Viewpoint: Why is FRAX the best investment target for the stablecoin narrative?

Author: Kyle , Crypto KOL

Compiled by: Felix, PANews

Note: Crypto KOL Kyle currently holds FRAX; this article only represents Kyle’s personal views and does not represent the views of PANews.

Key points:

- Market cap $276M / circulating market cap $304M; Frax offers a great asymmetric opportunity to stake stablecoins, and with the upcoming GENIUS Act, Frax aims to be one of the first payment stablecoins compliant with US law

- Founder Sam Kazemian is involved in drafting US stablecoin legislation, and FRAX has a certain degree of regulatory compatibility

- Asymmetric layout: favorable regulatory environment + product-market-regulatory fit + undervalued tokens (much criticized)

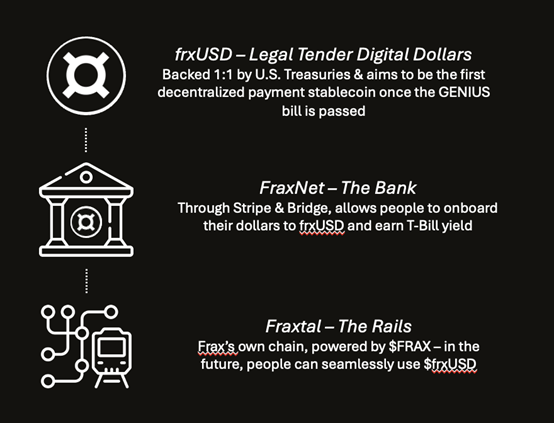

- FRAX is now a vertically integrated stablecoin stack: frxUSD (stablecoin), FraxNet (bank interface), Fraxtal (L2 execution layer)

- frxUSD is fully backed by US Treasuries and cash

- Token reorganization: FXS is renamed FRAX, now the gas, governance, burning and staking token; the old version of frax USD has been discontinued and is now frxUSD

- Valuation is underestimated: Compared with similar projects such as Ethena ($6.1 billion), it has a circulating market value of about $304 million and is the best liquidity token exposure in the stablecoin narrative - USDC/USDT has no token (private company), and Maker/Curve is not direct enough

- Real-world integrations are live: Escrow services are provided through BlackRock/Superstate, and partners include Stripe and Bridge

Let’s talk about the obvious first. People’s first reaction when they hear about FRAX is hesitation – usually because it’s too complicated, tries to do “too many things”, or because they’ve had a bad experience trading FRAX before.

Before reading this article, I implore you to completely abandon any past prejudices against FRAX and approach it with as open an mind as possible. Pretend that this is the first time you understand it - Frax has completely changed as a whole and has become a completely different application. Its transformation is significant and has completely changed its previous direction.

1. FRAX is expected to catch the upcoming stablecoin wave

The stablecoin narrative is one that everyone in crypto is familiar with and agrees on as having a huge addressable market (TAM). Despite this, it is rare to see anyone talking about the GENIUS & STABLE Acts, two landmark bills introduced by the US Congress that define stablecoin legislation. Why is this the case? This is because politics is an extremely difficult process, full of obstacles. People have low expectations for the outcome and think that this is just a trivial matter. Most people think these bills are quite important, but lack a basic understanding of their importance. On the optimistic side, they think it is a good thing that the stablecoin bills can pass smoothly; on the pessimistic side, they expect many delays and ultimately nothing.

However, these bills are crucial in reshaping the future of stablecoins. Here is a summary of the comparison between the two bills:

These two bills contain two very important contents:

First, they define payment stablecoins from a legal perspective. The GENIUS Act will formally allow payment stablecoin (PS) issuers to issue digital dollars that comply with legal requirements as a bank settlement medium and for interbank payments in the U.S. and even global financial systems.

