XRP Price News Today: Ripple’s Staking Expansion and Saylor’s $90M Bitcoin Buy Put DeepSnitch AI’s 1000x Potential Against XRP and Solana in February 2026

Ripple just bolted new staking and security integrations onto its institutional custody platform, letting banks offer Ethereum and Solana staking without operating their own validator infrastructure.

Meanwhile, Michael Saylor’s Strategy picked up another $90 million in Bitcoin at an average price near $78,800, even though BTC spent most of the week well below that level and briefly touched $60,000.

Institutions are doubling down, and XRP price news is reflecting that confidence. But if you’re the type to go after something with moonshot potential rather than single-digit upside, like XRP price movement, DeepSnitch AI is worth a deep look.

It’s an AI-powered platform that audits contracts, tracks whales, and detects scams in real time. The presale has crossed $1.53 million at $0.03906, up 158% from $0.01510, and it’s powering toward launch at an incredible rate.

Ripple deepens its institutional custody stack while Saylor buys Bitcoin below his own cost basis

Ripple’s latest upgrade integrates Securosys hardware security modules alongside Figment’s staking infrastructure, so it embeds compliance checks directly into custody workflows. The expansion follows Ripple’s corporate treasury platform launch and builds on broader institutional staking momentum: Figment expanded access through Coinbase back in October, and Anchorage Digital added Hyperliquid staking in November.

And Saylor’s latest purchase brought Strategy’s total to 714,644 BTC at an average cost of $76,056. To put that in perspective, Bitcoin hasn’t climbed above $72,000 since last Tuesday, echoing 2022 when Strategy slowed buying as BTC fell below its cost basis. Despite the pressure, though, Bernstein called the sell-off the “weakest bear case” on record and kept its $150,000 BTC target for 2026.

Ripple updates are scattered as the token racks up some institutional credibility, and the macro backdrop speaks to XRP’s overall resilience. Then again, a platform like DeepSnitch AI, priced at presale levels with live AI tooling and an imminent launch, fits into that optimistic picture with prospects of far higher upside to complement it.

XRP market updates meet DeepSnitch AI’s launch countdown and Solana’s overhead resistance

1. DeepSnitch AI

Most people hear “AI crypto tool” and think chart bots or automated signals, which is fair enough, but DeepSnitch AI is something totally different. This is a full surveillance system, built by expert on-chain analysts who know exactly what DYOR is supposed to look like. It’s got five AI agents working in concert to scan, audit, and explain what is really happening inside a token before you touch it.

What makes this token worth discussing alongside today’s XRP price news is the contrast in upside, especially with DeepSnitch AI’s launch coming up in a matter of days. Ripple is building custody rails for banks, but DeepSnitch AI is building intelligence rails for you. The entire system functions as one cognitive layer, so you can query, explore, and act without hunting through scattered feeds.

The investment case goes beyond the tools, though, not least because of the platform’s proven utility (early holders are already testing the system via the internal platform), but also because staking is live with dynamic uncapped APR, rewarding holders who participate early even more.

The timing could not be sharper either, as launch is only moments away. Once that happens, a 1000x run is firmly on the cards, but until then, DeepSnitch AI is still priced accessibly at $0.03906.

Buying in now is the best way to see the highest gains, and you’ll be betting on a system that already works, priced as though it has not launched yet. That kind of asymmetry does not last, especially not with a moonshot-worthy token like this one.

