Plasma, which has raised over $24 million in funding to build a blockchain dedicated to stablecoins, what is the difference?

Author: Zen, PANews

Stablecoins are becoming the core carrier of on-chain payments, asset settlement and financial services, but the existing blockchain infrastructure has not been optimized for its characteristics - problems such as high transaction costs, performance bottlenecks and centralization risks are still common.

Plasma proposes a targeted solution: building a high-performance Bitcoin sidechain designed specifically for stablecoins, while being compatible with the EVM, providing zero-fee transactions, enhanced security and scalability.

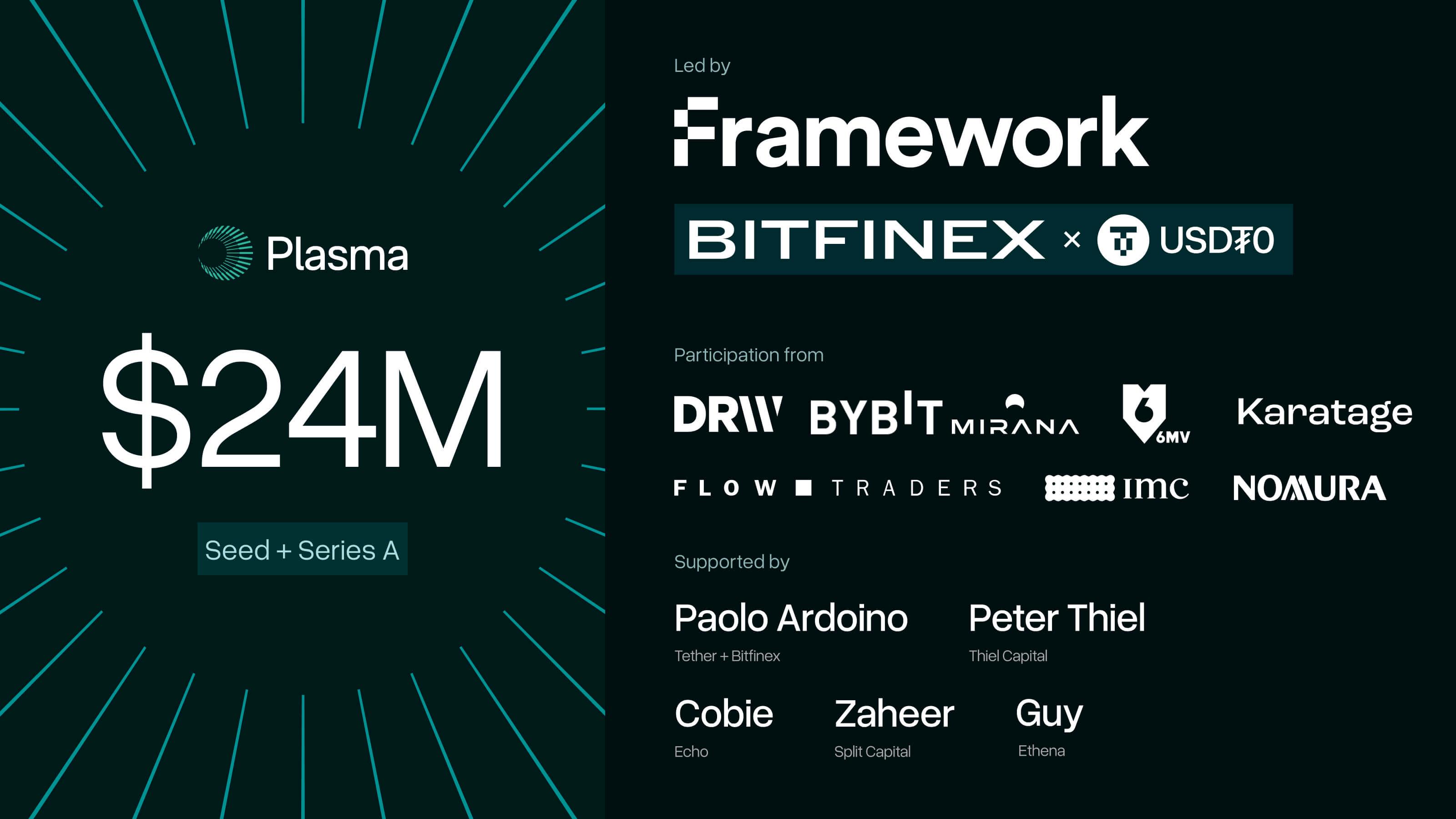

This idea has attracted market attention. In February this year, Plasma announced the completion of a $24 million financing, with investors including Framework Ventures, Bitfinex, Founders Fund, Tether CEO Paolo Ardoino and trader Cobie. In addition, Sonar, the first ICO product of the Echo platform founded by the well-known trader Cobie, also chose Plasma's initial token issuance as its "debut".

Why Stablecoins Need Dedicated Blockchains

According to the "BIG IDEAS 2025" report released by ARK Invest at the beginning of this year, the annualized transaction volume of stablecoins will reach 15.6 trillion US dollars in 2024, which is 119% and 200% of Visa and Mastercard respectively.

As a true "killer application" in the crypto field, stablecoins play a key role in multiple scenarios such as payment, cross-border settlement, DeFi, and on-chain transactions, attracting more and more new projects and traditional enterprises to accelerate their entry and build a new product ecosystem around them. Plasma takes the stablecoin infrastructure as the entry point, aiming to build a high-throughput, scalable blockchain specifically for stablecoins, and become the global settlement and issuance layer of the digital dollar.

The Plasma team believes that the mainstream public chains that stablecoins currently rely on have defects: Ethereum, which was the first to introduce stablecoins, is not ideal in payment scenarios due to its high gas fees; although Tron has won the market with low fees and fast speed, its number of nodes is limited and controlled by a single entity, and the network is too centralized.

