Altcoin Wipeout: ETH, XRP Selloff Triggers $600 Million in Liquidations

The entire cryptocurrency market turned red on Monday morning after the relatively calm weekend trading, but the altcoins are leading the pack this time.

At the same time, bitcoin has also retreated but in a more modest manner, which has increased its dominance over the market.

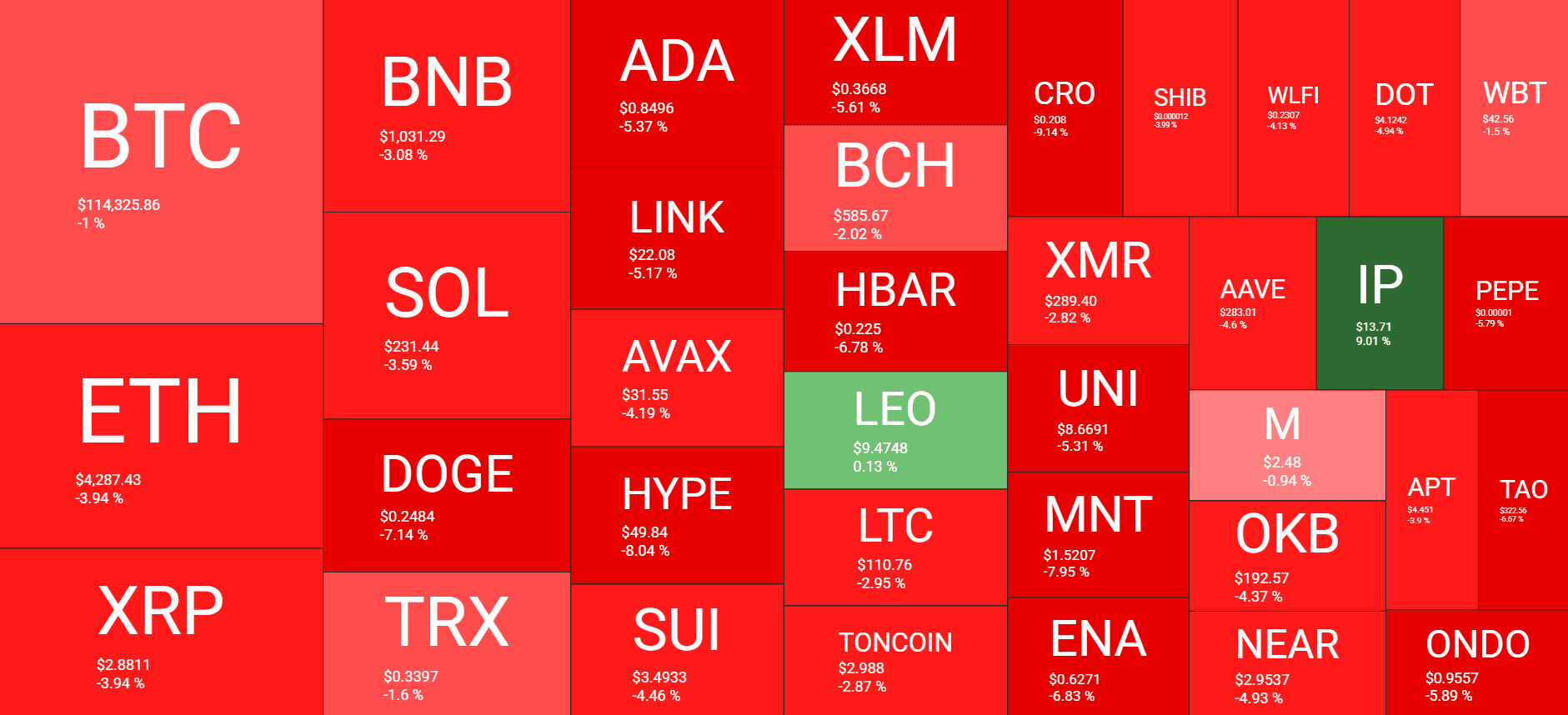

Cryptocurrency Market Overview. Source: QuantifyCrypto

Cryptocurrency Market Overview. Source: QuantifyCrypto

The chart above demonstrates a very clear picture of the current sentiment among the altcoins. The largest of the bunch has set the trend with a 4% drop that has taken it to a weekly low of under $4,300. ETH was rejected on a couple of occasions at $4,700 in September, and its inability to resume its bull run has caused a substantial retracement.

