A look at seven new RWA projects on the chain: KTA has a market value of over US$900 million, and the on-chain capital market has become a hot spot

Author: Nancy, PANews

As traditional financial giants are bringing in capital, coupled with increasingly clear policy supervision, the RWA track is accelerating into the mainstream vision. Once a small circle of exploration, asset chaining is now becoming a bridgehead for compliance innovation. Recently, a new wave of "compliance + imagination" has quietly set off on the chain, and many projects with the RWA label have attracted market attention.

In this article, PANews takes stock of the seven new on-chain forces that have been active under the RWA narrative recently, covering Base, BNB Chain and Solana ecosystems. Most projects are evolving in multiple dimensions such as application implementation, compliance practices and ecological linkage, taking into account both narrative imagination and practical implementation.

Keeta (KTA)

Keeta (KTA) is a Layer1 network based on the Base network, connecting the global financial system, with built-in KYC real-name authentication, digital identity, on-chain foreign exchange (FX) mechanism and flexible rule engine. Officially stated that it is the first blockchain network that can truly support compliant financial transactions on a global scale. Keeta previously received $17 million in funding from former Google CEO Eric Schmidt, and the investment was valued at $75 million at the time. CEO Ty Schenk was a partner of investment institution Steel Perlot and director and CEO of LFG Payments.

GMGN data shows that as of May 26, KTA's market value has recently exceeded US$910 million, and the number of coin holding addresses has exceeded 73,000.

Related reading: With an 8-fold increase in a single month, supported by Google’s halo and the boast of 10 million TPS, is the new L1 Keeta a potential stock or just a hype concept?

BUILDon (B)

BUILDon (B) is a popular MEME coin deployed on BNB Chain and the main trading medium of USD1, a US dollar stablecoin backed by the Trump family. GMGN data shows that as of June 26, the market value of $B once exceeded 460 million US dollars, setting a record high, and the number of addresses holding the coin exceeded 25,000.

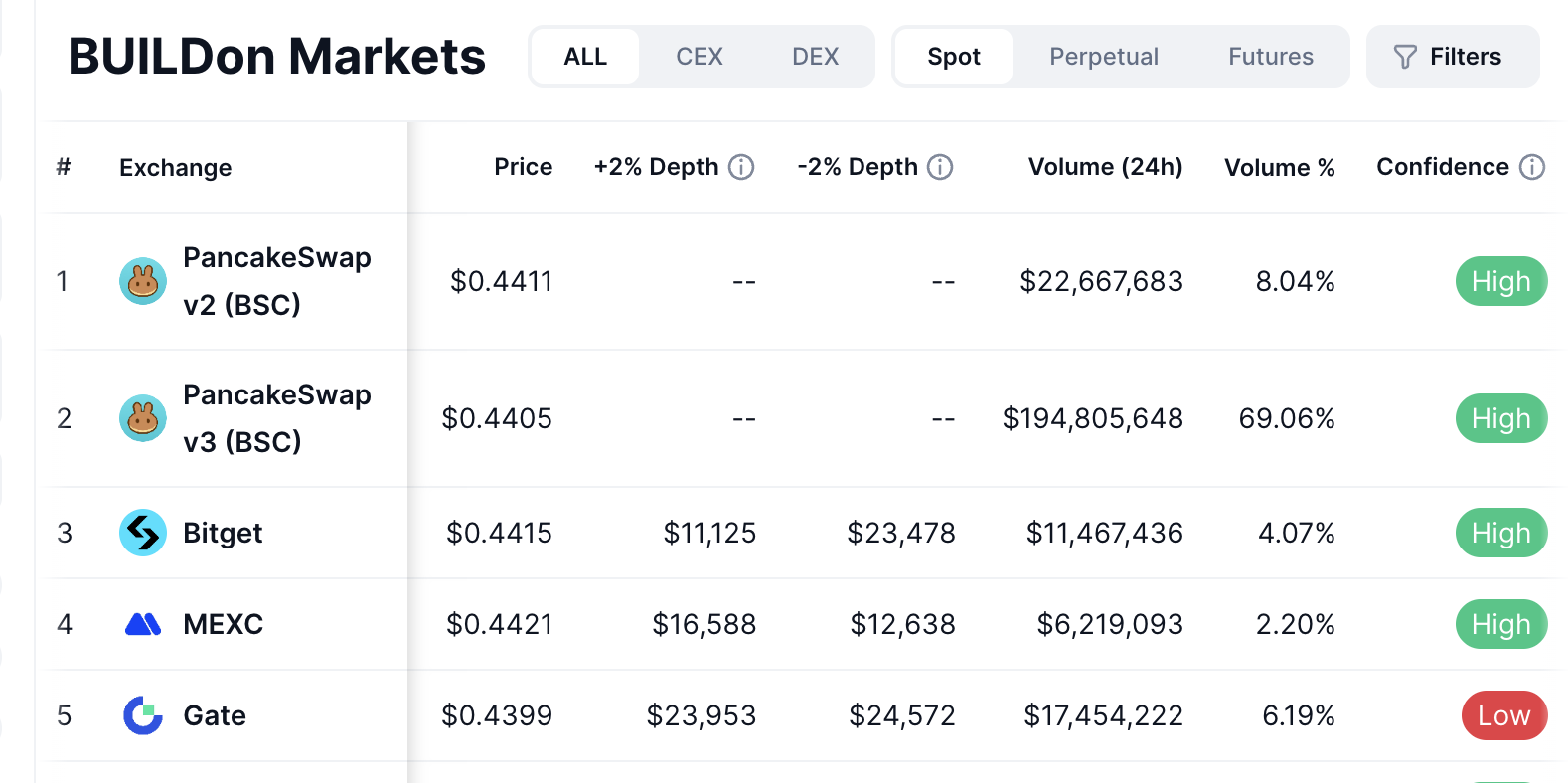

According to the latest data from DeFiLlama and CoinMarketCap, as of May 26, 98.88% of USD1 issuance was concentrated in BNB Chain. In the past 24 hours, among all $B-related trading pairs, the transaction volume of the B/USD1 trading pair exceeded US$190 million, accounting for 69.06%, which shows the core position of $B in the USD1 ecosystem.

