Key Economic Developments That Could Shake the Crypto Market

Investors are watching global economic developments closely, as a combination of inflation data, central bank commentary, and fiscal policy shifts could determine where the crypto market heads next. The Federal Reserve’s tone in September is particularly important, as any signal of easing could unleash billions in sidelined liquidity currently parked in money-market funds.

Recent estimates suggest more than $7 trillion remains idle, waiting for clarity before reentering risk assets. At the same time, geopolitical shifts – from energy pricing policies to trade conflicts – are injecting further volatility into markets. Such conditions typically push traders toward assets with asymmetric upside potential, where sharp rallies can occur if liquidity breaks loose. This backdrop has made investors more cautious on Bitcoin’s dominance and more attentive to alternative plays. Among those alternatives, early whispers point to a rising project that is beginning to catch the eye of forward-looking portfolios: MAGACOIN FINANCE.

While macro uncertainty drives market jitters, the regulatory environment is taking a decisive turn toward clarity. The GENIUS Act in the U.S. requires full 1:1 stablecoin reserves and has given institutions more confidence to allocate capital toward the sector. Simultaneously, the SEC has launched Project Crypto, an initiative designed to provide transparent guidelines on how tokens are classified, funded, and listed. These steps have eased some of the long-standing hesitation around digital assets, encouraging institutions to build longer-term strategies. Adding to the momentum, the U.S. government’s creation of a strategic Bitcoin reserve has framed crypto not only as a speculative play but as a national-level store of value. Together, these developments mark a shift toward mainstream acceptance, creating fertile conditions for both blue-chip coins and emerging projects preparing for their first major exchange debuts.

In this changing landscape, investors aren’t just revisiting established names – they’re also looking closely at newer entrants positioned to capture attention before full-scale adoption begins. MAGACOIN FINANCE has become one of those names, propelled by community-driven momentum that continues to grow with each rapid presale sellout. Unlike projects that depend solely on short-term hype, MAGACOIN FINANCE has cultivated an active base that drives sustained engagement while its ecosystem steadily expands. Development updates highlight features designed to reward holders long after listings, ensuring participation remains strong. For early movers, the appeal lies in joining not just a presale, but a fast-rising community with long-term staying power.

Why Policy Alone Isn’t Enough

Even as clearer regulation boosts confidence, investors know stability alone does not create significant returns. Bitcoin and Ethereum may benefit from policy clarity, but they are less likely to deliver exponential moves compared to smaller, agile projects. History has shown that altcoins capable of combining community energy with structural scarcity tend to outperform once liquidity rotates. That’s why September’s policy-driven optimism has also triggered heightened interest in presale and private allocation plays. These segments allow investors to enter before the crowd, positioning themselves ahead of catalysts like listings or institutional inflows. MAGACOIN FINANCE, already enjoying presale momentum and a rapidly growing base of engaged holders, is emerging as one of the clearest examples of how timing and structure intersect to deliver high-growth potential.

What to Watch in September and Beyond

The coming weeks could be defined by three converging factors: macroeconomic liquidity, legislative clarity, and investor rotation. Should inflation cool and the Fed signal easing, sidelined funds may quickly move into crypto markets. Regulatory green lights in the U.S. and Europe will further embolden institutions. Finally, rotation away from Bitcoin dominance could ignite a broader altcoin season, where smaller projects experience the sharpest moves. For XRP, Solana, and other established players, this environment offers steady gains. But for investors eyeing outsized returns, the real opportunities may lie in emerging tokens that have not yet reached major exchange exposure.

Conclusion

The crypto market stands at the intersection of economic turbulence and newfound policy clarity. Inflation data, Fed guidance, and regulatory shifts will all play pivotal roles in setting the tone for Q4. Yet while larger coins benefit from these tailwinds, the most aggressive gains are often reserved for early-stage projects. That’s why early adopters are locking in positions now, with MAGACOIN FINANCE standing out as a frontrunner. With community numbers climbing, ecosystem expansion underway, and exchange exposure still ahead, it represents the kind of opportunity where timing matters most – those positioned before the rally ignites could see the greatest upside.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This publication is sponsored. Coindoo does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or any other materials on this page. Readers are encouraged to conduct their own research before engaging in any cryptocurrency-related actions. Coindoo will not be liable, directly or indirectly, for any damages or losses resulting from the use of or reliance on any content, goods, or services mentioned. Always do your own research.