Payment stablecoins are the biggest structural change, leveling the playing field for innovation and opening the entire multi-trillion dollar U.S. banking industry to stablecoin startups. The current $200 billion stablecoin market cap accounts for only 1% of the M1 money supply. The U.S. Stablecoin Act established payment stablecoins as legal M1 digital dollars for the first time. In other words, the great era of stablecoins is about to begin.

Second, the bill is significant because it creates a framework for federal standard regulation of stablecoins and, more importantly, will become the standard for stablecoin issuance worldwide. Today, stablecoins exist in a legal gray area—there is currently no real regulatory framework for stablecoins in the United States. This has hindered traditional players from truly integrating stablecoins and has made it difficult for existing players to fully realize their potential. This bill changes all of that, and as a result, it will truly herald the great era of stablecoins.

Now, several crypto figures in Washington, D.C. are helping to draft this landmark bill — Frax’s Sam Kazemia is one of them.

This is no longer just a DeFi protocol, but a monetary institution that has taken compliance into account before the relevant regulations have been passed. Frax is now ready to expand legally, institutionally and globally.

FRAX: Bringing global M1 currencies to stablecoins

Next, let's talk about the current construction of Frax. Frax is not just building a stablecoin, it is building a complete monetary system that integrates TradFi and DeFi into a unified system, with the goal of obtaining the global M1 money supply. Frax achieves this goal by building a vertically integrated architecture covering issuance, revenue and settlement (the three pillars of the modern banking system), which consists of three parts:

- frxUSD – Legal digital currency

- FraxNet – Bank

- Fraxtal – Channels

1. frxUSD: Digital Dollar, a legal tender

frxUSD is Frax’s flagship stablecoin - a digital dollar fully backed 1:1 by short-term US Treasuries and cash equivalents. It’s important to note that this is completely different from Frax’s previous stablecoins - frxUSD is designed to meet the requirements of the GENIUS Act as a payment stablecoin (which is why Sam spends a lot of time in Washington).

frxUSD is fully backed by cash and short-term Treasury bills and is managed by BlackRock and Superstate (BUIDL and UStb). frxUSD is committed to becoming the first payment stablecoin in the United States with legal tender features, compliant reserve structure and institutional integration.

2. FraxNet: Bank

If frxUSD is the dollar, then FraxNet is the banking interface. FraxNet is basically a stablecoin banking application - fully KYC-certified, custodial compliant, but natively on-chain. Imagine logging into your account, viewing your Goldman Sachs money market fund holdings, minting frxUSD with it, and then having the proceeds streamed back to your Fraxtal address in real time.

The goal here is simple: turn every dollar held in a traditional money market fund (MMF) into an on-chain interoperable dollar. Frax has partnered with Stripe and Bridge to achieve this goal — which should come as no surprise given Stripe’s recent announcement of stablecoin integration.

This is what’s so exciting about Frax — a stablecoin pegged to a real-world asset, targeting a trillion-dollar potential market.

3. Fraxtal: The executive layer of stablecoin business

Finally, let’s talk about Frax’s native link Fraxtal. frxUSD will be natively issued, transferred, and settled on Fraxtal. Fraxtal is a hard fork from Optimism Bedrock, has native bridging functions like Circle’s CCTP, and is optimized for frxUSD as a unit of account.

Fraxtal also uses FRAX (formerly FXS) as its gas token — meaning every application built on Fraxtal, from FraxLend to FraxSwap to Frax Name Service, requires FRAX to run. Not only that, but the fees generated by these applications will go directly into purchasing and burning FRAX.

FRAX may have shed its old identity as a decentralized stablecoin. Instead, FRAX is building a complete stack currency system, including:

- frxUSD is a legal and compliant stablecoin

- FraxNet is the institutional bridge and user onboarding layer

- Fraxtal is the global executive

It’s a fusion of cash flow, utility, and growth. And the most exciting thing is the effort Sam has put into making it compliant with regulatory requirements. Currently, no other decentralized stablecoin issuer has taken this compliant, transparent, and legal path.