2. XRP

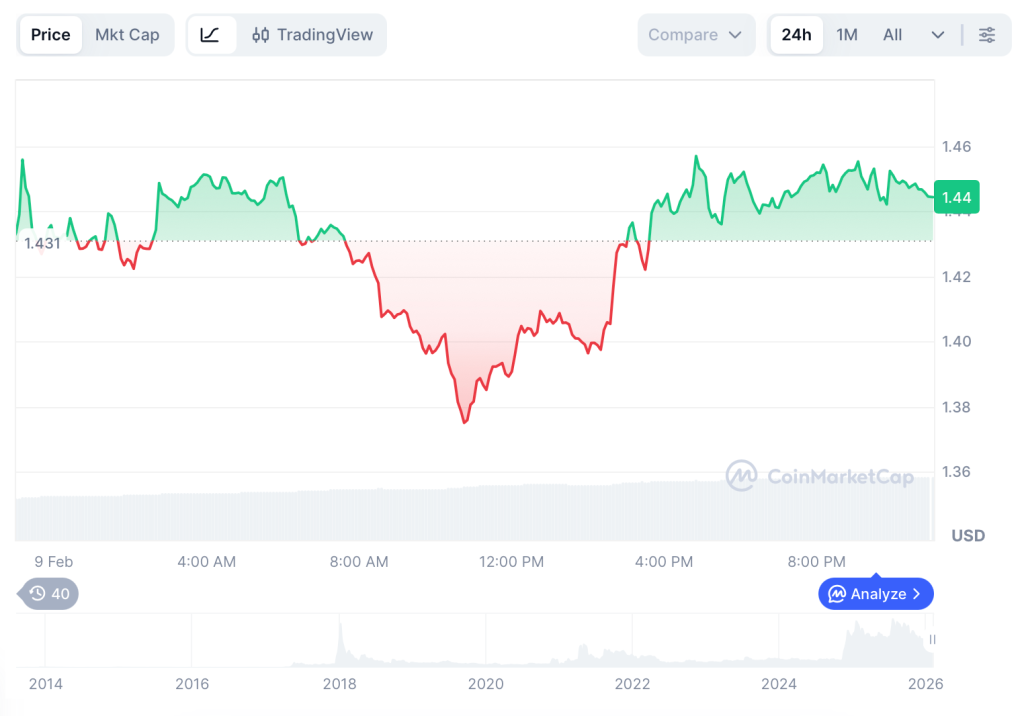

XRP was up about 1.1% to around $1.45 on February 9, bouncing on oversold technicals and positive social sentiment around the custody expansion. A hold above the $1.36 Fibonacci level keeps a retest of $1.54 alive, while a break below risks a revisit to the $1.13 low.

XRP could get to around $1.59 by year-end, so that would be around 10% upside, which really isn’t much, though it’s also something if you want slight gains and a lot of stability. The Ripple headlines reinforce the fact that XRP has strong fundamentals to fall back on, no matter what the market may be up to, but XRP’s price movement has a structural ceiling that presale-stage tokens like DeepSnitch AI don’t have to contend with. That’s why the latter has far more room to run.

3. Solana

SOL faced overhead resistance near key levels as the second week of February kicked off, with major altcoins stalling at range highs across the board.

Forecasts suggest SOL could reach above $117 before the year is through, which would bring in a roughly 35% gain. Solana’s throughput and developer ecosystem keep it competitive, and there is no doubt it remains a strong Layer-1.

Still, at its market cap, 100x returns are off the table, which isn’t at all the case for DeepSnitch AI.

Last look

XRP price news is optimistic enough, with the prospect of slight rewards over 2026, but the fact remains that large caps can’t really offer more than the percentage gains it has on the cards. DeepSnitch AI, however, has all the room in the world to run, and it has the utility and credibility to make that run too.

Priced at $0.03906 in Stage 5 of 15 with launch breathing down the calendar, this is the moment to buy, using the tiered bonus codes to multiply entry and earn dynamic uncapped staking APR while also riding the same price appreciation as your base buy.

Put simply, a bigger entry today compounds into a significantly larger position once the market prices in what is already working.

For the bonus codes and the presale, head over to the DeepSnitch AI official site, and be sure to track further updates on X and Telegram.

FAQs

What is the latest XRP price news in February 2026?

XRP was at about $1.45 on February 9, supported by Ripple’s expanded custody and staking integrations. XRP market updates point to steady institutional growth, but DeepSnitch AI at presale pricing with live tools and imminent launch offers a completely different tier of upside.

Why are investors watching DeepSnitch AI alongside XRP?

While Ripple updates strengthen XRP’s institutional foundation, DeepSnitch AI delivers AI-powered scam detection and whale intelligence at $0.03906 presale pricing with launch days away. XRP price movement projects around 10% by year-end, while DeepSnitch AI’s 100x potential is due to its different scale entirely.

What is the XRP price prediction for 2026?

Analysts project XRP could brush with $1.60 or so by year-end, but alongside solid XRP price news, there’s DeepSnitch AI at presale pricing with live AI tools, dynamic staking, and imminent launch for anyone wanting exponential returns instead.

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.

The post XRP Price News Today: Ripple’s Staking Expansion and Saylor’s $90M Bitcoin Buy Put DeepSnitch AI’s 1000x Potential Against XRP and Solana in February 2026 appeared first on CaptainAltcoin.

추천 콘텐츠

Propel to Report Q4 and Full Year 2025 Financial Results and Announces Dividend Increase

UK crypto holders brace for FCA’s expanded regulatory reach