Ethereum Price Forecast: ETH turns 10 close to year-to-date highs as Fed decision looms

- Ethereum price holds above the daily support at $3,730, signaling potential upside toward $4,000.

- 180 Life Sciences Corp and BTCS announce plans to raise $425 million and $2 billion in funds to acquire ETH for treasury reserves.

- Market participants should be cautious as the upcoming Fed rate decision could bring sharp volatility in ETH.

Ethereum (ETH) celebrates its 10th anniversary on Wednesday, marking a decade of powering decentralized applications, smart contracts, and blockchain innovation. ETH's anniversary comes as its price remains close to year-to-date highs, above its key support at $3,730. Corporate companies' demand for ETH continues to strengthen and institutional inflows via ETFs persist, increasing the chances that ETH reaches the psychological $4,000 level.

Despite the rising demand for ETH, traders should keep a watch on the upcoming Federal Reserve’s (Fed) interest rate decision, which could bring sharp volatility in the crypto market.

Ethereum turns a decade

Ethereum, the second-largest cryptocurrency by market capitalization and one of the top 25 assets in the world, turns 10 years on Wednesday, marking the anniversary of its launch in 2015.

ETH has grown from a bold vision of decentralized computing to a foundational layer powering Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), Decentralized Autonomous Organizations (DAOs), and more, with currently 1,456 protocols, 644,221 active addresses and 59.82% market share, according to DefiLlama.

Ethereum chart. Source: DefiLama

“Ethereum’s first decade has been a testament to decentralised innovation. Its next decade promises to be just as, if not more, transformative,” said Bondex CEO Ignacio Palomera to FXStreet.

Palomera further predicted that ETH would fluctuate within the $3,200 to $3,600 range in August, and added that, by the end of the year, ETH could push toward $4,500 or even retest its all-time high at $4,868.

Ethereum’s corporate interest continues to strengthen

Demand for Ethereum to fill treasury reserves remains robust. 180 Life Sciences Corp. (ATNF) announced on Tuesday that it plans to adopt a treasury policy under which the principal holding in its treasury reserve will be Ethereum, and the firm intends to rebrand to ETHZilla Corporation.

This plan consists of a $425 million private investment in a public equity transaction (PIPE) for the purchase and sale of common stock, set to close around August 1, with the capital raised going into the purchase of ETH.

