of daily active users declined slightly in February, user stickiness remains strong, proving that Web3 games are more resilient than ever. Although the overall market conditions have diverted investors' attention, the gaming industry still attracts a lot of funds, with $55 million in investment in February alone. This shows that the long-term development potential of blockchain games cannot be shaken.

Key Takeaways

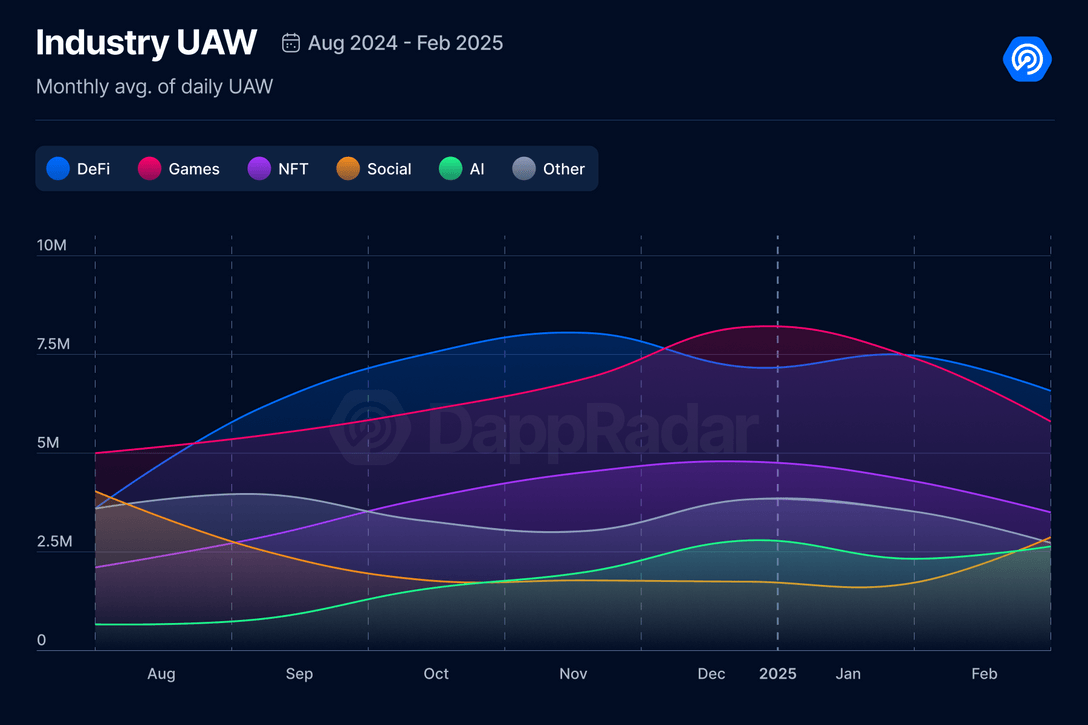

- Daily unique active wallets (dUAW) fell 16% to 5.8 million in February, reflecting broader market challenges, but user stickiness remains strong.

- opBNB and Aptos maintained their lead in gaming activity, while Soneium and Abstract continued to grow in traction, with activity increasing by more than 20,000%.

- The trading volume of gaming NFTs reached US$41 million, of which ImmutableX processed 72% of the transactions.

