Bitmine Scoops Up Another 28,625 Ethereum ($82.1M) as Market Bleeds – Details

Ethereum is fighting to hold the $2,800 level after a brutal correction that has erased more than 45% of its value since late August. The sharp decline has flipped market sentiment decisively bearish, with many traders fearing that ETH has entered a prolonged downtrend. Bulls are struggling to establish a reliable support level, and the lack of strong buy-side reaction so far has only intensified uncertainty. Liquidity continues to thin out across major exchanges, reinforcing the narrative that the market is still deep in a risk-off phase.

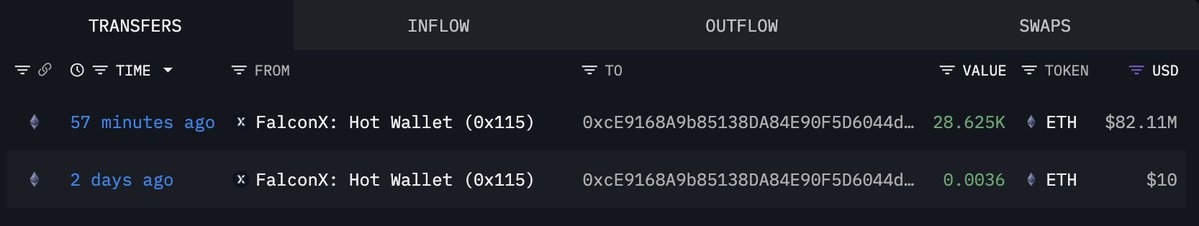

Yet, despite the heavy selling pressure and underwhelming price performance, not all major players are stepping back. In fact, some are doubling down. Fresh on-chain data from Lookonchain reveals that Tom Lee’s Bitmine — a well-known crypto-focused investment operation—continues to buy ETH aggressively at current prices. Bitmine has been one of the few entities consistently adding to its position during the downturn, signaling strong conviction that Ethereum remains undervalued in the long term.

This divergence between retail fear and whale accumulation is becoming increasingly notable. As ETH hovers around a critical psychological level, the coming days may determine whether this whale’s confidence translates into broader market stabilization or remains an isolated bet against the prevailing trend.

Bitmine’s Aggressive Accumulation Signals Confidence

According to Lookonchain, Tom Lee’s Bitmine has continued its aggressive accumulation, purchasing another 28,625 ETH worth $82.11 million. This move reinforces the growing narrative that some of the market’s most sophisticated players are positioning for a rebound despite the prevailing fear and relentless selling pressure. Large-scale buying during deep corrections has historically aligned with early reversal zones, and Bitmine’s conviction adds weight to the idea that Ethereum may be approaching a significant turning point.

Still, a recovery is far from guaranteed. ETH remains trapped near the $2,800 zone, a level that has acted as a fragile line of defense during this downturn. For momentum to shift, Ethereum must not only hold this area but also reclaim the $3,000 mark, which has now flipped into an important resistance zone. A decisive move above this level would signal that buyers are finally stepping back in with strength, potentially setting the stage for a broader trend reversal.

Until then, the situation remains delicate. Bitmine’s accumulation offers a bullish signal, but without confirmation from price structure, Ethereum continues to walk a tightrope. A failure to hold current levels could invite another wave of capitulation, but stability here may spark the rebound whales seem to be anticipating.

Testing a Major Weekly Support Zone

Ethereum’s weekly chart shows the asset sitting on a critical support zone after a steep decline from the $4,800 region. Price has now pulled back to around $2,800, a level that aligns closely with the 200-week moving average—a historically important area where ETH has often found long-term support. This zone previously acted as a launchpad during major market reversals in both 2022 and mid-2023, making its defense crucial for maintaining broader structural strength.

The recent breakdown below the 50- and 100-week moving averages highlights the intensity of the current selloff. Momentum clearly shifted in favor of bears over the past weeks, with several large red candles confirming aggressive distribution. However, ETH’s current stabilization attempt above the 200-week MA signals that buyers are finally stepping in, preventing a deeper slide toward $2,400.

If Ethereum can hold above this support area and reclaim the psychological $3,000 level, a recovery structure could begin to form. But if the 200-week MA breaks convincingly, the market could face a more prolonged correction.

Featured image from ChatGPT, chart from TradingView.com

You May Also Like

Regulatory Clarity Could Drive 40% of Americans to Adopt DeFi Protocols, Survey Shows

Michael Burry’s Bitcoin Warning: Crypto Crash Could Drag Down Gold and Silver Markets