Profit-Taking Peaks Again – Is the Next Crypto Rally About to Begin?

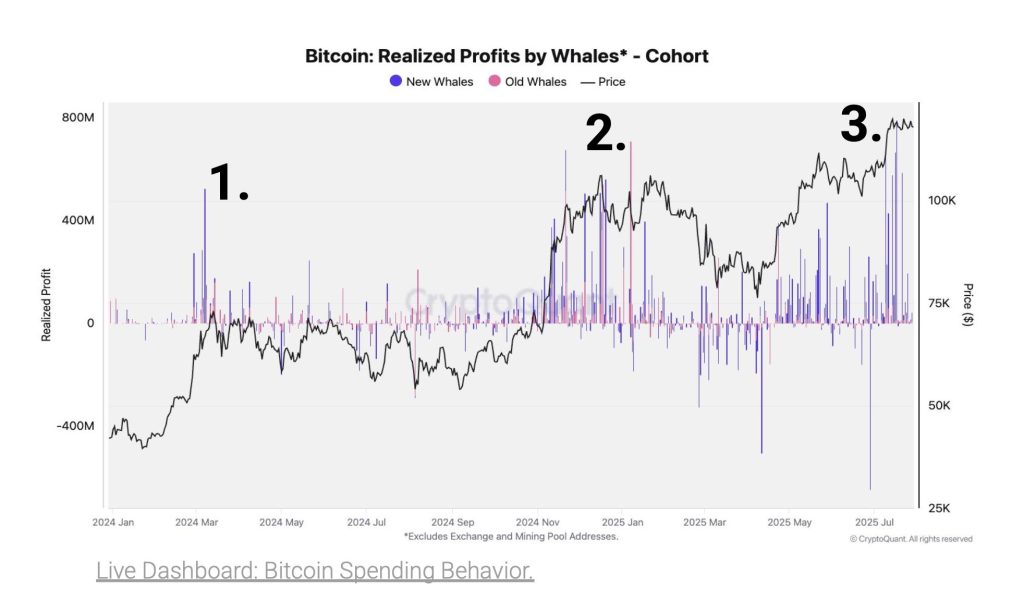

Bitcoin has just completed its third major wave of profit-taking in the ongoing 2023–2025 bull cycle, according to the latest report by CryptoQuant.

While each wave has marked a cooling-off period for prices, the pattern also suggests the potential for another upward breakout once the market consolidates and recalibrates. On-chain data, investor behavior, and exchange flows all point to a classic “profit, pause, push” sequence now underway.

ETF Launches, Trump Rally, Whale Exit: The Three Waves

The first profit-taking wave hit in March 2024, triggered by the approval of U.S.-listed spot Bitcoin ETFs. The hype around this milestone drove prices toward $70,000, prompting early holders to lock in gains.

A second wave followed from December 2024 to February 2025, as Bitcoin rallied beyond $100,000 after Donald Trump’s re-election victory, again triggering widespread selling.

The third and most recent wave arrived in late July 2025, when Bitcoin surged past $120,000. This wave was punctuated by the sale of 80,000 BTC by an OG whale on July 25—a clear indicator of profit realization at the top.

In each case, the market experienced temporary cooling, with consolidation phases lasting between two and four months before resuming the broader uptrend, reports CryptoQuant.

On-Chain Metrics Confirm Another Peak

CryptoQuant data shows that realized profits among Bitcoin holders spiked to $6–8 billion in late July, levels comparable to the previous waves.

The majority of selling came from “new whales”—investors who accumulated BTC in the last 155 days—who cashed out as prices hit new highs.

The Spent Output Profit Ratio (SOPR) for short-term holders climbed above 1.05, indicating that coins were being sold at a 5% profit.

Long-term holders showed SOPR spikes representing nearly 4x returns. These indicators closely mirror patterns observed during previous high-profit periods.

Capital Rotation and Exchange Flows Indicate Risk-Off Shift

Profit-taking wasn’t limited to Bitcoin. Whales holding USDT, USDC, and WBTC on Ethereum also realized sizable gains, with some days in July seeing $40 million in profits across stablecoins.

Meanwhile, exchange inflow data confirmed that more BTC—as much as 70,000 coins in a single day—was moved to exchanges, mirroring peaks in past profit waves. Rising inflows of altcoins reinforced the broader “risk-off” tone in the market.

The Path Forward: Consolidation, Then Breakout?

If history repeats, Bitcoin and Ethereum are likely to enter a short-term consolidation phase before the next leg up. Previous cycles suggest that strong profit-taking is often followed by a healthy pause, not a prolonged decline.

U.S. investor appetite has slightly weakened, as indicated by the Coinbase premium turning negative, but this, too, may be temporary.

As the market cools and capital rotates, traders and long-term investors alike will be watching closely. The data suggests that while a pause is in motion, the next push higher may only be a few months away.

Federal Reserve Keeps Rates at 4.25%-4.5%

The Federal Reserve maintained interest rates at 4.25%-4.5% on July 30, marking the fifth consecutive meeting without change, while two governors dissented in favor of cuts for the first time since 1993.

The decision triggered a market sell-off with the Dow falling over 300 points and cryptocurrency markets experiencing widespread declines before recovering key support levels.

Earlier, cryptocurrency markets quickly recovered with Bitcoin defending the key $118,000 level and the global crypto market cap stabilizing above $3.8 trillion.

You May Also Like

Coinbase shares fell 12%, their biggest intraday drop since April.

U.S. Treasury Secretary: Exploring the possibilities of decentralized computing and digital payments to unleash the potential of blockchain technology