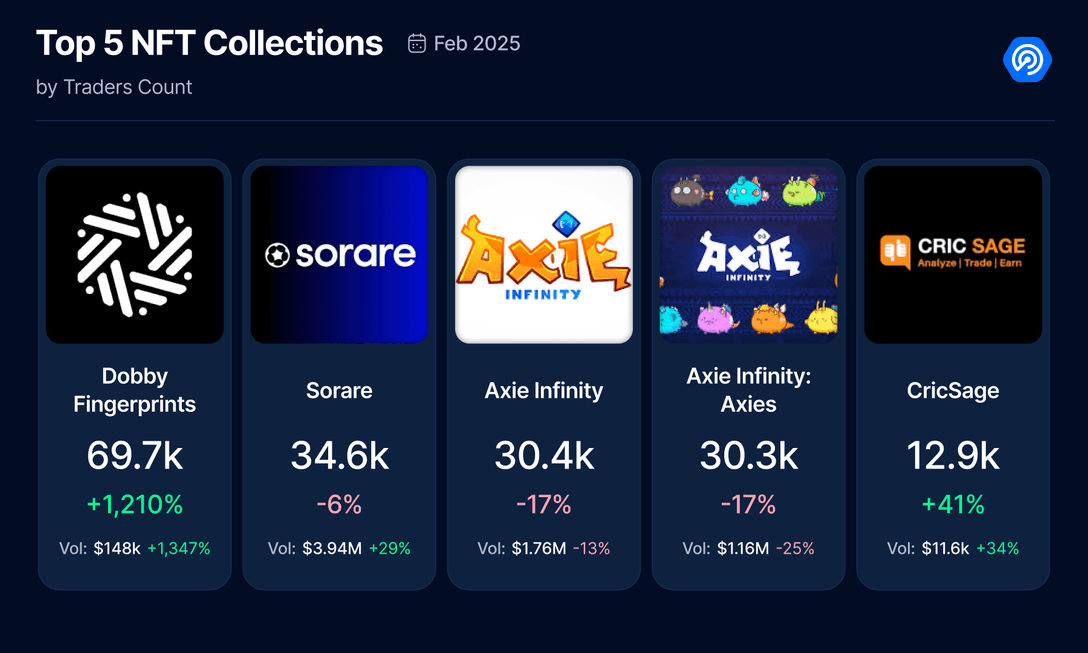

- Sports NFTs led in terms of transaction volume, recording 659,097 transactions and $7.7 million in volume, driven by Sorare and CricSage.

- Blockchain gaming investments surged to $55 million, up 243% from January, with infrastructure accounting for 92% of all investments.

1. Overview

In February, blockchain gaming experienced a significant cooling, reflecting broader market challenges. Daily unique active wallets (dUAW) fell 16% compared to January to approximately 5.8 million.

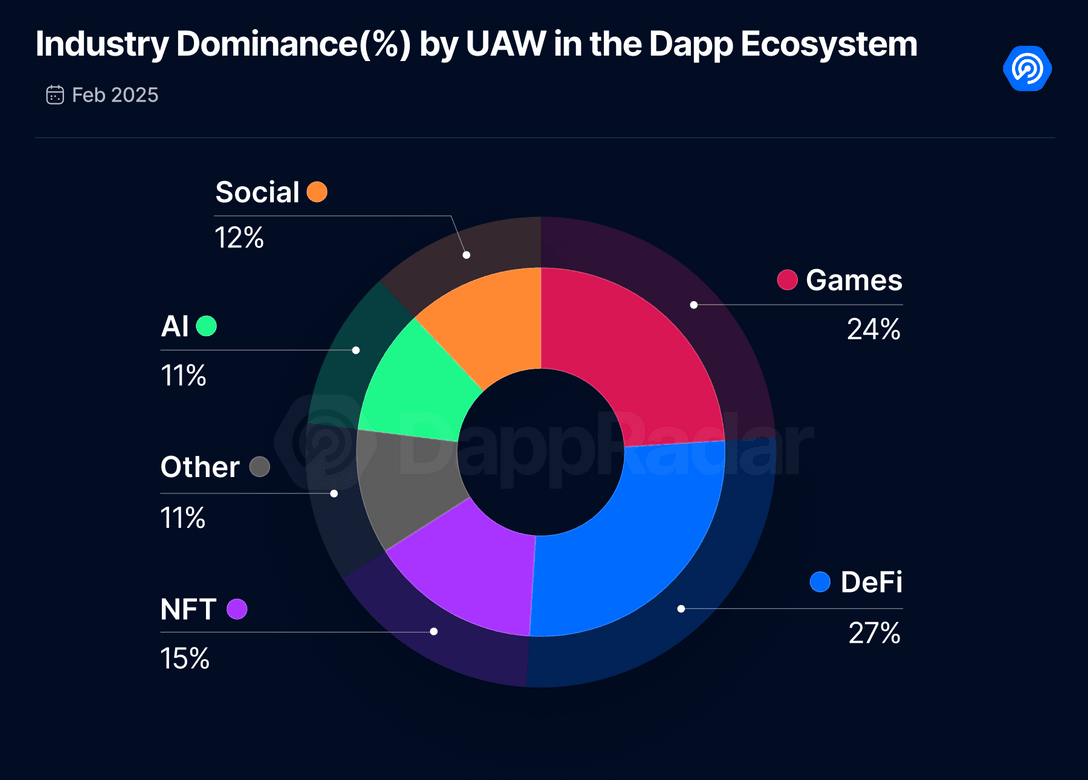

While blockchain games have historically held a certain market position, the economic situation has shifted investors’ attention back to DeFi, which has now become the dominant narrative as market uncertainty causes traders to exit their positions.

