Trump Wants GENIUS Bill Sent Straight to His Desk, Without Congressional Tweaks

US President Donald Trump has called on the House of Representatives to swiftly pass the GENIUS Act without making any amendments, urging lawmakers to deliver the bill to his desk “ASAP.”

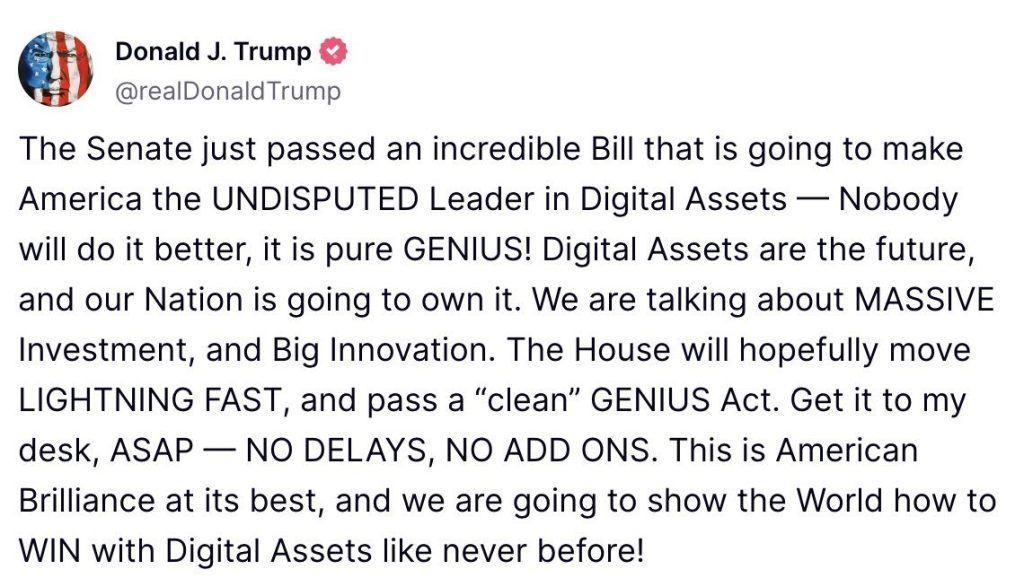

In a post on Truth Social Thursday, Trump celebrated the Senate’s approval of the bill and warned against any attempts to delay or tweak it.

“The Senate just passed an incredible Bill that is going to make America the UNDISPUTED Leader in Digital Assets,” he wrote. “Get it to my desk, ASAP — NO DELAYS, NO ADD ONS.”

The push comes a day after the Senate passed the GENIUS Act in a 68 to 30 vote, with 18 Democrats joining most Republicans in support.

Formally known as the Guiding and Establishing National Innovation for US Stablecoins Act, the bill represents Congress’s first major attempt to regulate stablecoins, which are crypto tokens pegged to the US dollar.

Source: Truth Social/@realDonaldTrump

Source: Truth Social/@realDonaldTrump

GENIUS Act Faces Scrutiny Over Trump’s Crypto Gains Ahead of House Debate

Next, the House is expected to take up the measure, with Republicans holding a narrow majority. While GOP leadership is likely to support the bill, partisan tensions remain.

The GENIUS Act failed its initial Senate vote in May. This was largely due to concerns about Trump’s ties to the crypto industry. Sen. Elizabeth Warren, one of the bill’s strongest critics, raised serious objections. She accused the president and his family of standing to make “hundreds of millions” if the bill becomes law.

Trump’s USD1 stablecoin reportedly brought in $57m last year. Despite the controversy, several Democrats say the need to regulate the growing stablecoin sector is urgent. Sen. Mark Warner, who also raised concerns about Trump’s crypto ventures, argued that the US cannot afford to remain on the sidelines while other countries move forward with digital asset policy.

With Backing from Industry, Stablecoin Bill Moves Ahead Despite Regulatory Gaps

If the House passes the GENIUS Act, it would create a federal licensing system for stablecoin issuers. Each token would be required to maintain full 1:1 backing with US dollars.

In addition, the bill would restrict how reserves are used, limiting them to redemptions and low-risk investments such as Treasury repos. It also mandates anti-money laundering checks and basic consumer protections.

Once cleared by the House, the bill would head to President Trump for his final signature.

Large crypto firms have largely welcomed the legislation. Many have spent millions lobbying in Washington to shape digital asset rules. However, critics say the bill leaves important gaps.

While it prohibits members of Congress and their families from profiting off stablecoins, it does not apply the same rule to the president or first family. As a result, Trump could continue issuing stablecoins even as he signs the regulations governing them into law.

Other provisions in the bill have also drawn criticism. It prohibits yield-bearing stablecoins, a move some say protects traditional banks but stifles innovation. Additionally, the bill’s strict compliance rules could increase costs. This may push out smaller issuers and concentrate power among a few large players.

Even so, momentum appears to favor the bill. Trump’s allies see his urgency as a strategy to lock in digital asset policy. They hope to avoid delays from drawn-out Congressional negotiations or the risk of the bill being bundled with more contentious crypto legislation.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Vitalik Buterin Questions the Continued Relevance of Ethereum’s Layer 2 Solutions