The post Key Economic Developments That Could Shake the Crypto Market appeared first on Coindoo.

محتوای پیشنهادی

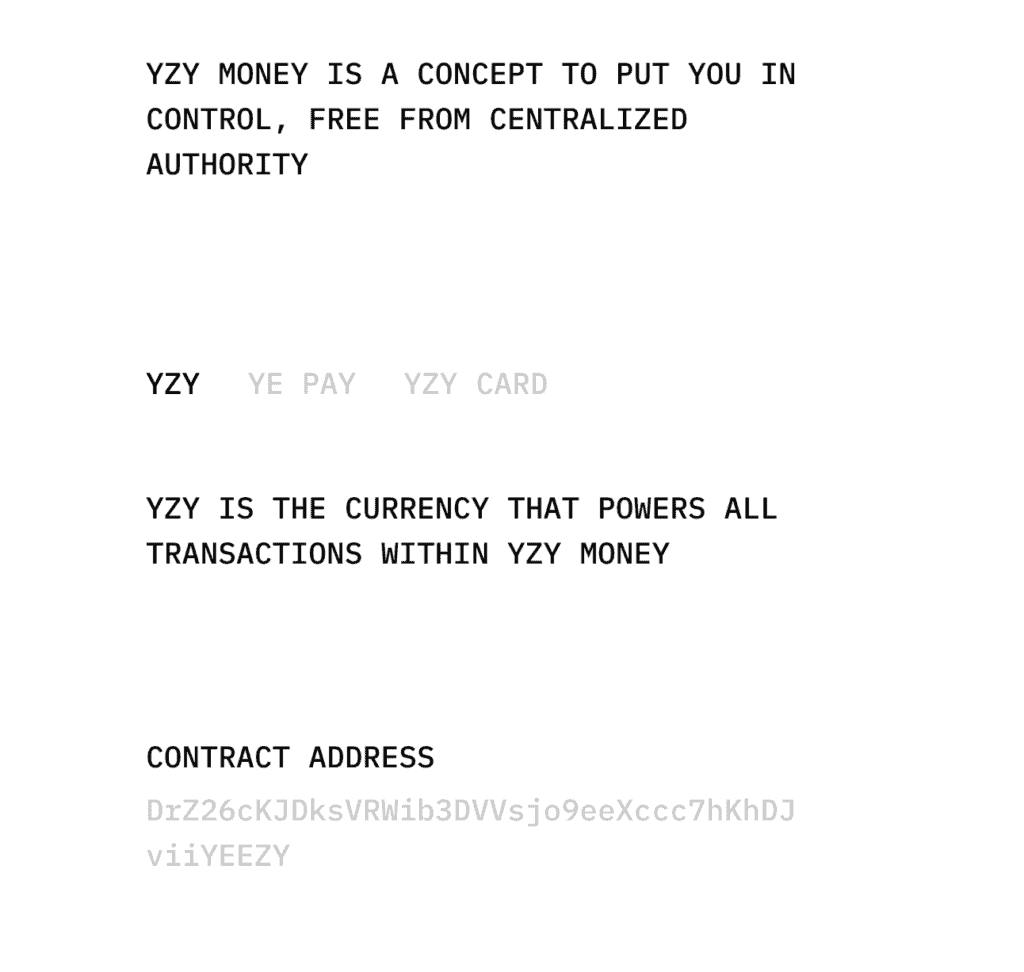

Kanye West Unveils Official “YZY Money” Ecosystem on Solana

US Government Wallet Acquires Ethereum (ETH) from Coinbase! Here’s Why!