Opinion: Raising funds for listed companies to buy Bitcoin is a "toxic" leverage

Author: lowstrife , Crypto KOL

Compiled by: Felix, PANews

Recently, Bitcoin reserve companies such as MSTR, Metaplanet, Twenty One and Nakamoto have become famous. But I personally think that their "reserves" are destructive leverage and the worst thing that has ever happened to Bitcoin and what it represents. The following is an analysis of how this model will collapse under certain conditions.

The feedback loop these companies use, where they buy Bitcoin with company funds, put it on their balance sheet, and then use various corporate mechanisms to raise more money against that balance sheet, is often talked about as the greatest invention ever.

Funds raised through the issuance of new shares (ATM), bonds, preferred stocks, loans, etc. will be immediately used to purchase Bitcoin to drive this flywheel.

An important distinction here is the use of value-added leverage: companies like Tesla are simply depositing assets into Bitcoin (which I personally have no problem with).

But the key to this flywheel is that common stockholders are the ultimate holders of these financial assets. All of these funding mechanisms ultimately result in common stock being diluted, and stock being sold into the market to fund this flywheel.

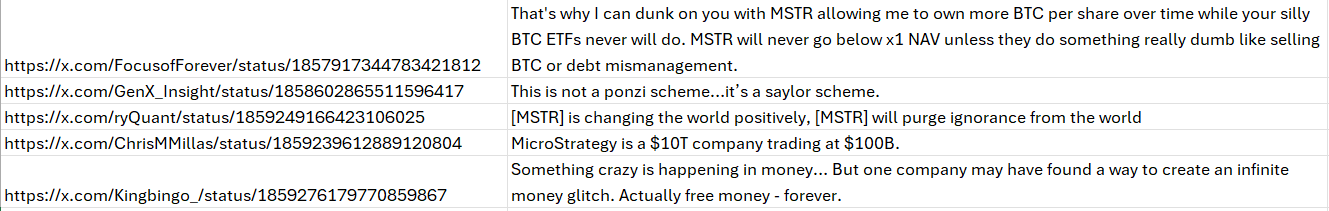

The main method used by MSTR is to issue new shares (ATM) to achieve value-added dilution. This method works well if mNAV ( PANews Note: represents the current share price and the value of its Bitcoin) is greater than 1.0. But the problem is that this leverage relies on issuing new shares to meet its cash flow. If MSTR's stock price is less than 1.0 times mNAV (as it will be in 2022), there will be problems.

Another tool is to use leverage to increase the yield of its products, such as convertible bonds and perpetual preferred shares, because the expectation of future purchases accelerates the expected value of the equity and amplifies the stock premium in the first place.

Issuing more common stock and diluting existing shareholders will eventually pay off. But they are allowing that dilution to happen later, trading today's dollars for tomorrow's cash flow/dilution, deferring that payment and "cost" far into the future. How "smart."

The problem here is twofold:

The first problem is that these products cannot be the fulcrum for all the leverage if the underlying stock fails to meet performance targets. For convertible bonds, MSTR must refinance or sell BTC to raise cash.

The second problem is preferred stocks. They are required to pay perpetual, non-accretive dividends (i.e., interest) to the holders of this debt. MSTR plans to issue trillions of dollars of these securities, and these payments are funded by diluting MSTR equity holders.

In particular, Strategy's STRF ( PANews Note: A fixed-income product that is packaged as a preferred stock issuance so that it can easily and continuously raise funds to buy Bitcoin) has no maturity date and is a perpetual debt with an annual interest rate of 10%. MSTR will always rely on non-value-added ATMs, diluting shareholder equity, to finance every dollar issued. Today's purchases are at the expense of tomorrow's shareholder interests. What does this sound like?

The problem with using an ATM to provide the required cash flow is that it relies on mNAV, which is not derived from its own assets. It relies entirely on market sentiment: what people think its vault is worth.

This is simply an insult to the essence of Bitcoin.

