Glassnode Explains Why $2 Is a Critical Zone for XRP

Market intelligence platform Glassnode has buttressed the importance of the $2 psychological price mark to XRP investors.

XRP recovered to close above $2 last week after a push below. The fourth-largest cryptocurrency by market cap dropped to a low of $1.82 in the previous week, but ETF momentum and a broader market recovery saw it bounce to close at $2.04.

This momentum has spilled into the new week, spurring a near 7% increase. Notably, XRP reached an intra-week high of $2.28 before relinquishing some of its upside today.

The $2 Mark Is Crucial for XRP

Meanwhile, XRP is still trading above the $2 zone at the time of writing, an area Glassnode believes is essential to XRP investors’ psychology. The platform identified how holders have reacted to XRP reaching the price mark since early 2025.

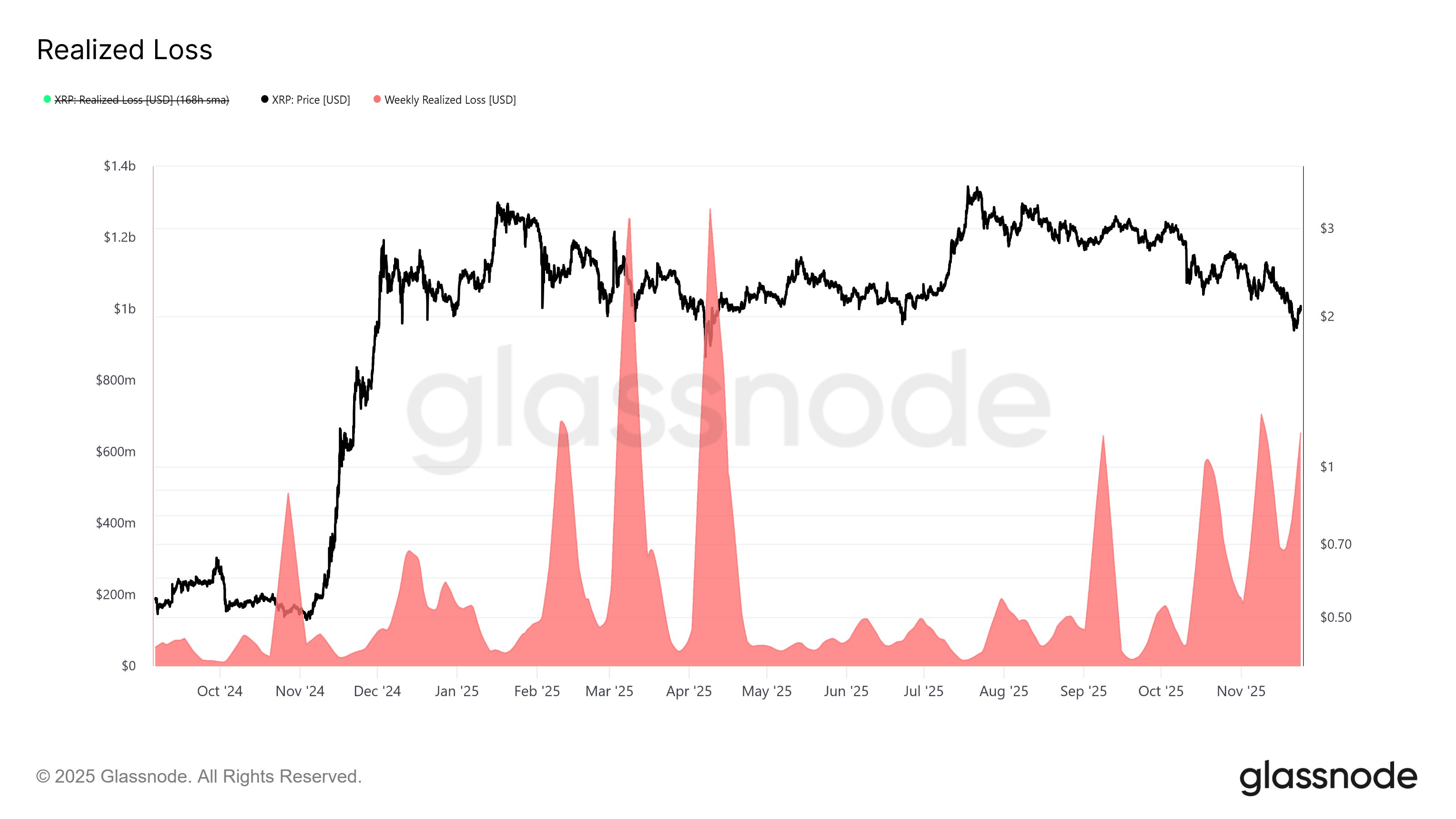

For context, the November 24 report shows that investors have realized losses of between $500 million and $1.28 billion per week each time XRP drops to the psychological level since March. An accompanying chart shows that when XRP fell to $1.90 in early March, holders realized losses slightly above $1.2 billion per week.

XRP Realized Losses/Glassnode

XRP Realized Losses/Glassnode

A similar scenario happened during the April drop to $1.61. Investors also sold their holdings at a combined loss of nearly $1.3 billion per week. Glassnode highlighted that this emphasizes how investors behave towards the $2 price level. Specifically, a drop below raises skepticism, resulting in the sales even at a loss, while holders remain optimistic above the zone.

Notably, this builds on an earlier report showing that XRP’s daily realized losses have spiked to $75 million daily, the highest level since April. They increased their selling spree from $50 million per day in early October.

Whales Take Profit Amid 17% Rally

In a parallel social media post, analyst Ali Martinez noted that whales are taking profit amid the price rebound. Notably, XRP has rallied over 17% in the last 72 hours, outperforming most major cryptocurrencies.

While it showed signs of recovery, whales holding between 1 million and 10 million XRP locked in profits, selling over 180 million tokens in the process. Further analysis shows that the selloff campaign brought these whales’ new stash to 4.74 billion XRP.

Despite these, XRP seems to be standing strong. The token remains well above $2, specifically changing hands at $2.20, spurred by the ETF buzz. For perspective, the Franklin Templeton and Grayscale XRP ETFs launched yesterday in the US market and had an immediate impact.

They attracted a combined $130 million in positive flow, bringing the net inflow into US XRP ETFs on Monday to $164 million. This institutional lure has absorbed selling pressure, fostering its over 7% 24-hour growth.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

ServicePower Closes Transformative Year with AI-Driven Growth and Market Expansion