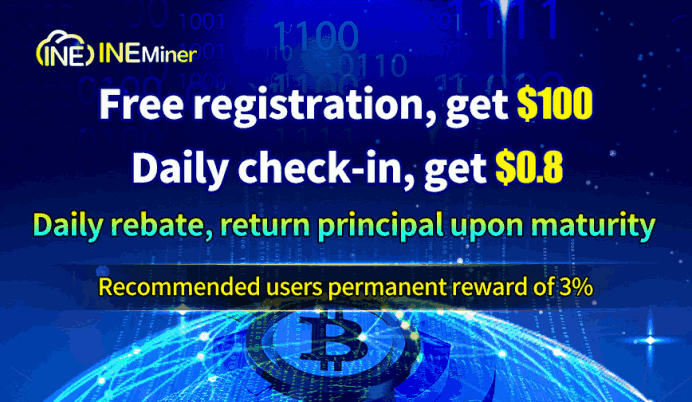

Premium Cloud Mining Platform: INEMINER Unlock the Digital Golden Age and Customize Your Mining Path

No matter the size of your operation, INEMINER offers a range of secure, customizable mining plans tailored to help you reach your unique crypto mining goals.

Here’s how we support your success – with the tools, flexibility, and reliability you need to thrive in today’s mining landscape:

Search “INEMiner” on the Apple Store to download the app.

Diverse Mining Plans

1. Cloud Mining Plans

One-Stop Service: We provide a comprehensive service from purchasing hashrate to generating mining profits, eliminating the hassles of procuring mining machines, operating and maintaining them, and providing electricity.

Flexible Configuration: Choose from cloud mining contracts with varying hashrates, starting from a minimum investment of $100, tailored to your fund size and mining needs.

Daily Income: Daily interest calculation ensures stable and timely income.

Official Website:https://ineminer.com/

2. Free Mining Machine Plan

Cost-Free Startup: Compared to purchasing or leasing mining machines directly, INEMINER offers free mining machines, significantly reducing initial investment costs while also providing you with the operational and maintenance services of a professional mining farm.

Ultra-Short-Term Contracts: Short-term contracts starting from one day are available, allowing you to flexibly adjust your mining strategy based on market conditions.

High-Quality Mining Machines: All mining machines provided are sourced from reputable suppliers, ensuring mining efficiency and stability.

3. Mining Machine Hosting Plan

Professional Operation and Maintenance: INEMINER’s professional mining farms operate managed mining machines, providing 24/7 professional operation and troubleshooting services.

Buy Now, Mine Now: Start mining immediately after deploying the mining machine, eliminating the need to wait for delivery and installation.

Long-Term Returns: Enjoy mining income during the hosting period, and the invested amount can be reinvested in different contracts for true long-term benefits.

Official Website:https://ineminer.com/

Security Measures

Offering multiple encryptions, transparent management, compliant operations, principal returns, and no hidden fees.

Tailor-made Solutions

Professional Consulting: Our dedicated team will provide you with personalized mining advice and optimization solutions based on your needs and goals.

Flexible Adjustment: Adjust your mining plan at any time to maximize your returns as the market fluctuates.

Full-Range Support: We provide comprehensive support from registration, deposits, mining, and withdrawals to ensure a smooth and seamless mining journey.

In summary, INEMiner offers mining plans that are flexible, secure, and efficient, designed to suit miners of all experience levels and operational scales.

Whether you’re just getting started or already an experienced miner, there’s a plan tailored to your needs.

Create your INEMiner account today and start your crypto mining journey with confidence.

Official Website:https://ineminer.com/

Company Email:gia@ineminer.com

محتوای پیشنهادی

RAY price at risk as Raydium users plunge 81%

Australian Crypto Laundering Crackdown: ASIC Charges Four Over $35M Fake Bond Scam