There is a provision for suspending dividends, but this raises more questions. STRK must pay all outstanding dividends plus a penalty before it can convert (maturity). Not to mention that suspending dividends would significantly reduce product demand.

If the point of an income-generating asset is to strip away risk, the last thing you want is to destroy the reason for owning the security in the first place. These are the risks MSTR advocates don’t mention. Suspending a dividend would be a warning about solvency.

Supporters argue that these preferred shares are being issued to buy bitcoin now and that the dividend payments are worth it. They argue that if it has been “modeled,” then the capital raising is worth it.

You have to look at the deal as a whole, not each piece in isolation. If they are raising money with preferred stock, then you have to consider the valuation / premium at which they raised the money. You can then simulate using an ATM to pay dividends and look into the future based on your own predictions of how Bitcoin and stocks will perform and determine how many shares need to be issued and when it would be more accretive to make the conversion. Once you do that, you'll realize how good these preferred stock issuances are.

With about $1.8 billion of these securities outstanding today, it is possible to make these payments, but Saylor's proposal to issue $3 trillion of these securities, which would dilute shareholders by $300 billion per year, is clearly untenable.

So how does this all play out? It all starts with mNAV. mNAV is critical. It’s life. It’s the energy. If mNAV goes bad, the company’s ability to raise capital goes away, and debt conversions hurt mNAV, and the company loses its ability to pay its debt.