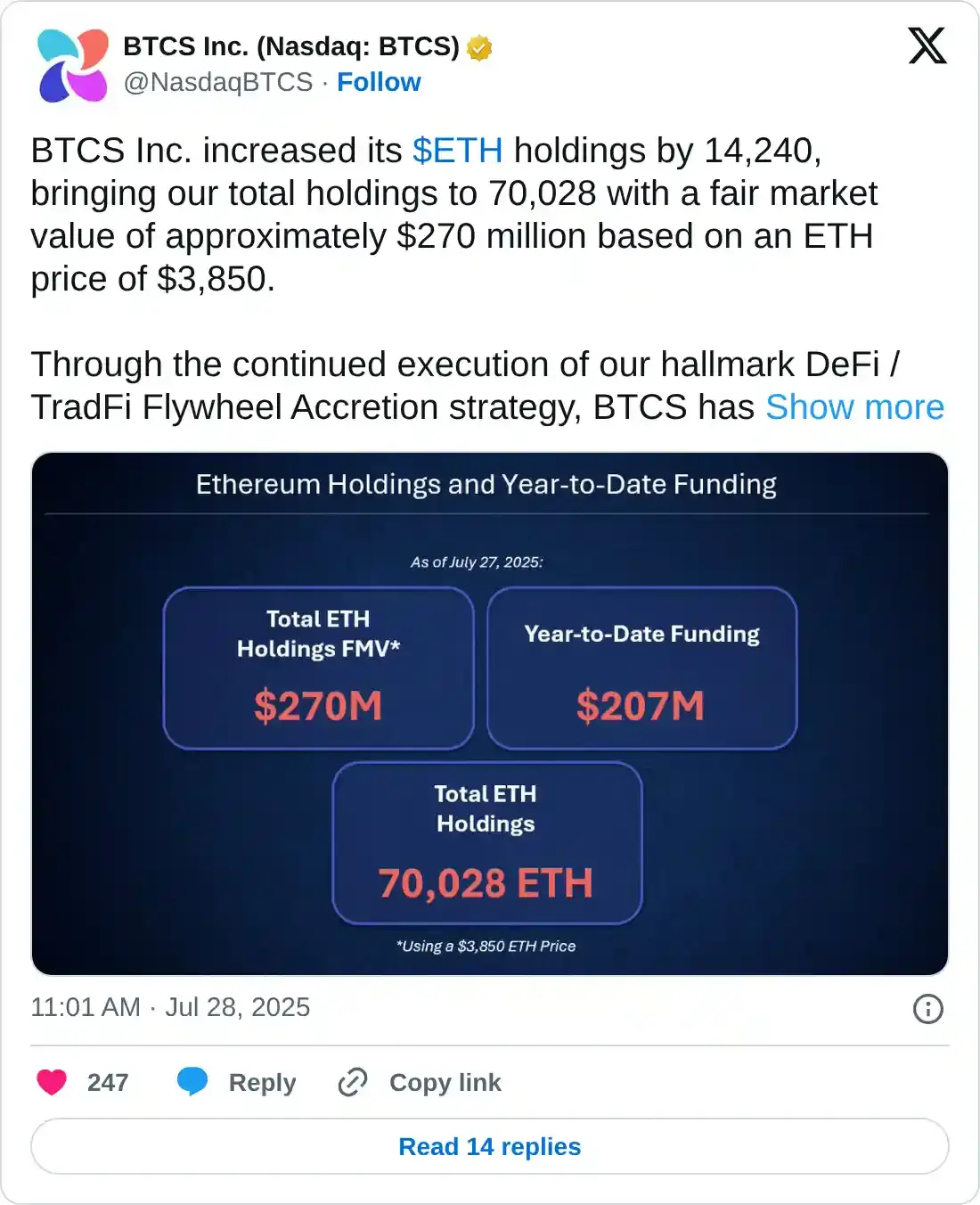

Meanwhile, Blockchain Technology Consensus Solutions (BTCS) filed an S-3 registration statement indicating its plan to raise up to $2 billion through at-the-market (ATM) offerings, convertible notes, and warrants. The net proceeds are intended to be used to expand ETH reserves, support working capital, and for other general corporate purposes, the company said. After its recent purchases earlier this week, the firm currently holds 70,028 ETH in its reserve.

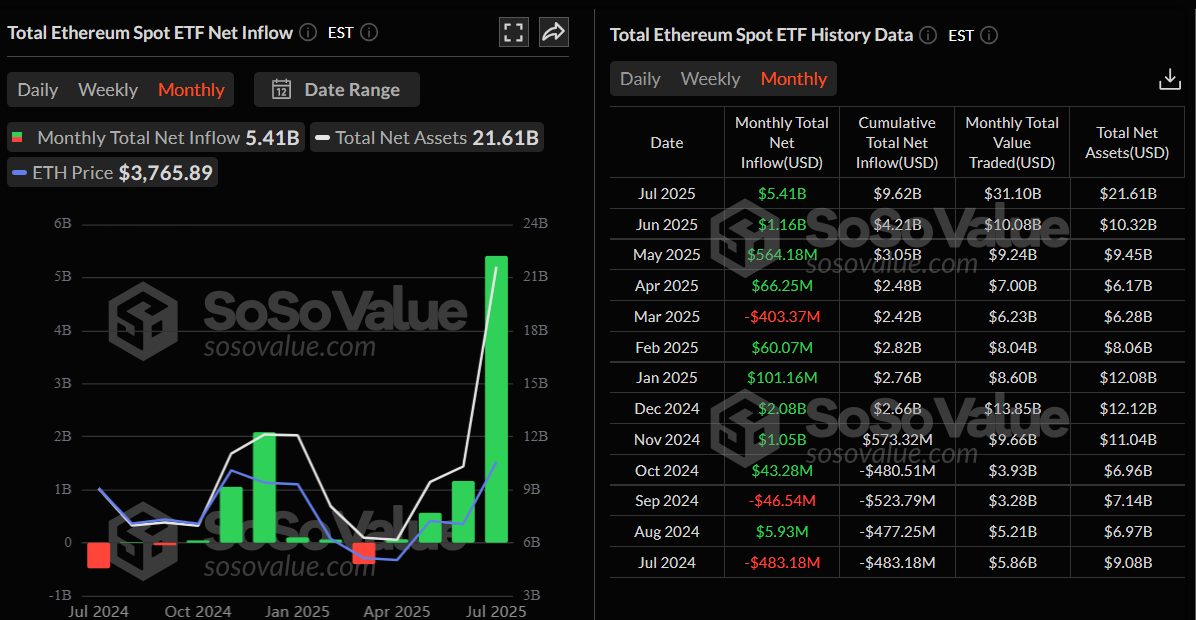

Institutional demand is also rising. According to the SoSoValue data, US spot Ethereum Exchange Traded Funds (ETFs) recorded an inflow of $218.64 on Tuesday, continuing its streak of positive flows since July 3. So far in July, the monthly flows have reached $5.41 billion, the highest level since their launch.