In addition, $B has received support from the mainstream exchange Binance and has been listed on Binance's Alpha platform and contract trading section. At the same time, Binance also announced that users will enjoy zero handling fees when withdrawing USD1 through BNB Chain, which will further stimulate the trading activity of USD1 ecological projects including $B. It is worth mentioning that WLFI, a crypto project under the Trump family, has recently officially purchased $B, which is the first time the institution has entered into MEME coin investment.

In terms of policy, the US GENIUS Stablecoin Act has recently passed the Senate vote, and now only needs the final approval of the House of Representatives and President Trump. Once the legislation is passed, it will lay a compliance foundation for the stablecoin market and have far-reaching impacts. According to a report by Citibank cited by The Block, Citi predicts that the market value of stablecoins will reach 1.6 trillion US dollars by 2030 under the baseline scenario and 3.7 trillion US dollars under the optimistic scenario. If the regulatory framework is in place, the issuer of stablecoins may become one of the largest holders of US debt. For emerging US dollar stablecoins such as USD1, compliance support and ecological integration will release greater potential, or make its main trading medium $B more imaginative.

ALLO (RWA)

ALLO (RWA) aims to build the world's first tokenized securities exchange, providing 7×24 hour trading, ultra-low fees and instant settlement, and has received support from institutions such as NGC Ventures, Morningstar Ventures and Gate. According to official disclosures, Allo has achieved $2.2 billion in RWA tokenization, pledged $50 million in Bitcoin, and launched a $100 million lending pool. Last year, ALLO was selected for the BNB Chain MVB8 acceleration program, and the token $RWA was recently launched on Binance Alpha.

GMGN data shows that as of May 26, the market value of $RWA has recently exceeded US$200 million, and the number of addresses holding the currency has exceeded 12,000.

Collaterize (COLLAT)

Collaterize is building an Internet capital market based on the Solana network, and is committed to creating the largest RWA asset pool on the market, enabling access, trading, and management of all tokenized assets. The $COLLAT token aims to introduce more individuals into the RWA tokenization process, allowing users to easily access a range of real assets on the chain. Pierre, co-founder of Collaterize, has worked for Microsoft and IOTA. Recently, Collaterize has received interactive support from Solana officials and co-founder Toly on many occasions.

GMGN data shows that as of May 26, the market value of $COLLAT has soared since May, reaching a peak of over US$91 million, and the number of addresses holding the currency has exceeded 13,000.

Paraverse (PVS)

Paraverse (PVS) includes ParaLab, a decentralized cloud rendering platform for XR and 3D assets, and ParaHere, a Web3 trading platform. Its practical token PVS is a core tool for payment, rewards, and governance within the ecosystem. Users can access high-performance cloud rendering services and earn staking rewards by holding PVS. The token was officially launched on Solana in March this year. According to official disclosures, Paraverse has attracted more than 1,000 corporate partners and more than 10,000 independent developers worldwide since 2016, with applications covering digital twins, education and training, medical rehabilitation, and virtual live broadcasts.

GMGN data shows that as of May 26, the market value of PVS has exceeded 18 million US dollars, and the number of coin holding addresses has exceeded 7,600.

GitFish (Linux)

GitFish is an innovative platform based on Solana, which aims to tokenize and trade the open source code base on GitHub, that is, to allow users to convert GitHub code base into tradable tokens, and the code base owner can obtain certain fees (such as swap fees) through transactions. GitFish is incubated by Alliance DAO and has received forwarding or reply support from Solana, Raydium and Helius. The pre-sale of GitFish's first project $Linux ended within three days, attracting about $7.5 million in capital injection. However, Linus Torvald, the father of Linux, responded in his latest response that he did not participate in any activities of GitFish.

GMGN data shows that as of May 27, $Linux has been falling since its opening, and its current market value is approximately US$10 million, almost half of its private placement price of US$2.3.

Convergent (CVGT)

According to the official introduction, Convergent (CVGT) is an LSDFi protocol built on Solana, supported by Jito and Pyth Network. The protocol allows users to mint stablecoin USV by over-collateralizing SOL with an interest rate of 0%. The protocol will pledge the user's pledged SOL to Jito, so that users can continue to receive staking rewards and income in the background while holding $USV. The minted $USV can be used to participate in DeFi applications in the Solana ecosystem. $CVGT is Convergent's governance token, and holders can earn protocol income and vote on protocol parameters (such as emissions, fees, and collateralization rates). Convergent claims that there is no pre-sale, VC round, or seed unlocking.

GMGN data shows that as of May 26, the market value of CVGT has recently climbed to more than US$7 million, and the number of addresses holding the coin has exceeded 2,500.

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Vitalik Buterin Questions the Continued Relevance of Ethereum’s Layer 2 Solutions