Solana Price Prediction: Analysts See $250 Target But Rollblock Draws Attention For Bigger 30x Return

The Solana price prediction chart has become a hot topic as the token edges closer to the $250 mark after a strong summer rally. While Solana continues to impress with steady gains and network strength, another project is starting to dominate investor chatter.

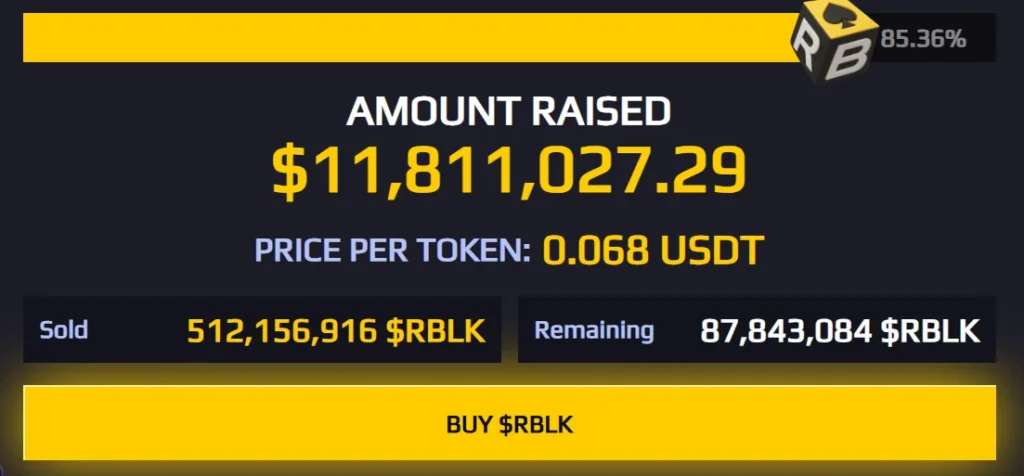

Rollblock (RBLK) has already raised more than $11.8 million in its presale, with 85% of tokens sold. Its early adoption and deflationary design are now drawing attention as a contender for far bigger returns.

Solana Price Prediction: Analysts Eye $250 Breakout

Solana has been one of the strongest performers through the summer, climbing from June’s dip at $126 to its current level around $244. The chart indicates a healthy sequence of increasing lows, which is backed by consistent volume and rising moving averages. Every pullback has had a great reception, with a belief in the underlying strength of Solana and its expanding ecosystem.

Source

The momentum has also gained significant traction since the beginning of August, when the level of trading volume shot up, together with a movement across critical resistance areas.

The short-term averages are still higher than the long-term averages, signifying a market bias that is still skewed towards the buyers. Solana is holding steady around the critical support zones, and despite a slight cooling off in trading, it has maintained the uptrend.

Analysts now see the $250 mark as the next target, with some suggesting the possibility of higher levels if volume expands again. Others remain cautious, warning that a failure to hold above $230 could bring short-term pressure. For now, Solana continues to build on its gains, with steady network growth adding to its market resilience.

Rollblock Draws Attention For Bigger 30x Return

Rollblock (RBLK) has emerged as one of the most talked-about projects in the crypto space, building its reputation on adoption rather than speculation. Long before its first exchange debut, the platform had already processed more than $15 million in wagers.

Its ecosystem spans over 12,000 gaming titles, including poker, blackjack, live dealer tables, and a growing sports prediction league. Licensed by Anjouan Gaming and fully audited by SolidProof, Rollblock provides a level of trust and accountability often missing in GameFi. Its tokenomics add another layer of strength.

Weekly revenue flows into token buybacks and burns, creating scarcity, while staking pools distribute steady returns to holders. This mix of adoption and deflationary design is what continues to attract both gamers and investors.

Several standout features are shaping current growth:

- More than 55,000 users actively participate on the platform.

- A capped token supply of one billion, securing scarcity.

- Fiat payment access through Visa, Mastercard, Apple Pay, and Google Pay.

- Staking rewards offering up to 30% APY.

With over $11.8 million raised in its presale and 85% of tokens sold at $0.068, Rollblock has already shown it can generate real traction. Speculators now point to its blend of adoption, transparency, and incentives as reasons why RBLK could deliver a potential 30x return once it reaches broader markets.

Solana Price Prediction Meets Rollblock’s Bigger Ambition

Solana price prediction chart may be holding the spotlight with talk of a $250 target, but Rollblock is steadily rewriting the narrative. With more than $11.8 million raised in its presale and 85% of tokens snapped up at $0.068, RBLK is proving it has the traction to go beyond speculation. Many now see Rollblock’s mix of adoption and scarcity as the catalyst that could one day outpace Solana’s market strength.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

This article is not intended as financial advice. Educational purposes only.

You May Also Like

Essential Guide: Binance Pauses RUNE Network Upgrade – What Traders Must Know

Dogecoin’s Strongest Support Zone Revealed—Here’s The Level