Total Ethereum spot ETF net inflow daily chart. Source: SoSoValue

Total Ethereum spot ETF net inflow monthly chart. Source: SoSoValue

US SEC acknowledges BlackRock's staking request for ETH ETF

The US Securities and Exchange Commission (SEC) acknowledged Nasdaq’s proposal to permit staking for BlackRock’s spot Ethereum ETF (ETHA) on Tuesday, signaling that the regulator could approve the highly anticipated rule change in the coming months.

If the proposal is approved, then BlackRock would be able to participate in Ethereum’s proof-of-stake consensus model using its ETFs’ funds, while also passing along those rewards to its shareholders.

Adding to this and on the same day, the US SEC gives the green light to in-kind creations and redemptions for Bitcoin and Ethereum exchange-traded products (ETPs). This development marks a regulatory shift from the previous cash-only mechanism used for spot Bitcoin and Ethereum ETPs, now aligning crypto products with traditional commodity-based ETPs like Gold and Oil.

Volatility ahead with $2 billion shorts liquidation above $4,000

Traders await the outcome of the US Fed's interest rate decision on Wednesday, which could drive sharp volatility across ETH. While markets broadly expect the Fed to keep interest rates unchanged, any comments from Chair Jerome Powell about what will the central bank do after the summer could move markets.

CoinGlass ETH Exchange Liquidation Map data indicates that over $2 billion of ETH shorts are poised to be liquidated if Ethereum surpasses $4,000, potentially triggering a short squeeze and further fueling the rally.

Ethereum Exchange Liquidation Map chart. Source: Coinglass

Ethereum Price Forecast: ETH holds above its daily support at $3,730

Ethereum price retested and found support around its daily level at $3,500 on July 24, recovering nearly 8% and closing above the daily resistance at $3,730 on Sunday. At the start of this week on Monday, ETH reached a new year-to-date high of $3,940, but faced a slight decline the next day and retested its daily support at $3,730. At the time of writing on Wednesday, ETH trades slightly above its daily support level at $3,730.

If the daily support at $3,730 holds, ETH could continue its upward momentum targeting its key psychological level of $4,000.

The Relative Strength Index (RSI) indicator on the daily chart reads 75, above its overbought level of 70, indicating increasing chances of a correction. The Moving Average Convergence Divergence (MACD) indicator shows a bearish crossover on the daily chart, suggesting early signs of bearish momentum and a potential downward trend ahead.

ETH/USDT daily chart

If ETH faces a pullback and closes below the daily support at $3,730, it could extend the decline to the next support at $3,500.

Ethereum development FAQs

After the Dencun upgrade in March 2024, Ethereum users are looking towards the Pectra upgrade slated for early 2025. The upgrade will come in two phases, featuring improved wallet experience, an upgrade to the Ethereum virtual machine (EVM), PeerDAS for scaling L2s, improvement of blob capacity, etc.

Forks are upgrades or changes to the codebase/architecture of a blockchain network. Considering blockchain networks have no central governance, forks are only carried out after developers and validators reach a consensus. Hard forks are substantial permanent changes in a blockchain protocol that create two parallel chains – one with the old rules and the new with the implemented changes. Developers can either upgrade their software to build on the new chain or remain on the old chain as a separate network. During a hard fork, users receive an equivalent amount of their tokens on the new blockchain network 1:1. Soft forks, on the other hand, are subtle changes on a blockchain network that are backwards-compatible, meaning the network still operates as a single entity even when some developers don't implement the new changes.

Famously scribbled by Ethereum co-founder Vitalik Buterin in 22 minutes, Ethereum improvement proposal EIP-7702 is an advanced way of marrying EIP-3074 and ERC-4337 to unlock massive adoption for Ethereum's smart wallet functionality. Slated to go live in the upcoming Pectra upgrade, EIP-7702 will implement an advanced version of account abstraction enabling features like batching that allows users to pay a one-off transaction fee for multiple actions, sponsorship to enable an account pay gas fees for other users and wallet recovery options if users misplace their seed phrase.

Layer 2 is a collective term for protocols that aim to scale Ethereum by processing batches of transactions off the Mainnet. After performing a series of mathematical computations to ensure their validity, these L2s send a compressed version of the transactions back to the Mainnet for final processing. As a result, Layer 2 networks reduce transaction fees and enhance the Mainnet's speed while reaping its security. Think of them like several personal assistants that help their boss to process a series of paperworks. These assistants send a summarised version of the paperworks to the boss who confirms and signs on them.

Layer 3 solutions are application-specific blockchains built upon existing Layer 2 networks to offer high scalability and interoperability. For example, an L3 can focus on tackling privacy, increased scalability, gaming, or some complex functionality while still ultimately deriving security from the Layer 1.

You May Also Like

XRP Holders Achieve Financial Freedom through BlockchainCloudMining

a16z warns of loopholes in draft cryptocurrency rules, recommends adopting a "digital commodity" regulatory framework