However, there are some uncertainties in the future. As highlighted in the February Dapp Industry Report , the AI sector continues to gain significant traction, with some AI-focused Dapps seeing activity grow by over 900%. The growing importance of AI is particularly evident in blockchain games, where its use in gameplay and infrastructure is becoming more common.

Some blockchain gaming projects are actively integrating AI:

- Ruyui: This upcoming on-chain virtual avatar project is being developed by Ruyui Studios and will be launched on Abstract in early 2025. Ruyui combines animation, gaming, and blockchain technologies, using AI to enable dynamic character interactions and personalized experiences, and is designed for both blockchain enthusiasts and mainstream audiences.

- InZOI: Krafton’s upcoming life simulation game featuring AI-driven characters is scheduled to release in Early Access on Windows on March 28 of this year. This innovation will allow non-player characters (NPCs) to interact realistically, creating an immersive experience.

- The Game Company: In partnership with Fetch.ai, The Game Company integrated the Web3 native AI model ASI-1 Mini, using decentralized AI technology to enhance the gaming experience through intelligent real-time interactions.

The above games are just examples of many projects that are actively using AI to enhance blockchain games.

The best performing gaming blockchain

opBNB maintains its leading position, followed closely by the rapidly rising Aptos.

Most other chains in the rankings remained stable. However, significant increases in monthly activity were observed for the following chains:

- Abstract: Recently launched, Abstract is seeing steady growth in activity, driven primarily by the gaming dapp Treasure Ship.

- Soneium: Soneium was launched by Sony Block Solutions Labs in January 2025 and quickly gained traction, especially through Evermoon, a game that quickly became one of the main growth drivers for blockchain.

- Avalanche C-Chain: Although Paradise Tycoon is not very well-known, it always contributes to Avalanche's gaming activities.

