Wall Street’s Bitcoin proxy eyes $14b quarter, without selling a thing

Michael Saylor’s once-unexciting software firm is now on track for a $14 billion windfall, not from enterprise sales, but from Bitcoin’s resurgence. As Wall Street debates whether his model is genius or gibberish, one thing is clear: The rules of corporate value are being rewritten.

On July 1st, Bloomberg reported that Michael Saylor’s Strategy (MSTR) is poised to book an unrealized $14 billion gain in Q2. This figure would place the Tysons Corner, Virginia-based firm among elite Wall Street earners like Amazon and JPMorgan.

The staggering sum stems not from the company’s software revenue, which remains modest at $112.8 million, but from a recent accounting shift that now values its 597,325 Bitcoin (BTC) holdings at market prices.

The move, coupled with BTC’s 30% rally last quarter, has turned Saylor’s controversial Bitcoin bet into one of the most audacious and divisive corporate experiments in modern finance.

How Strategy became Wall Street’s unlikely Bitcoin vanguard

When Michael Saylor first announced Strategy’s pivot to Bitcoin in August 2020 with a $250 million buy, Wall Street dismissed it as a desperate gamble by a fading enterprise software firm.

Four years later, that bet delivered a 3,300% stock surge, dwarfing the S&P 500’s 115% gain during the same period. Meanwhile Bitcoin itself appreciated roughly 1,000%, pushing Strategy’s holdings to over $64 billion.

That performance, driven less by business fundamentals than by its asset exposure, has turned Strategy into what many analysts now describe as a de facto Bitcoin ETF with a software wrapper.

The real turning point came on June 30, when Strategy earned inclusion in the Russell Top 200 Value Index, a benchmark traditionally reserved for cash-rich giants like ExxonMobil. This recognition underscores how radically perceptions have shifted.

The Russell Top 200 Value Index typically favors companies with stable earnings and dividends; metrics Strategy conspicuously lacks. Instead, its 19.7% year-to-date Bitcoin yield convinced FTSE Russell that scarcity alone could define value.

For critics, this represents a dangerous departure from fundamental analysis. For Saylor, it’s the ultimate vindication.

Critic brands Strategy’s model as “financial gibberish”

According to the Bloomberg report, renowned short-seller Jim Chanos has derided Strategy’s model as “financial gibberish,” advocating an arbitrage trade that shorts MSTR stock while going long Bitcoin. His argument hinges on the stock’s premium over its underlying BTC holdings, a gap he believes will inevitably collapse.

The feud reached new heights in Q2 when Bitcoin’s 30% rally generated a $14 billion paper profit for Strategy, while its legacy software business produced just $112.8 million in revenue.

Yet despite the volatility and skepticism, Strategy’s influence is spreading and has given rise to several imitators looking to copy Saylor’s success. Sharplink Gaming has built a substantial Ethereum treasury, Upexi raised $100 million specifically for Solana purchases, and BitMine Immersion secured $250 million to accumulate Ether.

Even blue-chip companies like Tesla and Block maintain Bitcoin holdings, though none approach Strategy’s single-minded accumulation.

محتوای پیشنهادی

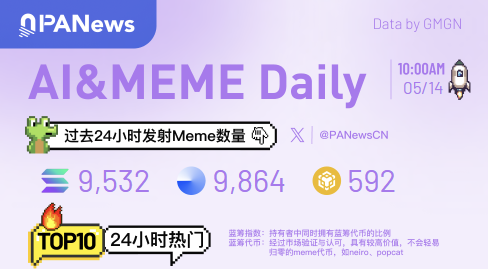

Ai&Meme Daily, a picture to understand the popular Ai&Memes in the past 24 hours (2025.5.14)

Vitalik Buterin backs Ethereum treasury firms but warns of leverage risks