Galaxy earns $30.7m in Q2 as Bitcoin holdings, AI strategy expand

Galaxy Digital is once again in the black, largely due to appreciation of its crypto holdings.

- Galaxy Digital reported $30.7 million in profits

- The company acquired 4,272 bitcoins in 2025

- Its Bitcoin holdings are now worth $48 million

After a brutal Q1 loss of $295 million, Galaxy Digital is once again turning a profit. On Tuesday, August 5, the digital assets firm founded by Mike Novogratz announced its quarterly earnings results.

During the second quarter of 2025, Galaxy Digital reported $30.7 million in profits and $0.08 in earnings per share. The company’s adjusted earnings before interest, taxes, depreciation, and amortization rose to $211 million.

July was the strongest month in terms of financial performance since the firm went public on the Nasdaq on May 16. The firm saw record results in the Global Markets segment, along with strong growth in asset management and infrastructure.

Later in the quarter, Galaxy also completed a sale of over 80,000 Bitcoin for a client—one of the largest crypto transactions in history.

Galaxy Digital earnings rise on crypto appreciation

Galaxy Digital’s adjusted EBITDA was primarily driven by the appreciation of its digital asset holdings and venture capital investments. The company also acquired 4,272 bitcoins in the second quarter, putting its Bitcoin reserves at $48 million.

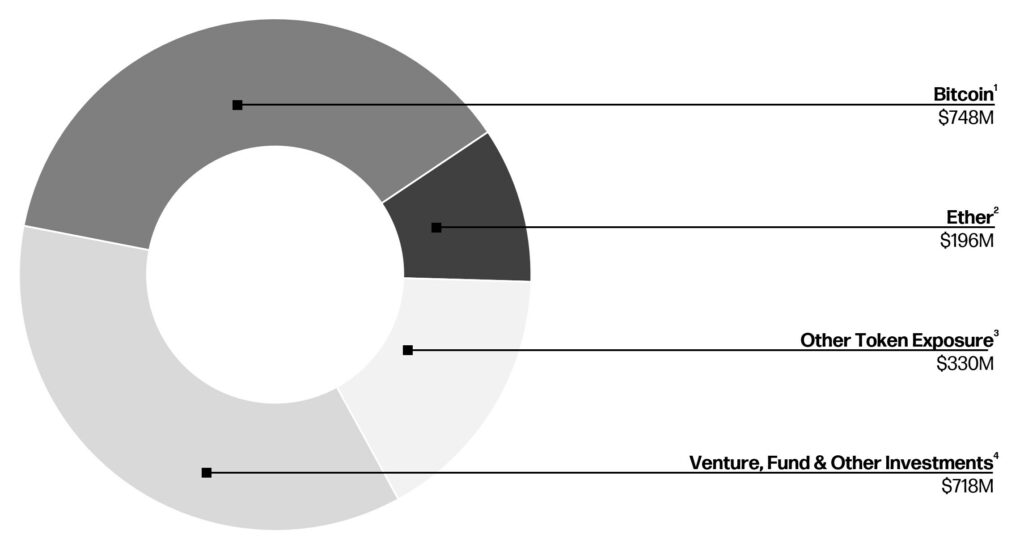

Galaxy Digital reported total holdings of $2.6 billion, primarily in Bitcoin (BTC), Ethereum (ETH), and venture investments. The company also holds $1.2 million in stablecoins and cash reserves.

Still, this appreciation is not Galaxy’s only focus. The firm is expanding its data center business to offer computing power for artificial intelligence. It acquired 160 acres of land to expand its Helios data center, following a deal with CoreWeave for additional output.

محتوای پیشنهادی

CryptoQuant analysis: Bitcoin's current pullback is within the normal fluctuation range

A Web3 team claiming to be from Ukraine lured members to clone malicious code under the pretext of an interview.