Grayscale Files with SEC to Launch AVAX Trust ETF on Nasdaq

Highlights:

- Grayscale has filed with the SEC to convert its Avalanche Trust to an ETF.

- The asset manager wants its ETF to trade on Nasdaq to attract more investors to Avalanche’s ecosystem.

- Grayscale plans to issue and redeem shares in large blocks.

According to a new Securities and Exchange Commission (SEC) S-1 filing, asset manager Grayscale is planning to launch an Avalanche (AVAX) Exchange Traded Fund (ETF) on Nasdaq. The planned move involves converting Grayscale’s existing Avalanche Trust to an ETF under the market ticker AVAX.

Like many ETFs, it allows investors to gain exposure to AVAX without directly holding the asset. Notably, each share’s value will represent a portion of AVAX tokens held by the Trust, excluding expenses. Overall, the product aims to provide cost-effective investment options with minimal risks. In addition, it will attract more investors to the growing Avalanche ecosystem.

Grayscale stated:

Shares Issuance and Redemption Exercises

The asset manager stated that it will issue and redeem shares in large blocks, called “Baskets.” Also, authorised financial firms will serve as intermediaries for the operations. For now, Grayscale will handle creation and redemption operations in cash through a third-party platform that buys and sells AVAX. However, should regulators approve in-kind creation and redemption directly in AVAX, Grayscale could adopt such options in the future.

Companies Involved in Grayscale’s AVAX ETF Operations

The ETF sponsor will be Grayscale Investments. Notably, the asset manager plans to use The Bank of New York Mellon as the ETF transfer agent and administrator. On its part, Coinbase will handle AVAX storage and trade as the ETF’s custodian and prime broker.

The investment manager also noted that the ETF is not registered under the Investment Company Act, eliminating the Commodity Futures Trading Commission (CFTC) control. The filing outlines risks, which investors must review to make informed investment decisions.

Grayscale stated:

Investment Firms Show Growing Interest in Altcoin ETFs

After converting its Bitcoin (BTC) and Ethereum (ETH) Trusts to ETFs last year, Grayscale has sought means to diversify its ETF products by filing for many other altcoin ETFs. These include Ripple’s XRP, Solana (SOL), Polkadot (DOT), Dogecoin (DOGE), Litecoin (LTC), Cardano (ADA), etc. In March 2025, VanEck filed an S-1 application for the AVAX ETF, underscoring growing interest in the asset. However, the SEC has postponed its final decisions on most ETF applications to October 2025, eliminating the possibility of any imminent ETF approval.

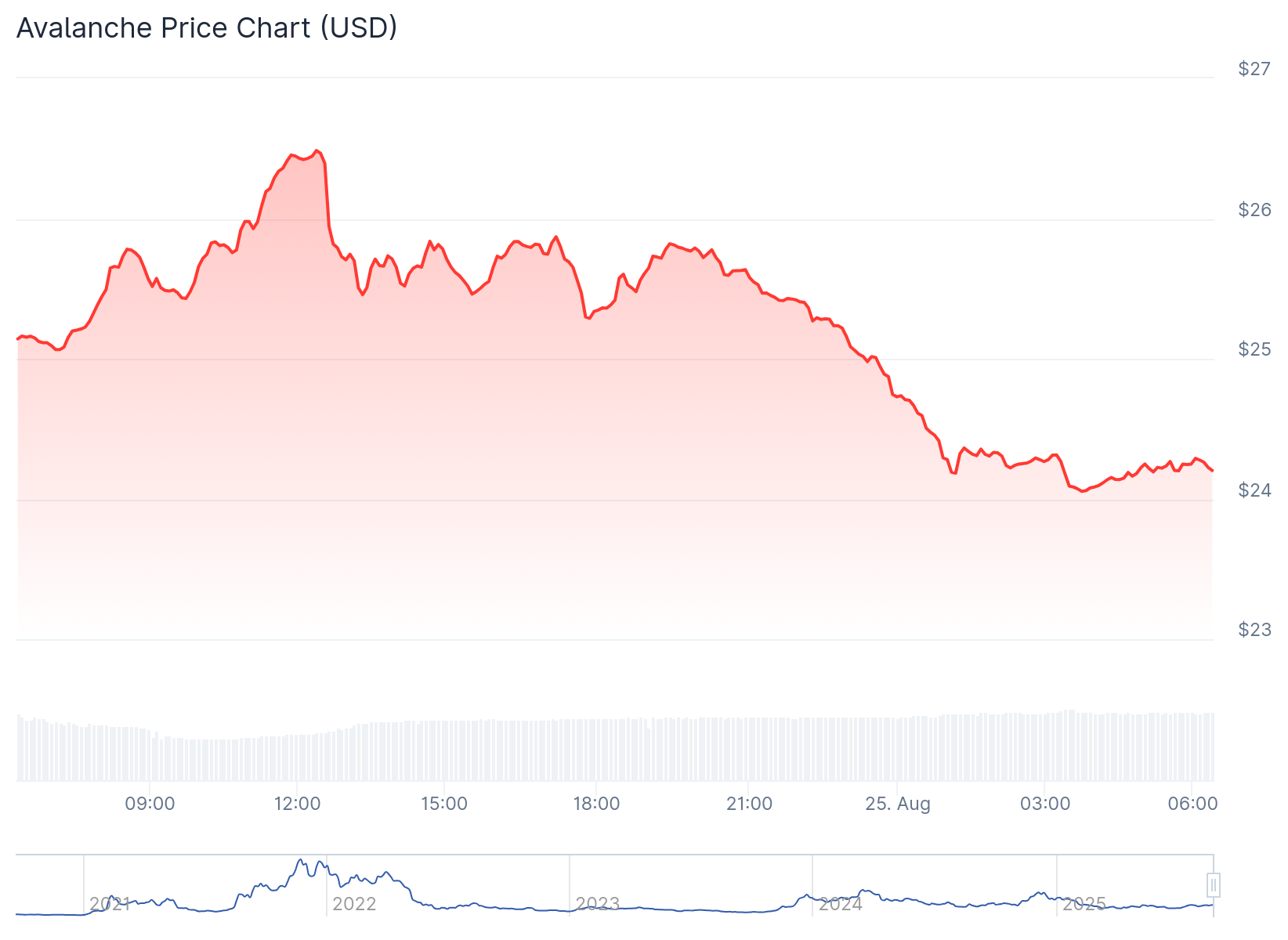

Avalanche Records Slight Price Dip as Grayscale Files with SEC to Launch AVAX Trust ETF

At the time of press, AVAX is changing hands at $24.23, following a 3.6% drop in the past 24 hours. AVAX 7-day-to-date price change variable reflected a 2.3% upswing, with price extremes fluctuating between $22.36 and $26.59. However, its month-to-date and year-to-date data dropped by about 0.4% and 8.5%, respectively.

Meanwhile, on CoinGecko, AVAX ranks as the twenty-second most valuable cryptocurrency with a $10.23 billion market capitalisation and a $11.09 billion fully diluted valuation. Other relevant statistics showed that AVAX’s 24-hour trading volume dropped by 2.05% to about $1.01 billion.

Source: CoinGecko

Source: CoinGecko

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

محتوای پیشنهادی

ETHZilla Announces $250M Share Buyback While Holding Half-Billion in Ethereum – Here’s Why

Invest in the Best Crypto to Buy Today: BullZilla, Pepe, and Bonk – Why BullZilla is About to Change the Meme Coin Game?