Ethereum Co-Founder Vitalik Buterin Introduces Fusaka: Ethereum’s Most Ambitious Scaling Solution Yet

Ethereum co-founder Vitalik Buterin has unveiled Fusaka as the network’s most ambitious scaling upgrade, set to activate on December 3 with revolutionary technology that eliminates the need for any single computer to download complete blockchain data.

The upgrade introduces PeerDAS, allowing validator nodes to verify information by checking small random pieces rather than entire data blocks.

Buterin described the technology as “unprecedented” for live blockchains, as it enables massive scalability improvements while maintaining security.

Each network participant downloads only small “chunks” to probabilistically verify that sufficient data exists for complete reconstruction when needed.

The upgrade addresses mounting pressure on Ethereum’s base layer amid criticism that Layer 2 solutions create fragmented user experiences.

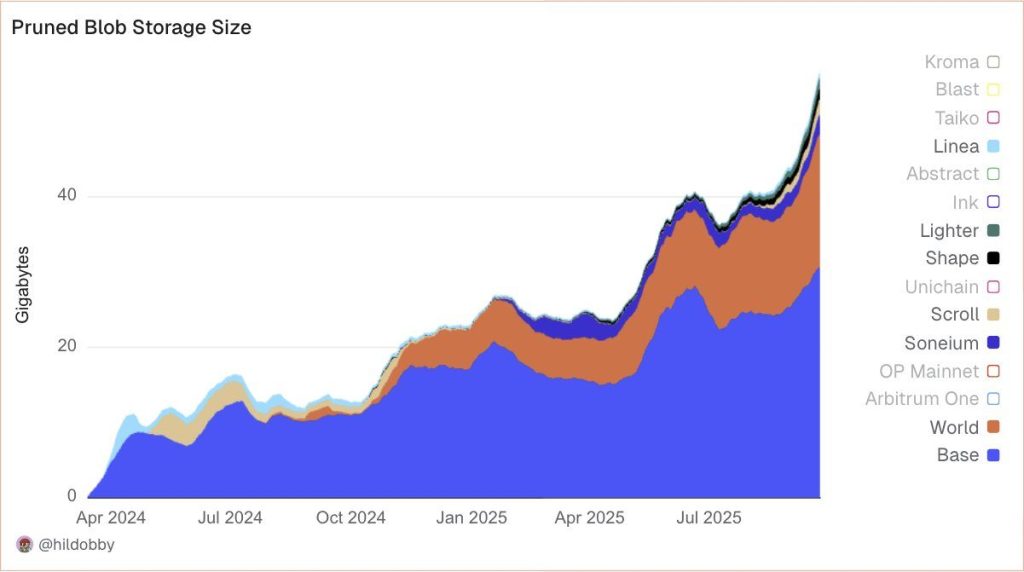

Source: X/@hildobby

Source: X/@hildobby

Current network congestion forces over 2 million ETH into exit queues, facing 43-day delays, while entry processing completes in just 7 days.

Fusaka will more than double blob capacity within two weeks through automated parameter-only forks, expanding from the current limits of 6/9 blobs to 14/21.

The phased approach begins with conservative increases before becoming more aggressive as the technology proves stable.

The upgrade comes as Ethereum’s revenue fell 44% to $14.1 million in August despite ETH reaching new all-time highs above $4,950.

Layer 2 adoption has reduced base layer fee generation, creating sustainability concerns about the network’s economic model.

Revolutionary Data System Changes Everything

As reported earlier, the Fusaka Upgrade is scheduled to go live on December 3, and PeerDAS will fundamentally alter how the blockchain networks handle information by distributing data verification across thousands of computers, rather than requiring complete downloads.

Traditional systems force every participant to store entire blocks, creating bottlenecks as networks grow larger.

The new approach uses mathematical probability to ensure data availability. If more than 50% of data chunks remain accessible across the network, any computer can theoretically download those pieces and reconstruct missing information using erasure coding techniques.

Initially, complete data blocks must still exist in one location for broadcasting new information and emergency reconstruction when publishers provide incomplete data.

However, these roles remain untrusted, requiring only one honest participant among potentially hundreds of dishonest actors.

Future developments will eliminate even these centralized functions through cell-level messaging and distributed block building.

Different computers can handle these tasks for different blocks, which further decentralizes the entire process.

Notably, Buterin emphasized the cautious testing approach core developers have adopted despite years of development work.

The conservative blob count initially increases and will become more aggressive as real-world performance validates the technology’s stability and security.

Ethereum Battles Revenue Crisis With Infrastructure Focus

The Fusaka upgrade addresses Ethereum’s growing economic challenges as Layer 2 networks reduce mainnet transaction demand.

August revenue of $14.1 million marked one of the weakest months since early 2021, which has raised concerns about sustainability.

Witnessing this, Buterin recently proposed low-risk DeFi protocols as Ethereum’s potential revenue anchor, comparing the model to Google Search funding broader company operations.

He suggested protocols offering 5% yields on blue-chip stablecoins could provide economic stability without compromising ethical foundations.

These protocols include mainstream lending platforms like Aave, where users can earn stable returns by supplying USDT and USDC to borrowers without speculative risks.

Fusaka’s infrastructure improvements will reduce transaction costs for such applications, making them accessible to everyday users who previously faced prohibitive gas fees when interacting with DeFi protocols.

The upgrade includes 11-12 Ethereum Improvement Proposals targeting scalability and node efficiency improvements.

Blob parameter-only forks will activate automatically based on predetermined schedules rather than requiring separate network upgrades.

Additionally, recent controversies in the validator queue also add to the ongoing scalability pressures.

However, Buterin defended the current 43-day exit delays as essential security features, comparing validator commitments to military service, which requires “friction in quitting.”

The upgrade follows May’s successful Pectra implementation, which introduced account abstraction and increased validator staking limits from 32 ETH to 2,048 ETH.

That upgrade delivered infrastructure improvements for social recovery wallets and smart contract execution capabilities.

For Fusaka, the improvements in data availability will support the next growth phase of Ethereum, while maintaining the security guarantees that distinguish Ethereum from its competitors.

You May Also Like

Jerome Powell’s Press Conference: Crucial Insights Unveiled for the Market’s Future

Shiba Inu Price Forecast for Feb 9: Here’s Key Overhead Resistance for Any Move Upwards