Faced with the challenges of high fees and centralization, Plasma proposed a new blockchain designed specifically for stablecoins. It plans to build a sidechain on the Bitcoin blockchain and be fully compatible with the Ethereum Virtual Machine (EVM). This design is intended to meet the foundation of decentralized financial activities while leveraging Bitcoin's security and providing zero-fee USDT transactions to fundamentally unlock the potential of a trillion-dollar stablecoin market.

Plasma's vision and ideas have also received a positive response from the capital market. In February 2025, Plasma announced that it had raised a total of US$24 million in the seed round and the A round, led by Framework Ventures and Bitfinex. Participants also included well-known institutions such as Bybit, Flow Traders, 6th Man Ventures, IMC, and Nomura Securities, as well as angel investors such as Tether CEO Paolo Ardoino, Founders Fund founder Peter Thiel, crypto Kol Cobie and Zaheer Ebtikar.

In addition, Founders Fund, a well-known venture capital firm founded by Peter Thiel, announced a strategic investment in Plasma on May 22, 2025 to further accelerate its process of promoting the adoption of stablecoins in key regions such as Latin America and the Middle East.

Inheriting the security of the Bitcoin network, it plans to launch a "zero-fee" transfer mechanism

"Because Bitcoin's unparalleled security and decentralization provide an ideal foundation for global stablecoin settlement, and Bitcoin itself is a premier store of value asset." The Plasma team believes that Bitcoin's robust, trustless network provides tamper-proof security and provides a solid foundation for its system. This is the original intention of launching the Bitcoin sidechain.

In terms of the core consensus mechanism, in order to achieve a balance between certainty and processing efficiency, the team independently developed PlasmaBFT, which is based on Fast HotStuff and supports processing thousands of transactions per second, meeting the transaction speed requirements of global stablecoin payments. PlasmaBFT is written in Rust and is optimized for low end-to-end latency (i.e., the latency from sending a request to receiving a submitted response).

In addition, Plasma does not operate in isolation, but achieves trust-minimized security inheritance by anchoring the state root to the Bitcoin network. This design approach allows Plasma to achieve a security level comparable to Bitcoin without relying on a single verification node or intermediary, reducing the risk of single point failure or attack, and providing a solid trust foundation for large-scale liquidation of stablecoins.