2. Outstanding Games

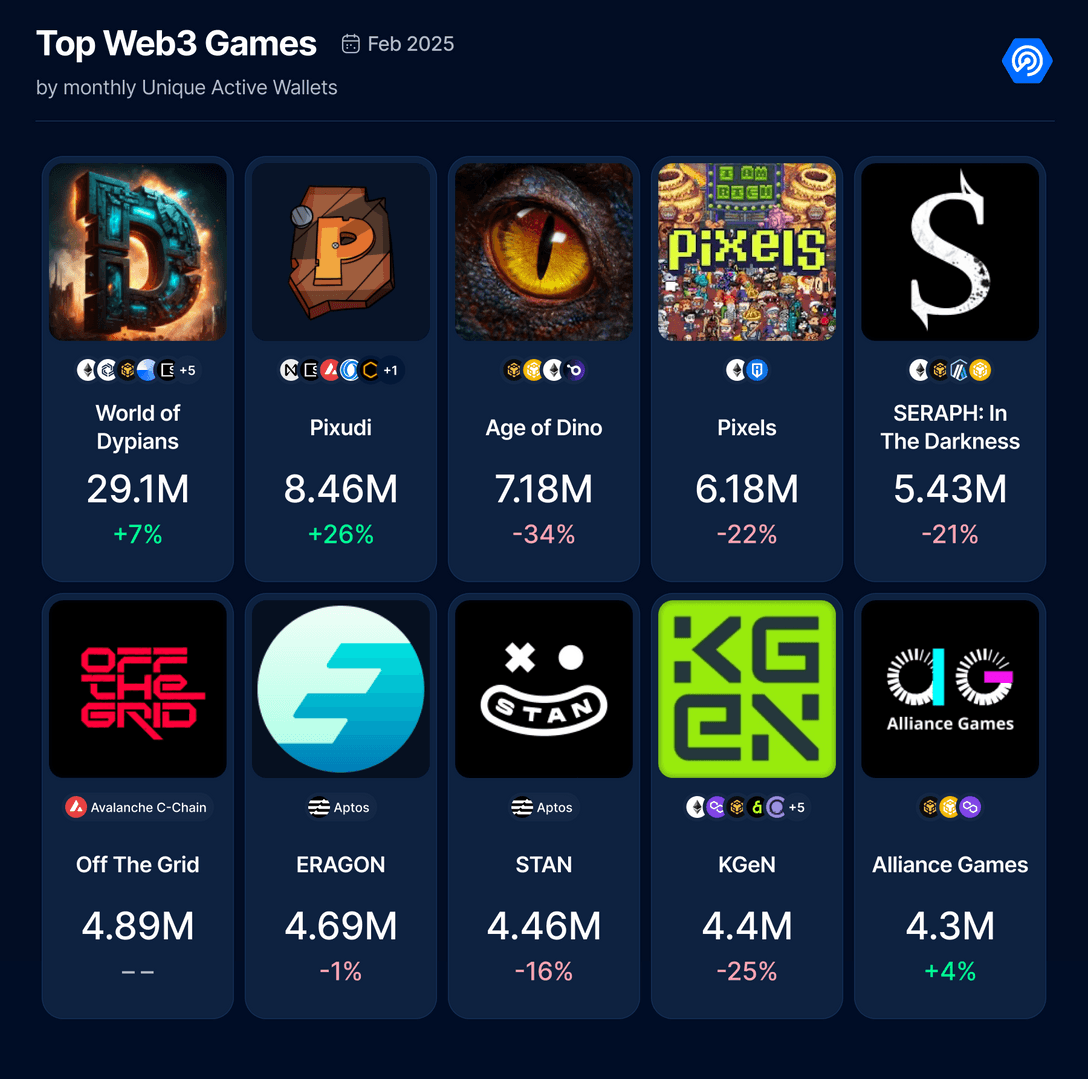

The gaming dapps space saw notable changes in February, with new entrants entering the top 10 list and existing projects continuing to thrive.

World of Dypians continues to lead the pack. Pixudi also grew significantly, helped by its recently announced partnership with Immutable. This move enables Pixudi to provide its community with a smoother gaming experience, advanced blockchain integration, and enhanced asset ownership.

Age of Dino made waves in early March with the release of 10,000 Ways for Dinosaurs to Die, an AI-driven game that will introduce dynamic and unpredictable events such as volcanic eruptions, meteor strikes, and extreme weather to ensure that every game is driven by AI mechanics.

SERAPH: In The Darkness officially launched Season 2 with improved combat mechanics and a redesigned in-game economy. This season’s prize pool is 50 BNB and 6.1 million SERAPH tokens, which is expected to raise the level of competition and attract more players.

With a stable user base, Off The Grid galvanized the community by announcing the “OTG IRL Championship” at the HyperX Arena in Las Vegas. The event brought together 60 creators to compete for $2,000 in prize money and was live-streamed on Twitch. In addition, an update was launched in March, including gameplay enhancements and a new playable area.

STAN also made the list, branding itself as a companion gaming platform focused on community interaction, connecting gamers with content creators through shared interests, friendship, and rewarding experiences.

