Franklin Templeton brings BENJI platform to VeChain for tokenized treasury access

Franklin Templeton is in the process of integrating its BENJI platform with VeChain, enabling users to access tokenized U.S. Treasury bills through its blockchain.

- Franklin Templeton is integrating its BENJI platform with VeChain.

- The integration allows users to buy and hold tokenized U.S. Treasury bills on VeChain.

- BENJI provides access to the Franklin OnChain U.S. Government Money Fund (FOBXX), a regulated fund backed by U.S. government securities, cash, and repurchase agreements.

- BitGo and Keyrock will support the integration by providing regulated custody and liquidity services.

- The FOBXX fund holds $780 million in assets and is already available on 8 other chains.

- The fund competes with other tokenized money market products like BlackRock’s BUIDL and Ondo’s OUSG.

Franklin Templeton is expanding its footprint in the tokenized finance sector by integrating its BENJI platform with VeChain, a layer-1 blockchain, known for its dual-tokenomics model. The VeChain integration will enable users worldwide to purchase and hold tokenized US Treasury bills on the blockchain, while providing regulated custody and liquidity support through BitGo and Keyrock.

For context, the BENJI platform provides tokenized access to the Franklin OnChain U.S. Government Money Fund (FOBXX), a regulated U.S. money market fund backed primarily by government securities, cash, and repurchase agreements, fully recorded and transferrable on-chain. Each BENJI token represents a share in the fund, which aims to maintain a stable $1 value.

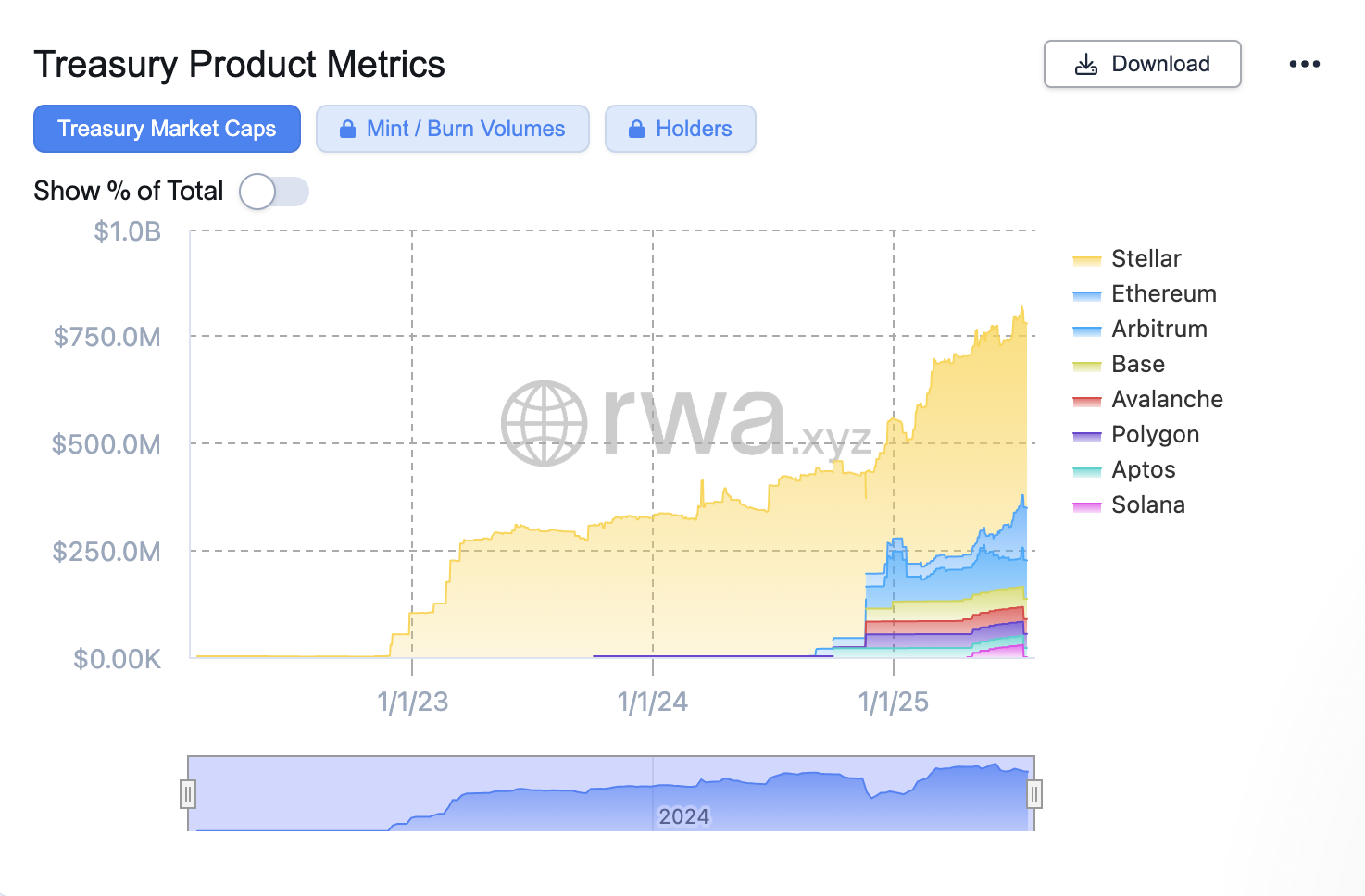

FOBXX fund’s current blockchain presence

The FOBXX fund, which currently holds $780 million, is already available across several other blockchain networks, including Stellar, Ethereum, Solana, Arbitrum, Avalanche, Polygon, Base, and Aptos. Among these, Stellar currently holds the largest portion of BENJI’s market cap at over $430 million.

The FOBXX fund directly competes with other tokenized money market products, most notably the BlackRock’s BUIDL fund and Ondo Short-Term U.S. Government Treasuries Fund (OUSG), which recently expanded to XRP Ledger.

You May Also Like

DOJ Alum Kevin Muhlendorf Tapped To Police SEC As Inspector General Ahead of Trump’s Crypto Shift

Senator Warren: Crypto lobbying has a detrimental effect on politics