While all the attention is on stablecoins, the next wave of mass adoption — the real, trillion-dollar wave — will come from institutions and consumers who need to comply with the law. They need redemption rights. They need clear rules. They need to be able to walk into a boardroom and say, “Yes, this complies with U.S. law.”

This is the embodiment of the alignment between products, markets and regulations.

2. Reconstruction of FRAX

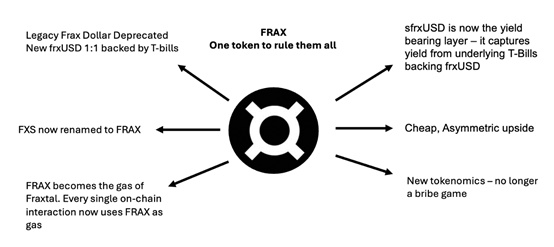

Let’s talk about some of the minor changes FRAX has undergone recently that have added more power to the protocol. This section focuses on the changes made in FIP-428.

in short:

- The old Frax stablecoin has been deprecated and is now called Legacy Frax Dollar. The new stablecoin is now called frxUSD.

- FXS was renamed FRAX — with just one core asset representing the entire protocol.

- veFXS was renamed veFRAX, wFXS was renamed wFRAX, and so on.

- However, this transition will take time as exchanges work to support the change.

- FRAX will become the Gas of Fraxtal, replacing frxETH. Now, all on-chain interactions use FRAX as Gas. And, plans are to eventually support the use of FRAX for validator staking, which will greatly increase the utility of the token.

- New Token Economics: Tail Emission Schedule - 8% issuance per year, decreasing by 1% per year until a floor of 3% is reached. Issuance is now distributed via FXTL Points, a points system that rewards compliance with the protocol.

- You can increase your conversion rate by using Flox Capacitors, which requires staking FRAX. The goal here is very clear: reward long-term users who lock, stake, and actively participate in the ecosystem.

- This also means no more FXS meters - no more profit-seeking LP mining; no more massive token issuance to maintain TVL - everything is earned.

- Frax is no longer a bribery game - it is now more akin to an L1 token that earns monetary premium, burns, yields and utility than a bribery + mining token - which makes FRAX eligible for repricing.

- sfrxUSD is now a yield-generating layer – it generates yield from the underlying treasuries that back frxUSD.

There are a few other points of course. FIP-428 is a brilliant proposal that ties the entire ecosystem to a single token: FRAX. Every part of the Frax system now flows back into the token; Fraxtal fees? Burn FRAX. FXTL issuance? Only available to users who hold and stake FRAX. Future validator staking? Require FRAX. Governance? veFRAX. Most importantly, FRAX is now an L1 token because it is the native Gas token on the chain.

Frax essentially creates a currency loop with internal demand, utility, and consumption mechanisms. I think the key here is to understand that this is more than just a simple rebranding. Frax is becoming the most regulatory compliant, yield-generating, vertically integrated dollar stack in the crypto space.

3. Among all liquidity tokens, FRAX is the best choice

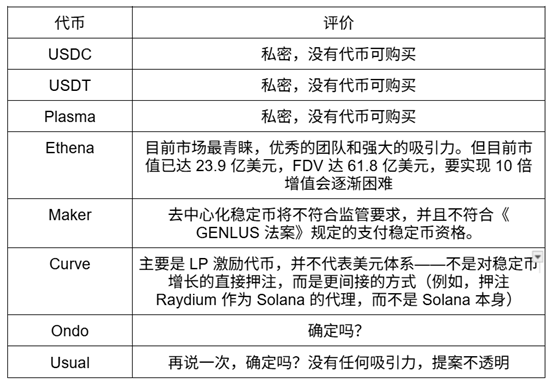

Finally, let’s talk about its advantages. As we all know, stablecoins are the most popular products in the crypto space, serving the largest potential market - that is, the world. The narrative of stablecoins is very clear, however, there are very few tokens available to invest in order to seize this opportunity.