XRP lost the crucial $3 support during the weekend, and its situation has only worsened since then. Despite numerous big price predictions for a surge to its all-time high of $3.65, the asset is down by 4% as well and sits beneath $2.9 as of press time.

Even more painful declines come from the likes of ADA, LINK, DOGE, HYPE, and CRO. HYPE has dumped by 8% to under $50 as Arthur Hayes disposed of his holdings, while CRO has plunged by 9% after reports about a data breach against the exchange behind it.

Although there are exceptions like IP, which are well in the green, they are very few, and most other mid- and lower-cap alts are down by substantial percentages. The total crypto market cap has lost another $60 billion in a day and is down to $4.060 trillion on CG.

In contrast, BTC’s dominance has risen to well over 56% as bitcoin’s price has dropped by a more modest 1%.

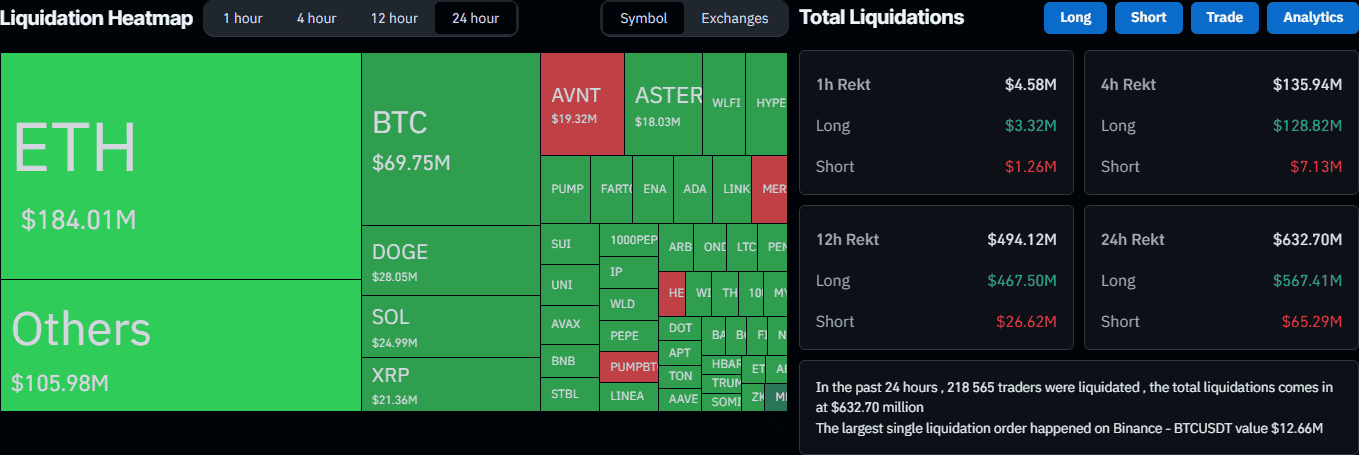

Data from CoinGlass shows that the overall value of wrecked positions has skyrocketed to more than $630 million daily, and nearly 220,000 traders have been liquidated. ETH is the leader, with over $184 million out of the entire amount.

Liquidation Heat Map. Source: CoinGlass

Liquidation Heat Map. Source: CoinGlass

The post Altcoin Wipeout: ETH, XRP Selloff Triggers $600 Million in Liquidations appeared first on CryptoPotato.

You May Also Like

Visa Expands USDC Stablecoin Settlement For US Banks

North America Sees $2.3T in Crypto