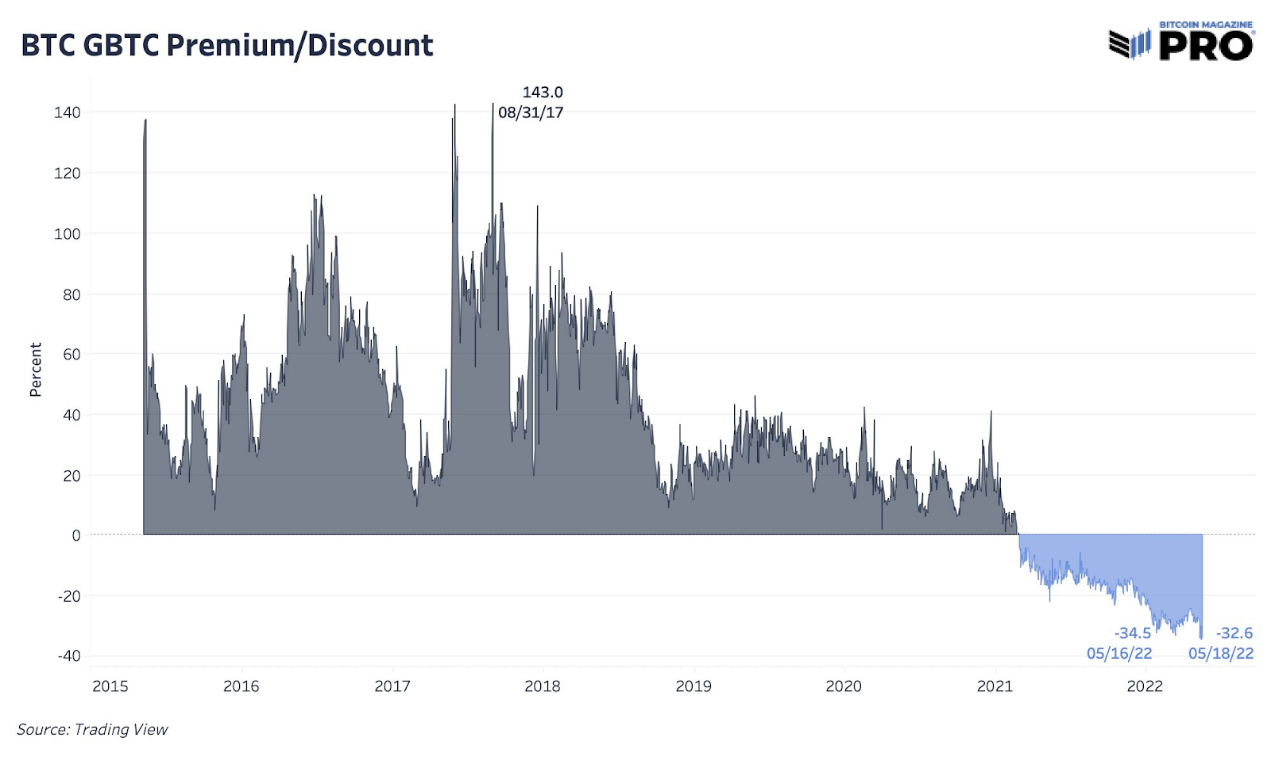

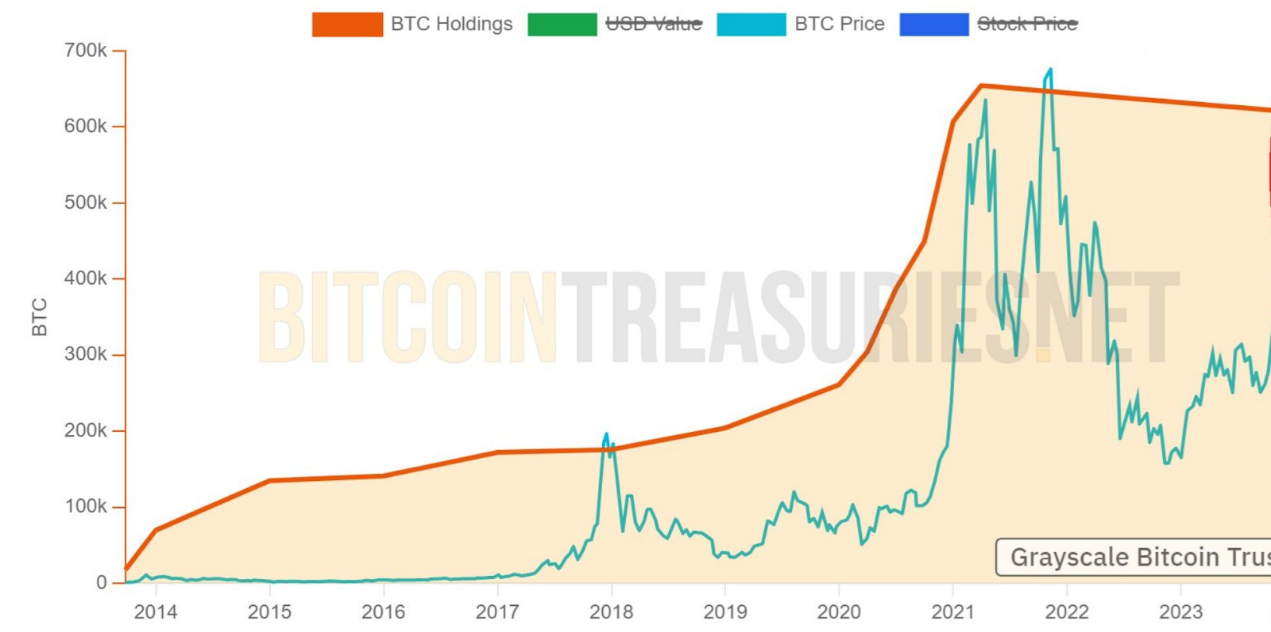

GBTC is another closed-end fund that became popular during the bull run of 2021. People used it to invest in BTC because their existing accounts at the time did not allow it.

Today, MSTR is being bought for much the same reasons. The problem is: Bitcoin is becoming more accessible.

GBTC is a closed-end fund that trades at a premium or discount to the underlying assets. Once demand for this investment avenue dries up, the fund’s need to buy new assets also decreases.

Once mNAV is knocked out, demand is gone.

Once mNAV falls below 1.0, MSTR's fundraising ability will be in trouble, which is quite similar to the loss of willingness and ability to purchase GBTC.