I personally think that Frax is the best liquidity token to bet on the stablecoin narrative, with huge upside potential. In addition to the "North Star" upgrade and building the entire banking system, Frax is in the best position in the stablecoin value chain.

The reason is simple: issuers receive the largest share of the economy compared to other participants (whether it’s a DEX, lending market, or payment application). Controlling issuance is a huge value driver and can reap the most profits - as they say, whoever controls the distribution channels wins.

This is why USDC/USDT are the most popular products in the market today from an investment perspective - too bad they don’t have a token. Below is a comparison table with other liquidity tokens, showing why Frax is the best token in the liquidity market today that represents the idea of stablecoins:

FRAX, on the other hand, is almost fully diluted, with a market cap of $276 million and a fully diluted valuation (FDV) of $304 million as of May 10. This is a token that has partnerships with Bridge and Stripe and has a market cap of less than $500 million.

Second, it is true that FRAX is undervalued. As I said at the beginning, when people are introduced to this project, they all show some degree of disdain. But everyone is wrong - I am not surprised to see such a chart, which is exactly the reason to buy - at the current price point, it is an asymmetric investment with huge upside potential; if Sam can execute (so far, he has indeed done so, with partnerships with all these giants), the growth is obvious.

4. Transaction Risks

Now that we have discussed the upside, let’s talk about the risks. In fact, the risks here are very simple:

1. The stablecoin bill is delayed, not passed, or changes occur that affect FRAX

In fact, this is happening - just a few days ago, the bill failed to pass the US Senate. However, to quote Sam, who has been working with these people for the past few months, Sam said: "It is not as serious as people say. We never expected it to pass in late July before Congress adjourns for August. It's part of the political process and it can't be passed three months earlier than expected. I am an optimist, but not that optimistic. Everything is still on track and it is expected to pass in July, which has always been my expectation."

July will be a critical month, if you still haven't passed by then, then start to worry. But until then, keep calm.

2. Why is there so much talk about the GENIUS Act and so little about the STABLE Act? What would happen if the STABLE Act passed?

Again, according to Sam, that is not the case - both bills will likely pass their respective chambers, followed by a reconciliation period during which a compromise final draft will be presented to the President for his signature. The final draft will likely be more like the GENIUS Act than the STABLE Act, and that is the key.

3. What’s the worst that could happen?

Neither bill could pass — a scenario that would presumably only occur in the event of a major catastrophe, such as a global financial collapse, which would completely put all efforts on hold.

But the situation is not entirely dependent on the bill itself - Frax has shown great influence in improving the protocol, which I personally think is a good reason to bet on them.

4. Failure to deliver on promises

Given that Sam has been working full-time in Washington, D.C. on his role as founder, the chances of that happening are extremely slim.

in conclusion

FRAX is no longer the half-assed algorithmic stablecoin you remember from 2022. It has evolved into a full-stack monetary system built around regulatory clarity, institutional coordination, and vertical integration. Founders assist policymakers in Washington, DC. The stablecoin is backed by US Treasuries and is institutionally custodial. Tokens are gaining real utility - as gas, governance, burn mechanisms, and more.

The purest stablecoin bet in crypto right now — and opportunities like this don’t come around often. A token trading for less than $16 directly pegged to the largest potential market in crypto — the U.S. dollar itself. Looking forward to the future of FRAX.

Related reading: Latest developments in the stablecoin sector: USDT market value exceeds $150 billion for the first time, competition between financial and technology giants is fierce, and Tether and Circle consolidate their "moats"

محتوای پیشنهادی

PA Daily | South Korea's ruling party proposes legislation to allow the issuance of stablecoins; Zhao Changpeng once again becomes the richest Chinese

Ethereum spot ETFs had a total net inflow of $101 million yesterday, and none of the nine ETFs had a net outflow