According to the official introduction, the deployment of the Plasma consensus mechanism will be carried out in three stages:

-

Trusted Validators: At the initial launch of the mainnet, validation will begin with a selected group of trusted entities. This controlled phase aims to establish a stable and secure network and provide support for further protocol improvements.

-

Scaling and scalability testing: Expanding the validator set to rigorously test Plasma’s horizontal scalability and performance with larger committees.

-

Full Decentralization: In the final phase, Plasma will transition to a permissionless model where anyone can become a validator, achieving full decentralization and enhancing network security.

In response to the pain point of high transaction fees, Plasma has launched a "zero-fee" transfer mechanism for stablecoins such as USDT and USDC, which will enhance the universality and convenience of stablecoin payments, especially for a large number of daily micropayment scenarios. The Plasma network adopts a block architecture and is designed with two parallel processing layers. One layer is responsible for normal fee transactions, which is faster; the other layer is dedicated to free transactions, which is slightly slower. This allows users to choose to be free, but need to "wait in line", or they can pay directly to take the fast track. In order to ensure the smooth flow of channels, Plasma has also added order mechanisms, including rate limits, minimum balance requirements, and replacement strategies to maintain overall efficiency and normal operation of the network.

Echo Snonar first phase project, please pay attention to the lock-up rules

XPL is the native token of the Plasma network, used to maintain consensus and security and as an execution layer fuel. Plasma said that the XPL token plays a core role in the system. It will not only ensure the security of the PlasmaBFT consensus mechanism, support Reth-based EVM execution, but also support the Bitcoin bridge with minimal trust.

The XPL public sale is conducted on the Plasma official website. Participants need to use the same wallet as when making deposits and complete compliance processes such as KYC identity verification and jurisdiction screening through the Echo Sonar platform. Pre-deposits will be open on June 9, and the actual sale will begin a few weeks later. Each participant's number of units corresponds to a guaranteed allocation quota, and XPL can be purchased using a variety of stablecoins. If some participants do not subscribe to their shares, the remaining XPL will be available to users willing to make additional investments in proportion. This round of public offering plans to sell 10% of the total XPL, corresponding to a fully diluted valuation of US$500 million. US investors must be qualified investors, and their XPL tokens will be locked for 12 months after the mainnet is launched.

During the deposit phase: Participants deposit stablecoins such as USDT, USDC, USDS or DAI into the Plasma Vault on Ethereum, and the vault contract deploys the funds to Aave and Maker to generate income. During the deposit period, participants accumulate "units" based on the duration of the deposit. The number of units reflects their deposit proportion and ultimately determines the guaranteed allocation share of XPL. There is an initial limit of US$100 million at the beginning of the deposit period, which may be gradually relaxed over time. Participants can withdraw funds at any time during the deposit period, but withdrawals will reduce their number of units accordingly.

After the deposit period ends, the Vault enters a locked state for at least 40 days, during which no deposit or withdrawal operations are allowed. During this period, all stablecoin deposits will be converted to USDT to prepare for the funds to be bridged to the Plasma mainnet.

When the Plasma Mainnet Beta is launched, participants will receive the corresponding XPL tokens, and the USDT funds during the deposit period will also be bridged to the Plasma network and withdrawable in the form of USDT. The XPL distribution for US participants will be postponed until the end of the lock-up period.

According to official instructions, this public offering is only open to eligible regions. The Sonar platform will be responsible for the entire compliance process, including KYC identity authentication, regional screening, qualified investor qualification verification and wallet association checks. Although US users can participate in deposit-earning units, they must verify their identity as qualified investors to purchase XPL, and the purchased XPL tokens will be locked for 12 months and cannot be resold. Plasma emphasized that the issuance structure reflects the core values of its network: encouraging long-term participation, maintaining alignment of interests and strengthening transparency, that is, "the network is built on participation, alignment of interests and transparency", ensuring that early contributors can fairly share the benefits of network growth.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%