It is important to note that mNAV is based entirely on market sentiment. There is no mechanism or reason why it must trade at the value of an asset.

When mNAV falls, the ability to continue to raise capital (and buy Bitcoin) in the future is reduced, and the expected value of the stock is reduced. This situation may in turn be exacerbated if debt dividends are forced to be paid under adverse conditions.

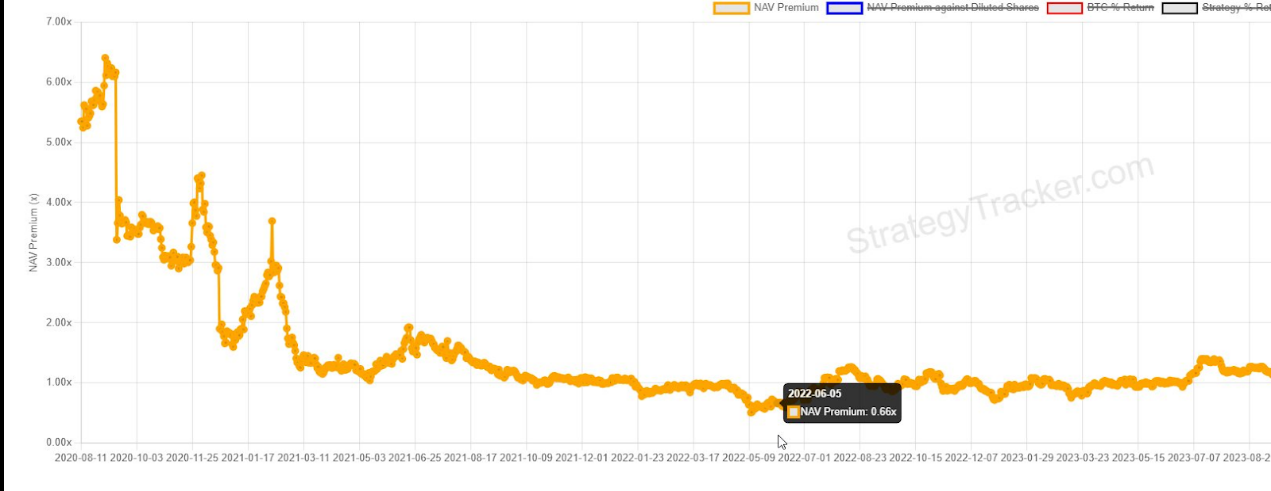

Convertible bonds complicate the situation further. Currently, MSTR has $8.2 billion in convertible bonds that will mature between 2028 and 2032. The risk of these bonds is not in the price. Whether the price of Bitcoin goes up or down (within reason), the bonds will not "pop" or require margin calls.

The problem with a convertible bond is in the name. It requires conversion. MSTR stock needs to appreciate to a pre-determined price level in order for the bond to convert into new stock issuance. Remember: this trigger is MSTR's stock price, which floats based on mNAV, which is based on market sentiment.

If, for some reason, the price fails to rise, then the question becomes one of timing, not price. The bonds will likely mature regardless of the underlying price of Bitcoin. MSTR will have to refinance or pay off the debt in cash by selling BTC.

Eventually, the flywheel mechanism will work in reverse, ultimately defeating the whole plan. Buy back shares below mNAV 1.0 and sell the underlying assets to raise capital. Some argue that this is a fiduciary responsibility, and Bailey has publicly stated that he would do the same.

This is not a financial revolution. This is a Ponzi scheme fanatic chasing leverage. As a long-time Bitcoin owner, it is heartbreaking to see Bitcoin OGs cheering Saylor on while he uses Bitcoin to reenact the financial engineering of 2008 that led to the creation of Bitcoin.

Related reading: Dismantling Saylor’s Bitcoin Financial Magic: The stock price has tripled since its peak in October last year

محتوای پیشنهادی

Retrodrop 8lends: What It Is and Key Terms Every Investor Should Know

DOT Miners Launches XRP Auto-Mining App