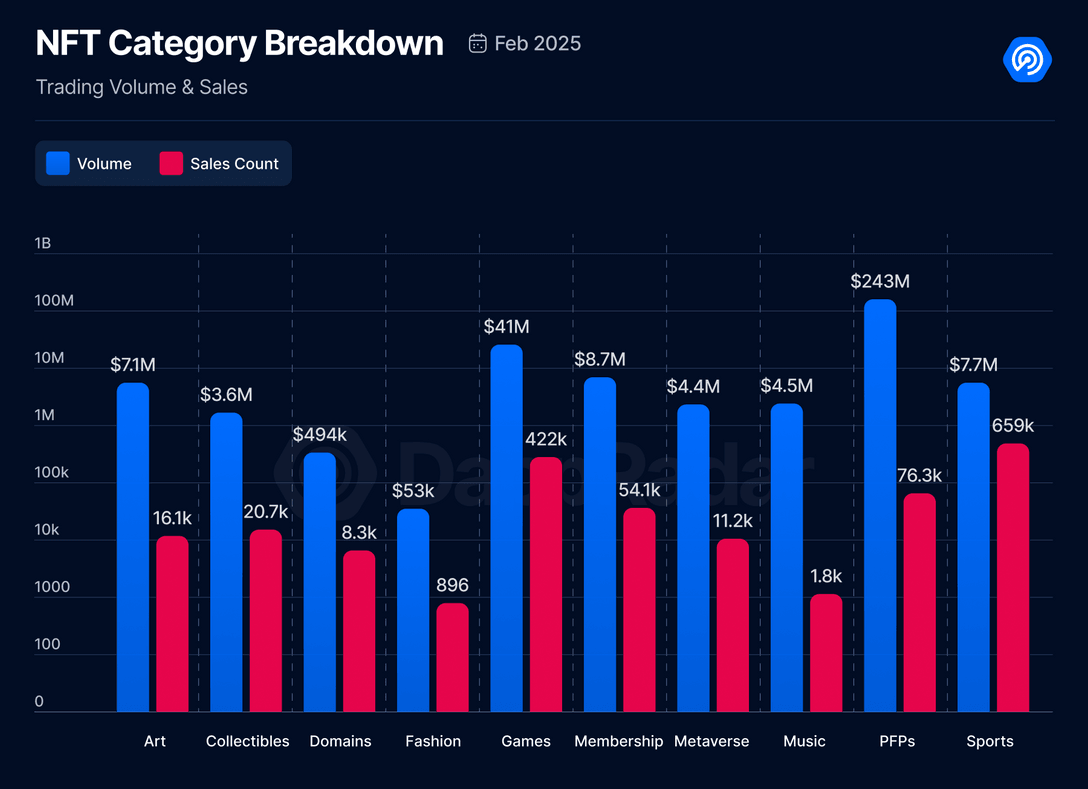

3. Gaming and sports NFTs lead market activity

In February, gaming and sports-related NFTs stood out in terms of trading activity. While avatar (PFP) NFTs generally dominate, gaming NFTs ranked second in trading volume with $41 million and 421,853 assets traded. ImmutableX played a central role, processing 72% of transactions. Series such as Guild of Guardians and Gods Unchained continue to drive a lot of trading activity, reflecting their enduring appeal in the gaming community.

Sports NFTs took the spotlight with the number of transactions, recording 659,097 transactions with a total transaction value of $7.7 million. Starkware facilitated 98% of the transactions. Series products such as Sorare and CricSage led this category, attracting a large number of traders.

The growing popularity of sports NFTs highlights the growing market interest in sports-related digital collectibles. This trend is driven by fans seeking more engaging, exclusive digital memorabilia and personalized interactions with their favorite athletes and teams. In addition, collaborations between sports organizations and blockchain platforms make NFTs easier to access and trade.

4. Blockchain game investment climbs to $ 55 million

In February, blockchain gaming investment recovered significantly, reaching a total of $55 million, up 243% from January. Infrastructure accounted for 92% of all investment, indicating that investors are optimistic about the long-term potential of blockchain gaming.

This month's key investments include:

- Marblex, the blockchain gaming division of South Korean gaming giant Netmarble, has reached a cooperation with Immutable to migrate Marblex's ecosystem and games to Immutable zkEVM. The two parties will launch an "ecosystem promotion plan" to provide developers with up to $20 million in support.

- Beamable has attracted $13.5 million in new funding to further develop its decentralized backend infrastructure for online games. The move represents a major shift away from the industry’s reliance on centralized data centers operated by tech giants. Beamable also plans to launch a blockchain token through the Beamable Foundation and open source its technology to give developers more control over their gaming infrastructure.

- Dubai-based gaming startup The Game Company (TCG) has raised $10 million through equity and token sales to advance its blockchain-enabled cloud gaming platform. TCG’s patented low-latency technology allows gamers to access and enjoy games anytime, anywhere, on any device, significantly improving the global gaming experience.

Overall, February’s investment landscape highlights growing confidence in blockchain gaming infrastructure, paving the way for adoption and innovation in 2025.

5. Conclusion

Despite the overall market downturn, blockchain games continue to grow, proving their resilience in uncertain times. While user activity has declined slightly, engagement remains stable, investor confidence is stronger than ever, and funding has increased significantly. Innovations in AI-driven gaming, NFT adoption, and infrastructure development are shaping the future of the industry, enhancing the long-term potential of blockchain games.

Related reading: February Dapp Report: User activity cools down, AI-related projects grow fastest

محتوای پیشنهادی

Next Ethereum memecoin to hit $1: Shiba Inu vs Little Pepe

Fourth Paradigm: Establishing a joint venture based on key opportunities and needs in the development of the stablecoin market